eBay 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Buyer Value Proposition

PayPal enables buyers to pay merchants quickly and easily without sharing sensitive financial information

(such as credit card or debit card numbers) or providing their name and address information. To make payments

using PayPal, buyers need to disclose only their email addresses to recipients. Buyers also benefit from PayPal’s

Buyer Protection Program, which, subject to specified limitations, reimburses buyers using PayPal with respect

to qualified purchases on or off eBay.com in certain key geographies if the buyer does not receive the item or, in

limited markets, if the item is significantly not as described. The Bill Me Later service allows qualifying U.S.

buyers to obtain a revolving line of credit from a third party lender at the point of sale. When using Bill Me

Later, buyers need to provide only their name, address, birth date and the last four digits of their social security

number. U.S. buyers may also be offered an opportunity to defer payments for purchases made using Bill Me

Later; under some promotional arrangements offered on select merchant sites, interest on such payments can be

deferred for as long as six months. We believe that many buyers wary of disclosing financial information online

find the limited amount of information they are required to provide using PayPal and Bill Me Later attractive.

Seller Value Proposition

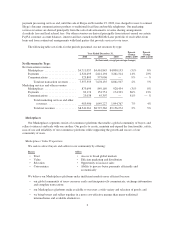

PayPal offers online merchants an all-in-one payment processing solution that is generally less expensive

than most credit card merchant accounts, offers industry-leading fraud prevention and streamlines the checkout

experience for users of approximately 94.4 million active registered accounts in approximately 190 markets as of

December 31, 2010. Active registered accounts are defined as registered accounts that successfully sent or

received at least one payment or payment reversal through the PayPal system (or Bill Me Later accounts that are

currently able to transact and that have received a statement) within the last 12 months. Users of active registered

accounts may engage in cross-border shopping, which may help merchants to increase sales volume by allowing

them to sell to a global base of buyers. Because PayPal already connects to more than 15,000 financial

institutions or bank partners around the world, buyers can use their local payment method of choice, no matter

where the seller is located. In addition, PayPal offers a payment gateway service that provides merchants that

already have a payment card merchant account with a secure connection from their online store to their internet

merchant account and processing network.

A merchant can typically open a PayPal account and begin accepting PayPal and other payment card

payments within a few minutes. Most merchants are approved instantly for a PayPal account and do not need to

provide a personal guarantee, acquire specialized hardware, prepare an application or contact a payment gateway.

PayPal can reduce or eliminate the need for merchants to receive and store sensitive customer financial

information. Furthermore, PayPal charges lower transaction fees than most U.S. merchant accounts, and charges

no setup fees and few or no recurring monthly fees.

The account-based nature of PayPal’s network helps us to better detect and prevent fraud when funds enter,

flow through and exit the PayPal network. Sellers can also reduce the risk of transaction losses resulting from

unauthorized credit, debit and other payment card use and fraudulent chargebacks if they comply with PayPal’s

Seller Protection Policy.

Various credit arrangements are available to buyers using Bill Me Later at the point of sale for certain U.S.

merchants through the issuing bank of the Bill Me Later credit products. In the fall of 2009, we made Bill Me

Later available as a payment option to approved U.S. PayPal customers and began to offer Bill Me Later as a

payment method on eBay.com in the U.S. In 2010, Bill Me Later became increasingly available as a payment

method on eBay.com in the U.S.

PayPal Overview

Joining PayPal

PayPal offers three types of accounts: Personal, Business and Premier. A new account holder typically

opens an account to send money for an eBay purchase or a purchase on another website, a payment for services

8