eBay 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

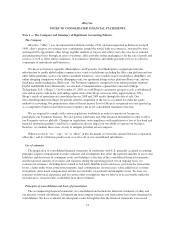

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

for VIEs including the consolidation of common structures, such as joint ventures, equity method investments

and collaboration arrangements. We adopted this guidance as of January 1, 2010. The adoption of this guidance

did not have a material impact on our consolidated financial statements.

In 2009, the FASB issued new accounting guidance related to the recognition of revenue from multiple

element arrangements. The new guidance states that if vendor specific objective evidence or third party evidence

for deliverables in an arrangement cannot be determined, companies are required to develop a best estimate of

the selling price for separate deliverables and allocate arrangement consideration using the relative selling price

method. We adopted this guidance as of January 1, 2010 on a prospective basis. The adoption of this guidance

did not have a material impact on our consolidated financial statements.

On January 1, 2010, we adopted the new accounting guidance related to certain revenue arrangements that

include software elements. The new guidance was applied on a prospective basis for revenue arrangements

entered into or materially modified in fiscal years beginning on or after June 15, 2010, with earlier application

permitted. The adoption of this accounting guidance did not have a material impact on our consolidated financial

statements.

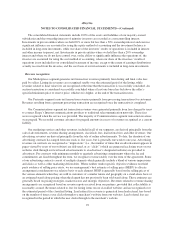

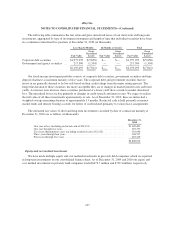

In January 2010, the FASB issued new accounting guidance related to the disclosure requirements for fair

value measurements and that provides clarification for existing disclosure requirements. More specifically, this

update requires (a) an entity to disclose separately the amounts of significant transfers in and out of Level 1 and

Level 2 fair value measurements and to describe the reasons for the transfers, and (b) information about

purchases, sales, issuances and settlements to be presented separately, on a gross basis rather than net, in the

reconciliation for fair value measurements using significant unobservable inputs (Level 3 inputs). This guidance

clarifies existing disclosure requirements for the level of disaggregation used for classes of assets and liabilities

measured at fair value and requires disclosures about the valuation techniques and inputs used to measure fair

value for both recurring and nonrecurring fair value measurements using Level 2 and Level 3 inputs. The new

disclosures and clarifications of existing disclosure were effective beginning January 1, 2010, except for the

disclosure requirements related to the purchases, sales, issuances and settlements in the rollforward activity of

Level 3 fair value measurements, which are effective for fiscal years ending after December 31, 2010. We do not

believe the adoption of this guidance will have a material impact to our consolidated financial statements.

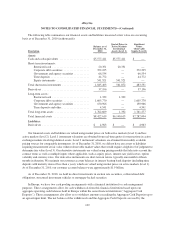

During the fourth quarter of 2010, we adopted the new disclosure guidance related to the credit quality of

financing receivables and the allowance for credit losses. This guidance requires companies to provide more

information about the credit quality of their financing receivables in the disclosures to financial statements

including, but not limited to, significant purchases and sales of financing receivables, aging information and

credit quality indicators. The adoption of this accounting guidance did not have a significant impact on our

consolidated financial statements.

99