eBay 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest and Other Income (Expense), Net

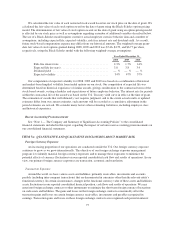

Interest and other income (expense), net, consists of interest earned on cash, cash equivalents and

investments, as well as foreign exchange transaction gains and losses, our portion of operating results from

investments accounted for under the equity method of accounting, interest expense consisting of interest charges

on the amounts drawn under our credit agreement and on our outstanding commercial paper and debt securities

and certain accrued contingencies. Interest and other income (expense), net excludes interest expense related to

Bill Me Later, which is included in cost of net revenues.

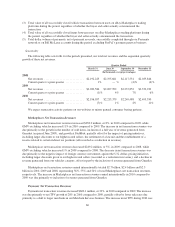

Interest and other income (expense), net, decreased $1.4 billion, or 97%, in 2010 compared to 2009. The

decrease was due primarily to the gain on the sale of Skype in 2009, partially offset by lower foreign exchange

transaction losses, an increase in interest income due primarily to a gain on the repayment in full of the Skype

note receivable and senior debt securities and higher average cash, cash equivalents and investment balances in

2010.

Interest and other income (expense), net, increased $1.3 billion, in 2009 compared to 2008. The increase

was due primarily to the $1.4 billion gain on the sale of Skype, partially offset by a decrease in interest income

due to lower interest rates that were earned on lower average cash, cash equivalents and investments balances in

2009.

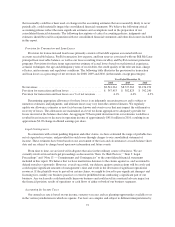

Provision for Income Taxes

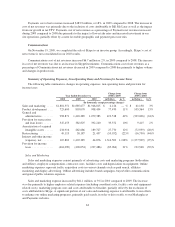

The provision for income taxes differs from the amount computed by applying the statutory U.S. federal rate

due primarily to foreign income with lower tax rates and tax credits, offset by state taxes and other factors.

Our effective tax rate was 14% in 2010 compared to 17% in 2009. The decrease in our effective tax rate for

2010 compared to the prior year was due primarily to the settlement of multiple uncertain tax positions.

Our effective tax rate was 17% in 2009 compared to 19% in 2008. The decrease was due primarily to the

gain resulting from the disposal of Skype (including the impact of the Skype legal settlement), which was not

taxable, as well as a benefit from a ruling issued by a tax authority, partially offset by a tax provision related to a

legal entity restructuring.

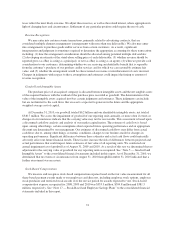

From time to time, we engage in certain intercompany transactions and legal entity restructurings. We

consider many factors when evaluating these transactions, including the alignment of our corporate structure with

our organizational objectives and the operational and tax efficiency of our corporate structure, as well as the

long-term cash flows and cash needs of our different businesses. These transactions may impact our overall tax

rate and/or result in additional cash tax payments. The impact in any period may be significant. These

transactions may be complex and the impact of such transactions on future periods may be difficult to estimate.

In 2009, we completed a legal entity restructuring as a result of which we transferred approximately $1.1 billion

in cash to the U.S. The tax impact of this restructuring was included in our 2009 provision for income taxes. As a

result of this transaction, we made cash payment for taxes of approximately $207.4 million during the first

quarter of 2010. See “Liquidity and Capital Resources — Cash Flows — Operating Activities” below.

We are regularly under examination by tax authorities both domestically and internationally. We believe

that adequate amounts have been reserved for any adjustments that may ultimately result from these

examinations, although we cannot assure that this will be the case given the inherent uncertainties in these

examinations.

66