eBay 2010 Annual Report Download - page 73

Download and view the complete annual report

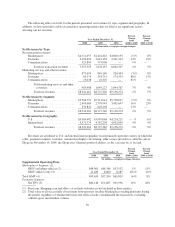

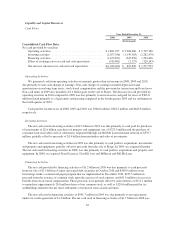

Please find page 73 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.due primarily to the repurchase of approximately 80.6 million shares of our common stock for an aggregate

purchase price of approximately $2.2 billion and the repayment of a bank obligation of $434.0 million assumed

in the Bill Me Later acquisition, offset in part by the proceeds from stock option exercises totaling $152.8 million

and $800.0 million of net proceeds from borrowings under our credit agreement.

The negative effect of currency exchange rates on cash and cash equivalents during 2008, 2009 and 2010

was due to the strengthening of the U.S. dollar against other foreign currencies, primarily the Euro.

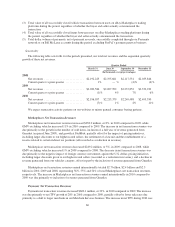

Stock Repurchases

In January 2008, our Board of Directors authorized a stock repurchase program that provides for the

repurchase of up to $2.0 billion of our common stock, with no expiration from the date of authorization. In

September 2010, our Board authorized an additional stock repurchase program that provides for the repurchase

of up to an additional $2.0 billion of our common stock, with no expiration from the date of authorization, for the

purpose of offsetting the impact of dilution from our equity compensation programs. During 2010, we

repurchased approximately $712.8 million of our common stock under these stock repurchase programs. As of

December 31, 2010, $1.9 billion remained for further repurchases of our common stock under our $2.0 billion

stock repurchase program approved in September 2010.

Our stock repurchase programs may be limited or terminated at any time without prior notice. Stock

repurchases under these programs may be made through a variety of open market and privately negotiated

transactions, including structured stock repurchase transactions or other derivative transactions, at times and in

such amounts as management deems appropriate and will be funded from our working capital or other financing

alternatives. The timing and actual number of shares repurchased will depend on a variety of factors including

corporate and regulatory requirements, price and other market conditions and management’s determination as to

the appropriate use of our cash. The programs are intended to comply with the volume, timing and other

limitations set forth in Rule 10b-18 under the Securities Exchange Act of 1934.

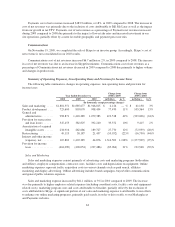

Credit Agreement

As of December 31, 2010, no borrowings or letters of credit were outstanding under our $1.8 billion credit

agreement. As described below, we have a $1.0 billion commercial paper program, and we maintain $1.0 billion

of available borrowing capacity under our credit agreement in order to repay commercial paper borrowings in the

event we are unable to repay those borrowings from other sources when they become due. As a result, at

December 31, 2010, $0.8 million of borrowing capacity was available for other purposes permitted by the credit

agreement.

Loans under the credit agreement will bear interest at LIBOR plus a margin ranging from 0.20 percent to

0.50 percent. Subject to certain conditions stated in the credit agreement, we may borrow, prepay and reborrow

amounts under the credit agreement at any time during the term of the credit agreement, which expires in

November 2012. Funds borrowed under the credit agreement may be used for working capital, capital

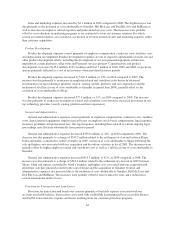

expenditures, acquisitions and other general corporate purposes. The credit agreement contains customary

representations, warranties, affirmative and negative covenants, including a financial covenant, and events of

default. The negative covenants include restrictions regarding the incurrence of additional indebtedness and liens,

and the entry into certain agreements that restrict the ability of our subsidiaries to provide credit support. The

financial covenant requires us to meet a quarterly financial test with respect to a maximum consolidated leverage

ratio. As of December 31, 2010, we were in compliance with the financial covenants in the credit agreement.

Shelf Registration Statement and Long-Term Debt

At December 31, 2010, we had an effective shelf registration statement on file with the Securities and

Exchange Commission that allows us to issue various types of debt securities, such as fixed or floating rate notes,

U.S. dollar or foreign currency denominated notes, redeemable notes, global notes, and dual currency or other

68