eBay 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 4 — Skype Related Transactions:

On November 19, 2009, we sold all of the share capital of Skype Luxembourg Holdings S.a.r.l., Skype Inc.

and Sonorit Holdings, A.S. (collectively with their respective subsidiaries, the “Skype Companies”) to

Springboard Group S.à.r.l. (the “Buyer”), an entity organized and owned by an investor group led by Silver Lake

and including Joltid Limited and certain of its affiliated parties, the Canada Pension Plan Investment Board and

Andreessen Horowitz. We received cash proceeds of approximately $1.9 billion, a subordinated note issued by a

subsidiary of the Buyer in the principal amount of $125.0 million and an equity stake in the outstanding capital

stock of the Buyer. We determined the fair value of our retained 30 percent equity stake to be approximately

$620.0 million. We also purchased senior debt securities with a face value of $50.0 million as part of a Skype

debt financing.

The sale resulted in a net gain of $1.4 billion, which was recorded in interest and other income (expense),

net in our consolidated statement of income. In conjunction with the sale of Skype, we reached a legal settlement

of a lawsuit between Skype, Joltid and entities controlled by Joltid’s founders, which resulted in a $343.2 million

charge to general and administrative expenses.

In March 2010, Skype paid in full the subordinated note receivable of $125.0 million and senior debt securities

of $50.0 million. As a result of the payment, we recorded a gain of approximately $22.8 million in interest and other

income (expense), net. In the same period, we reinvested approximately $91.4 million in new senior debt securities

issued by Skype, which are reflected in other assets on our consolidated balance sheet. These securities mature in

five years and offer a variable interest rate (approximately 7% as of December 31, 2010).

Mr. Marc L. Andreessen, a member of the board of directors of eBay, is a general partner of Andreessen

Horowitz, which owns less than 5% of the Buyer.

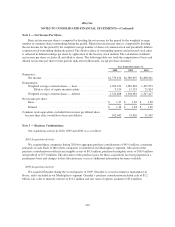

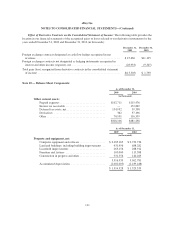

Note 5 — Goodwill and Intangible Assets:

Goodwill

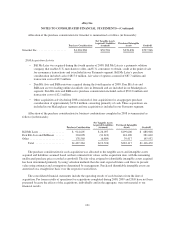

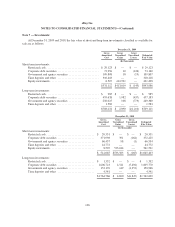

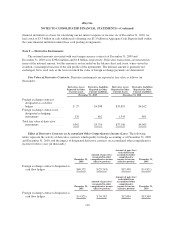

Goodwill information for each reportable segment is as follows (in thousands):

Balance as of

December 31,

2009 Goodwill Acquired Adjustments

Balance as of

December 31,

2010

Marketplaces ................................ $4,013,906 $77,602 $(19,736) $4,071,772

Payments ................................... 2,156,541 — (7,789) 2,148,752

$6,170,447 $77,602 $(27,525) $6,220,524

Goodwill related to our equity method investments, included in the table above, was approximately $27.4

million as of December 31, 2009 and 2010. The adjustments to goodwill during the year ended

December 31, 2010 were due primarily to foreign currency translation.

We conducted our annual impairment test of goodwill as of August 31, 2010 and determined that no

adjustment to the carrying value of goodwill for any reportable units was necessary. As of December 31, 2010,

we determined that no events or circumstances from August 31, 2010 through December 31, 2010 indicated that

a further assessment was necessary.

102