eBay 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

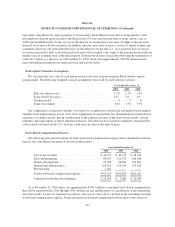

of up to an additional $2.0 billion of our common stock, with no expiration from the date of authorization, for the

purpose of offsetting the impact of dilution from our equity compensation programs. The stock repurchase

activity, under these stock repurchase programs during 2010 is summarized as follows (in thousands, except per

share amounts):

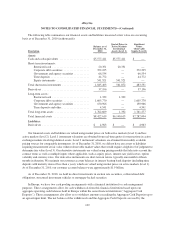

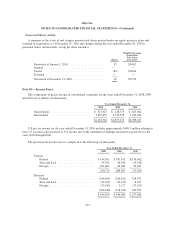

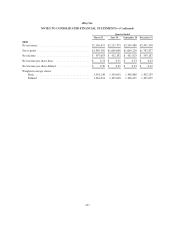

Shares

Repurchased

Average Price per

Share (1)

Value of Shares

Repurchased

Remaining

Amount

Authorized

Balance at January 1, 2010 .................... 49,805 $26.98 $1,343,500 $ 656,500

Authorization of new plan in September 2010 ..... 2,000,000

Repurchase of common stock .................. 26,793 26.60 712,793 (712,793)

Balance at December 31, 2010 ................. 76,598 $26.85 $2,056,293 $1,943,707

(1) The stock repurchase activity excludes broker commissions.

These repurchased shares are recorded as treasury stock and are accounted for under the cost method. No

repurchased shares have been retired or reissued.

From time to time, we enter into structured equity hedging transactions. We typically enter into and settle

these transactions within the same fiscal quarter. The structured hedging transactions are accounted for as equity

instruments. According to the terms of these transactions, if the market price of our common stock exceeds a

pre-determined price on the maturity date, we have the option to settle these transactions in cash or by

repurchasing shares of our common stock. If the market price of our common stock is below that pre-determined

price on the maturity date, we are required to settle these transactions by repurchasing shares of our common

stock. The number of shares repurchased through the use of structured equity hedging transactions are included

in the table above. The structured equity hedging transactions that settled in cash during 2010 resulted in

aggregate premiums of approximately $2.3 million, which were recorded as additional paid-in capital.

Our stock repurchase programs may be limited or terminated at any time without prior notice. Stock

repurchases under these programs may be made through a variety of open market and privately negotiated

transactions, including structured stock repurchase transactions or other derivative transactions, at times and in

such amounts as management deems appropriate and will be funded from our working capital or other financing

alternatives. The timing and actual number of shares repurchased will depend on a variety of factors including

corporate and regulatory requirements, price, other market conditions and management’s determination as to the

appropriate use of our cash. The programs are intended to comply with the volume, timing and other limitations

set forth in Rule 10b-18 under the Securities Exchange Act of 1934.

In addition to the above, we withhold shares from employees to satisfy minimum statutory tax obligations in

conjunction with nonvested shares under our equity incentive plans, which are included in treasury stock.

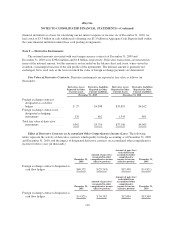

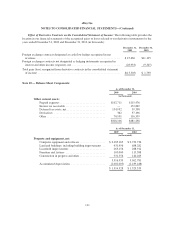

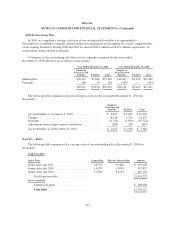

Note 17 — Stock-Based and Employee Savings Plans:

Equity Incentive Plans

We have equity incentive plans under which we grant equity awards, including stock options, restricted

stock units, nonvested shares and performance-based restricted stock units, to our directors, officers and

employees. At December 31, 2010, 626.4 million shares were authorized under our equity incentive plans and

77.0 million shares were available for future grant.

119