eBay 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

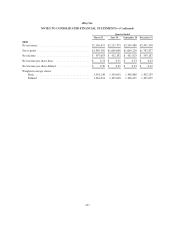

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

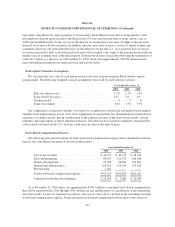

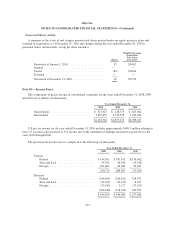

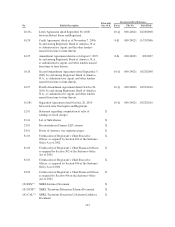

The following is a reconciliation of the difference between the actual provision for income taxes and the

provision computed by applying the federal statutory rate of 35% for 2008, 2009 and 2010 to income before

income taxes (in thousands):

Year Ended December 31,

2008 2009 2010

Provision at statutory rate .................... $764,248 $1,007,703 $ 734,456

Permanent differences:

Foreign income taxed at different rates ..... (519,203) (475,967) (441,044)

Gain on sale of Skype ................... — (498,360) —

Joltid settlement ....................... — 120,339 —

Legal entity restructuring ................ — 184,410 (23,649)

Change in valuation allowance ............ 48,614 58,670 1,407

Stock-based compensation ............... 26,730 41,436 7,595

State taxes, net of federal benefit .......... 54,356 49,606 31,003

Tax credits ........................... (9,251) (13,352) (48,745)

Other ................................ 38,596 15,569 36,463

$ 404,090 $ 490,054 $ 297,486

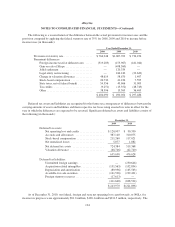

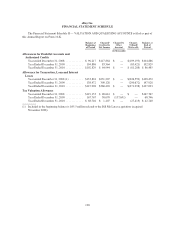

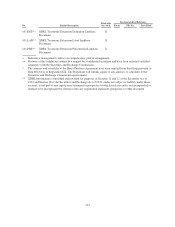

Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the

carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates in effect for the

year in which the differences are expected to be reversed. Significant deferred tax assets and liabilities consist of

the following (in thousands):

December 31,

2009 2010

Deferred tax assets:

Net operating loss and credits ................. $120,907 $ 90,390

Accruals and allowances .................... 387,140 310,075

Stock-based compensation ................... 211,260 117,021

Net unrealized losses ....................... 5,077 1,882

Net deferred tax assets ...................... 724,384 519,368

Valuation allowance ........................ (68,746) (42,740)

655,638 476,628

Deferred tax liabilities:

Unremitted foreign earnings .................. — (230,646)

Acquisition-related intangibles ................ (151,563) (102,894)

Depreciation and amortization ................ (80,956) (165,563)

Available-for-sale securities .................. (161,536) (199,421)

Foreign statutory reserves .................... (17,613) —

(411,668) (698,524)

$ 243,970 $(221,896)

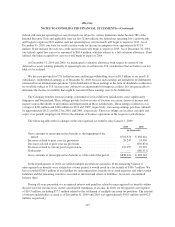

As of December 31, 2010, our federal, foreign and state net operating loss carryforwards, or NOLs, for

income tax purposes were approximately $91.0 million, $138.1 million and $231.5 million, respectively. The

124