eBay 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

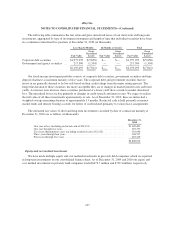

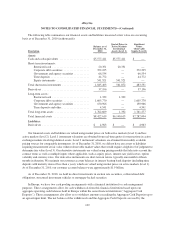

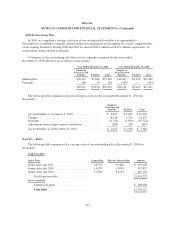

Long-Term Debt

In October 2010, we issued senior unsecured notes in an aggregate principal amount of $1.5 billion, of

which $400.0 million will mature in October 2013, $600.0 million will mature in October 2015 and $500.0

million will mature in October 2020. Interest on these notes is payable semiannually on April 15 and October 15.

Interest expense associated with these notes including amortization of debt issuance costs in 2010 was $5.5

million. Debt issuance costs are deferred costs and recorded as other non-current assets on our consolidated

balance sheet. At December 31, 2010, the estimated fair value of all notes included in long-term debt was

approximately $1.4 billion based on market prices on active markets (Level 1).

Short-Term Debt

Commercial Paper

In November 2010, we implemented a commercial paper program pursuant to which we may issue

commercial paper notes with maturities of up to 397 days from the date of issue in an aggregate principal amount

of up to $1.0 billion at any time outstanding. As of December 31, 2010, the weighted average interest rate on our

outstanding commercial paper notes was 0.20%, and the weighted average remaining term on our commercial

paper notes was 15 days.

Credit Agreement

We have a credit agreement that provides for an unsecured $1.8 billion revolving credit facility, which

matures on November 7, 2012. Loans under the credit agreement will bear interest at LIBOR plus a margin

ranging from 0.20 percent to 0.50 percent. As of December 31, 2010, no borrowings or letters of credit were

outstanding under our $1.8 billion credit agreement. As described above, we have a $1.0 billion commercial

paper program, and we maintain $1.0 billion of available borrowing capacity under our credit agreement in order

to repay commercial paper borrowings in the event we are unable to repay those borrowings from other sources

when they become due. As a result, at December 31, 2010, $0.8 billion of borrowing capacity was available for

other purposes permitted by the credit agreement.

As of December 31, 2010, we were in compliance with all covenants related to our debt.

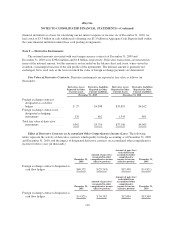

Note 13 — Commitments and Contingencies:

Commitments

Bill Me Later offers U.S. online consumers a way to obtain instant credit at the point of transaction through its

relationship with a chartered financial institution. Bill Me Later is neither a chartered financial institution nor is it

licensed to make loans in any state. Accordingly, Bill Me Later must rely on a bank or licensed lender to issue the

Bill Me Later credit products and extend credit to customers in order to offer the Bill Me Later service. Currently,

when a consumer makes a purchase using a Bill Me Later credit product issued by a chartered financial institution,

the chartered financial institution extends credit to the consumer, funds the extension of credit at the point of sale

and advances funds to the merchant. We subsequently purchase the receivables related to the consumer loans

extended by the chartered financial institution and, as a result of the purchase, bear the risk of loss in the event of

loan defaults. Although the chartered financial institution continues to own each customer account, we own the

related receivable, and Bill Me Later is responsible for all servicing functions related to the account.

As of December 31, 2010, $6.8 billion of unused credit was available to Bill Me Later accountholders. The

individual lines of credit that make up this unused credit are subject to periodic review and termination by the

issuing bank based on, among other things, account usage and customer creditworthiness.

114