eBay 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

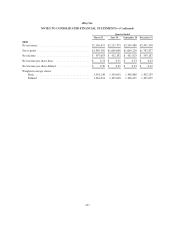

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

federal and state net operating loss carryforwards are subject to various limitations under Section 382 of the

Internal Revenue Code and applicable state tax law. If not utilized, the federal net operating loss carryforwards

will begin to expire in 2021 and the state net operating loss carryforwards will begin to expire in 2011. As of

December 31, 2010, our state tax credit carryforwards for income tax purposes were approximately $11.0

million. If not utilized, the state tax credit carryforwards will begin to expire in 2015. As of December 31, 2010,

our federal capital loss carryover amounted to $65.4 million, which is subject to a full valuation allowance. If not

utilized, the federal capital loss carryover will begin to expire in 2014.

At December 31, 2010 and 2009, we maintained a valuation allowance with respect to certain of our

deferred tax assets relating primarily to operating losses in certain non-U.S. jurisdictions that we believe are not

likely to be realized.

We have not provided for U.S. federal income and foreign withholding taxes on $8.3 billion of our non-U.S.

subsidiaries’ undistributed earnings as of December 31, 2010, because such earnings are intended to be indefinitely

reinvested in our international operations. Upon distribution of those earnings in the form of dividends or otherwise,

we would be subject to U.S. income taxes (subject to an adjustment for foreign tax credits). It is not practicable to

determine the income tax liability that might be incurred if these earnings were to be distributed.

The Company benefits from tax rulings concluded in several different jurisdictions, most significantly

Singapore and Switzerland. These rulings provide for lower rates of taxation on certain classes of income and

require various thresholds of investment and employment in those jurisdictions. These rulings resulted in a tax

savings of $284 million and $300 million in 2010 and 2009, respectively, increasing earnings per share (diluted)

by approximately $0.21 and $0.23 in 2010 and 2009, respectively. These tax rulings are in effect currently and

expire over periods ranging from 2016 to the duration of business operations in the respective jurisdictions.

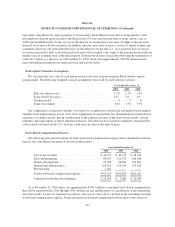

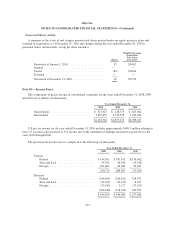

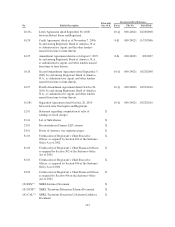

The following table reflects changes in the unrecognized tax benefits since January 1, 2009:

2009 2010

(in thousands)

Gross amounts of unrecognized tax benefits as the beginning of the

period ...................................................... $701,374 $ 838,616

Increases related to prior year tax provisions ......................... 26,247 33,904

Decreases related to prior year tax provision .......................... — (305,874)

Increases related to current year tax provisions ........................ 110,995 22,229

Settlements .................................................... — (160,531)

Gross amounts of unrecognized tax benefits as of the end of the period .... $838,616 $ 428,344

In the fourth quarter of 2010, we settled multiple uncertain tax positions. If the remaining balance of

unrecognized tax benefits were realized in a future period, it would result in a tax benefit of $356.7 million. We

have recorded $208.5 million of our liability for unrecognized tax benefits in accrued expenses and other current

liabilities and the remaining amount is recorded as deferred and other tax liabilities, net in our consolidated

balance sheet.

During all years presented, we recognized interest and penalties related to unrecognized tax benefits within

the provision for income taxes on the consolidated statements of income. In 2010, we recognized a net expense

of $19.5 million, including $17.7 million related to the settlement of multiple uncertain tax positions. The amount

of interest and penalties accrued as of December 31, 2009 and 2010 was approximately $90.5 million and $92.3

million, respectively.

125