eBay 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rendered, or a payment to an individual in lieu of cash or check. Allowing new account holders to join the

network when they make or receive payments encourages PayPal’s natural, user-driven growth. PayPal’s account

sign-up process asks each new account holder to provide PayPal with his or her name, street address, phone

number and email address. The account holder’s email address serves as the unique account identifier. PayPal

also offers certain customers who sell on their own websites the ability to accept credit, debit or other payment

card payments from buyers without requiring the buyer to open a PayPal account.

PayPal Transaction Overview

Buyers make payments at the PayPal website, at the eBay.com website, or at the websites of merchants that

have integrated PayPal’s Website Payments or Express Checkout features. Buyers can also make payments via

PayPal from their mobile device by accessing the Internet directly through their mobile device browser or by using

PayPal’s, eBay’s or other developers’ mobile applications. To make a payment at PayPal’s website, a buyer logs in

to his or her account and enters the recipient’s email address and the amount of the payment. To make a payment

through eBay.com or merchant websites, a buyer selects an item for purchase, chooses PayPal for payment and

enters his or her email address and password to authorize the payment. The buyer chooses whether PayPal debits the

money from the buyer’s PayPal balance, credit, debit or other payment card, Bill Me Later account (in the U.S.), or

bank account, and the payment is then credited to the recipient’s PayPal account balance. For some bank account

payments (which we call eCheck payments), the transaction is held until the funds have cleared the sender’s bank,

which typically takes three to five business days. Once the payment is completed, the recipient can make payments

to others or withdraw his or her funds at any time via check (in the U.S. and eight other countries), electronic funds

transfer, a PayPal-branded debit card (available only to U.S. users), a prepaid card (in the U.K. and Italy), or through

a credit to a recipient’s credit card account (in limited markets).

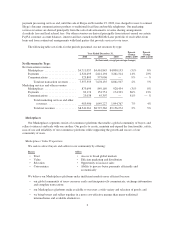

PayPal earns revenues in several ways:

• PayPal earns transaction fees when a Business or Premier account receives a payment or, in certain

qualified transactions, when a sender elects to pay the fee in lieu of the recipient;

• PayPal earns a foreign exchange fee when an account holder converts a balance from one currency to

another;

• PayPal earns fees from merchants who utilize PayPal’s Pro direct payment card processing services or

Payflow gateway processing services;

• PayPal earns fees when a user receives payments from outside the user’s country of residence;

• PayPal may earn fees when a user withdraws money to certain bank accounts, depending on the market

and the amount of the withdrawal;

• PayPal earns a return on certain customer balances; and

• Ancillary revenues are earned from related financial products.

PayPal incurs funding costs on payments at varying levels depending on the source of the payment. Funding

costs associated with credit card and debit card funded payments are significantly higher than bank account, Bill

Me Later, or PayPal balance-funded payments. U.S. account holders who choose to maintain PayPal balances in

U.S. dollars have the ability to sweep balances into the PayPal Money Market Fund. The PayPal Money Market

Fund, which is invested in a portfolio managed by BlackRock Fund Advisors, bore a current compound annual

yield of 0.12% as of December 31, 2010.

Verification of Account Holders

To fund payments from their bank accounts in the U.S., account holders must first become verified by

PayPal. The primary method for verification is our patented Random Deposit technique. Under this technique,

9