eBay 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

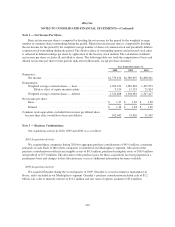

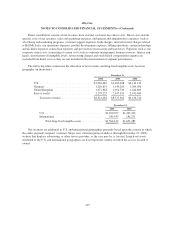

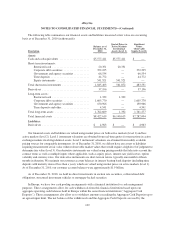

The following table summarizes our financial assets and liabilities measured at fair value on a recurring

basis as of December 31, 2010 (in thousands):

Description

Balance as of

December 31,

2010

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

Significant

Other

Observable

Inputs (Level 2)

Assets:

Cash and cash equivalents ..................... $5,577,411 $5,577,411 $ —

Short-term investments:

Restricted cash .......................... 20,351 20,351 —

Corporate debt securities .................. 372,225 — 372,225

Government and agency securities ........... 66,534 — 66,534

Time deposits ........................... 44,772 — 44,772

Equity instruments ....................... 541,521 541,521 —

Total short-term investments ................... 1,045,403 561,872 483,531

Derivatives ................................. 37,196 — 37,196

Long-term assets:

Restricted cash .......................... 1,332 1,332 —

Corporate debt securities .................. 1,605,770 — 1,605,770

Government and agency securities ........... 150,966 — 150,966

Time deposits and other ................... 4,541 — 4,541

Total long-term assets ........................ 1,762,609 1,332 1,761,277

Total financial assets ......................... $8,422,619 $6,140,615 $2,282,004

Liabilities:

Derivatives ................................. $ 4,963 $ — $ 4,963

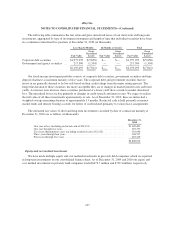

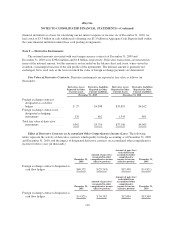

Our financial assets and liabilities are valued using market prices on both active markets (level 1) and less

active markets (level 2). Level 1 instrument valuations are obtained from real-time quotes for transactions in active

exchange markets involving identical assets. Level 2 instrument valuations are obtained from readily available

pricing sources for comparable instruments. As of December 31, 2010, we did not have any assets or liabilities

requiring measurement at fair value without observable market values that would require a high level of judgment to

determine fair value (level 3). Our derivative instruments are valued using pricing models that take into account the

contract terms as well as multiple inputs where applicable, such as equity prices, interest rate yield curves, option

volatility and currency rates. Our derivative instruments are short-term in nature, typically one month to fifteen

months in duration. We maintain our customer account balances in interest bearing bank deposits (including time

deposits with maturity dates of less than a year), which are valued using market prices on active markets (level 1).

As of December 31, 2010, our customer account balances were approximately $1.9 billion.

As of December 31, 2010, we held no direct investments in auction rate securities, collateralized debt

obligations, structured investment vehicles or mortgage-backed securities.

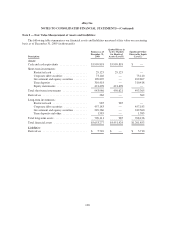

In Europe, we have two cash pooling arrangements with a financial institution for cash management

purposes. These arrangements allow for cash withdrawals from this financial institution based upon our

aggregate operating cash balances held in Europe within the same financial institution (“Aggregate Cash

Deposits”). These arrangements also allow us to withdraw amounts exceeding the Aggregate Cash Deposits up to

an agreed-upon limit. The net balance of the withdrawals and the Aggregate Cash Deposits are used by the

109