eBay 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

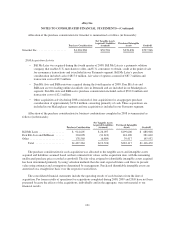

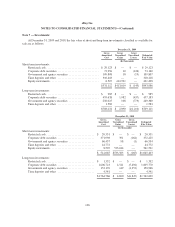

equity method investments are investments in privately held companies where we have the ability to exercise

significant influence, but not control, over the investee. In certain circumstances, investments include goodwill.

Our consolidated results of operations include, as a component of interest and other income (expense), net, our

share of the net income or loss of the equity method investments together with amortization expense relating to

acquired intangible assets. Our share of investees’ results of operations is not significant for any period

presented. Our cost method investments consist of investments in privately held companies where we do not have

the ability to exercise significant influence, or have control, over the investee. These investments are recorded at

cost and are subject to periodic tests for other-than-temporary impairment.

We assess whether an other-than-temporary impairment loss on our investments has occurred due to

declines in fair value or other market conditions. With respect to our debt securities, this assessment takes into

account our intent to sell the security, whether it is more likely than not that we will be required to sell the

security before recovery of its amortized cost basis, and if we do not expect to recover the entire amortized cost

basis of the security (that is, a credit loss exists). Other-than-temporary impairments are separated into amounts

representing credit losses, which are recognized in the consolidated statement of income, and amounts related to

all other factors, which are recognized in other comprehensive income (loss). With respect to our equity

securities, this assessment considers whether we expect the fair value of the security to recover as well as the

duration and severity of any declines in the fair value. We did not recognize an other-than-temporary impairment

loss on our investments in 2009 or 2010.

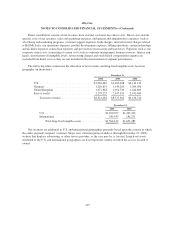

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed

using the straight-line method over the estimated useful lives of the assets, generally, one to three years for

computer equipment and software, up to 30 years for buildings and building improvements, ten years for aviation

equipment, the shorter of five years or the term of the lease for leasehold improvements, three years for furniture

and fixtures and vehicles.

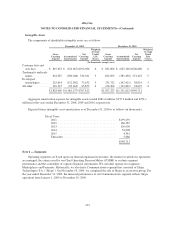

Goodwill and intangible assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable

intangible assets acquired in a business combination. Intangible assets resulting from the acquisitions of entities

accounted for using the purchase method of accounting are estimated by management based on the fair value of

assets received. Identifiable intangible assets consist of purchased customer lists and user base, trademarks and

trade names, developed technologies, and other intangible assets, including patents and contractual agreements.

Identifiable intangible assets are amortized over the period of estimated benefit using the straight-line method

and estimated useful lives ranging from one to eight years. No significant residual value is estimated for

intangible assets. Goodwill is not subject to amortization, but is subject to at least an annual assessment for

impairment, applying a fair-value based test.

We evaluate goodwill, at a minimum, on an annual basis and whenever events and changes in circumstances

suggest that the carrying amount may not be recoverable. Impairment of goodwill is tested at the reporting unit

level by comparing the reporting unit’s carrying amount, including goodwill, to the fair value of the reporting

unit. The fair values of the reporting units are estimated using an income and discounted cash flow approach. If

the carrying amount of the reporting unit exceeds its fair value, goodwill is considered impaired and a second

step is performed to measure the amount of impairment loss, if any.

96