eBay 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

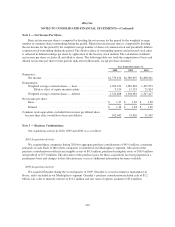

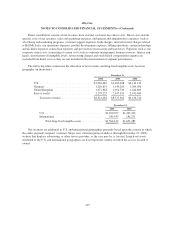

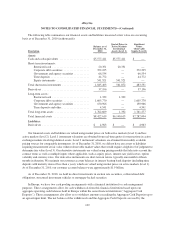

Allocation of the purchase consideration for Gmarket is summarized as follows (in thousands):

Purchase Consideration

Net Tangible Assets

Acquired/(Liabilities

Assumed)

Purchased Intangible

Assets Goodwill

Gmarket Inc. ................... $1,226,968 $50,526 $378,496 $797,946

2008 Acquisition Activity

• Bill Me Later was acquired during the fourth quarter of 2008. Bill Me Later is a payments solution

company that enables U.S. merchants to offer, and U.S. consumers to obtain, credit at the point of sale

for ecommerce transactions and is included in our Payments segment. Bill Me Later’s purchase

consideration included cash of $817.0 million, fair value of options assumed of $87.7 million and

transaction costs of $9.9 million.

• Den Blå Avis and BilBasen were acquired during the fourth quarter of 2008. Den Blå Avis and

BilBasen are two leading online classifieds sites in Denmark and are included in our Marketplaces

segment. Den Blå Avis and BilBasen’s purchase consideration included cash of $392.0 million and

transaction costs of $2.1 million.

• Other acquisition activity during 2008 consisted of four acquisitions for an aggregate purchase

consideration of approximately $178.6 million, consisting primarily of cash. Three acquisitions are

included in our Marketplaces segment and one acquisition is included in our Payments segment.

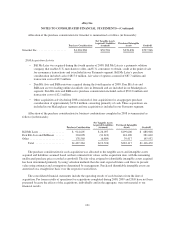

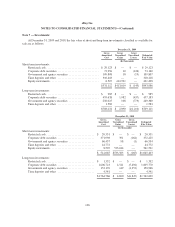

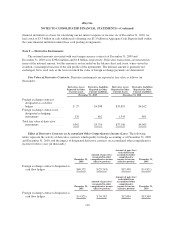

Allocation of the purchase consideration for business combinations completed in 2008 is summarized as

follows (in thousands):

Purchase Consideration

Net Tangible Assets

Acquired/(Liabilities

Assumed)

Purchased Intangible

Assets Goodwill

Bill Me Later .................. $ 914,605 $ 26,097 $199,600 $ 688,908

Den Blå Avis and BilBasen ...... 394,098 (31,612) 144,100 281,610

Other ........................ 178,560 (6,809) 39,417 145,952

Total .................... $1,487,263 $(12,324) $383,117 $1,116,470

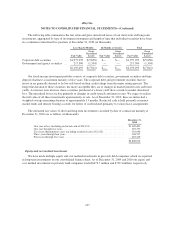

The purchase consideration for each acquisition was allocated to the tangible assets and intangible assets

acquired and liabilities assumed based on their estimated fair values on the acquisition date, with the remaining

unallocated purchase price recorded as goodwill. The fair value assigned to identifiable intangible assets acquired

has been determined primarily by using valuation methods that discount expected future cash flows to present

value using estimates and assumptions determined by management. Purchased identifiable intangible assets are

amortized on a straight-line basis over the respective useful lives.

The consolidated financial statements include the operating results of each business from the date of

acquisition. Pro forma results of operations for acquisitions completed during 2008, 2009 and 2010 have not been

presented because the effects of the acquisitions, individually and in the aggregate, were not material to our

financial results.

101