eBay 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

grant additional equity awards, change the mix of grants between stock options and restricted stock units or

assume unvested equity awards in connection with acquisitions.

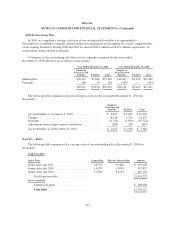

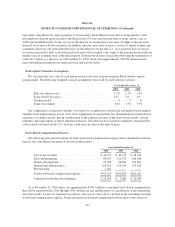

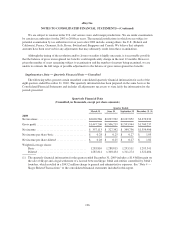

Stock Option Activity

The following table summarizes stock option activity under our equity incentive plans as of and for the year

ended December 31, 2010 (in thousands, except per share amounts):

Shares

Weighted

Average

Exercise

Price

Weighted Average

Remaining

Contractual Term

Aggregate

Intrinsic

Value

Outstanding at January 1, 2010 ......................... 54,048 $22.28

Granted and assumed ................................. 8,425 $23.57

Exercised .......................................... (11,957) $14.25

Forfeited/expired/cancelled ............................ (6,609) $29.21

Outstanding at December 31, 2010 ...................... 43,907 $23.67 4.18 $279,229

Expected to vest ..................................... 41,749 $23.83 4.08 $262,930

Options exercisable .................................. 29,051 $26.02 3.33 $145,841

The aggregate intrinsic value of options was calculated as the difference between the exercise price of the

underlying awards and the quoted price of our common stock. At December 31, 2010, options to purchase

29.3 million shares of common stock were in-the-money.

The weighted average grant-date fair value of options granted during the years 2008, 2009 and 2010 was

$7.46, $4.59 and $6.77, respectively. During the years 2008, 2009 and 2010, the aggregate intrinsic value of

options exercised under our equity incentive plans was $83.0 million, $69.7 million and $140.7 million,

respectively, determined as of the date of option exercise.

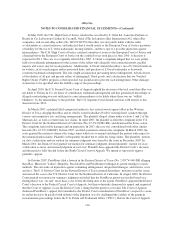

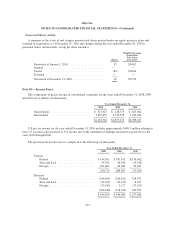

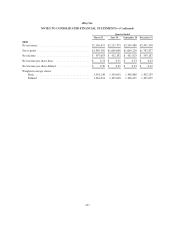

Restricted Stock Units

A summary of the status of and changes in restricted stock units granted (including performance-based

restricted stock units that have been earned) under our equity incentive plans as of December 31, 2010 and

changes during the year ended December 31, 2010 is presented below (in thousands, except per share amounts):

Shares

Weighted Average

Grant-Date

Fair Value

(per share)

Outstanding at January 1, 2010 ......................... 42,241 $18.13

Awarded ........................................... 15,843 $24.12

Vested ............................................ (14,920) $20.28

Forfeited ........................................... (4,816) $19.70

Outstanding at December 31, 2010 ...................... 38,348 $19.55

Expected to vest at December 31, 2010 .................. 31,699

During the years 2008, 2009 and 2010, the aggregate intrinsic value of restricted stock units vested under

our equity incentive plans was $55.4 million, $115.5 million and $362.8 million, respectively.

122