eBay 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

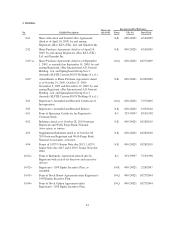

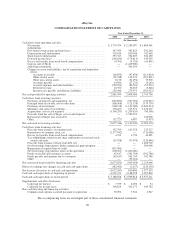

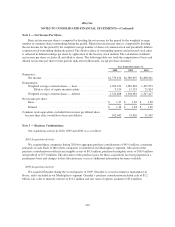

eBay Inc.

CONSOLIDATED STATEMENT OF CASH FLOWS

Year Ended December 31,

2008 2009 2010

(In thousands)

Cash flows from operating activities:

Net income ................................................. $1,779,474 $ 2,389,097 $ 1,800,961

Adjustments:

Provision for transaction and loan losses .......................... 347,453 382,825 392,240

Depreciation and amortization .................................. 719,814 810,946 762,465

Stock-based compensation ..................................... 353,323 394,807 381,492

Deferred income taxes ........................................ (206,636) (178,813) 349,595

Excess tax benefits from stock-based compensation ................. (4,701) (4,750) (41,891)

Gain on sale of Skype ........................................ — (1,449,800) —

Joltid legal settlement ........................................ — 343,199 —

Changes in assets and liabilities, net of acquisition and disposition

effects:

Accounts receivable ...................................... (66,853) (97,494) (111,614)

Other current assets ...................................... (91,188) 126,270 (251,821)

Other non-current assets ................................... 8,158 (31,292) 73,978

Accounts payable ........................................ 14,946 (27,235) (9,263)

Accrued expenses and other liabilities ........................ (220,591) (86,504) (95,522)

Deferred revenue ........................................ 10,350 56,855 (3,348)

Income taxes payable and other tax liabilities .................. 238,446 279,975 (501,512)

Net cash provided by operating activities ............................. 2,881,995 2,908,086 2,745,760

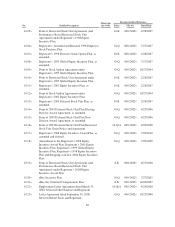

Cash flows from investing activities:

Purchases of property and equipment, net ......................... (565,890) (567,094) (723,912)

Principal loans receivable, net of collections ....................... (106,508) (121,138) (379,730)

Purchases of investments ...................................... (108,128) (1,142,098) (2,643,514)

Maturities and sales of investments .............................. 136,200 103,572 1,436,207

Acquisitions, net of cash acquired ............................... (1,360,293) (1,209,433) (90,568)

Proceeds from the sale of Skype, net of cash disposed ............... — 1,780,321 —

Repayment of Skype note receivable ............................. — — 125,000

Other ...................................................... (52,727) 6,487 (5,953)

Net cash used in investing activities ................................. (2,057,346) (1,149,383) (2,282,470)

Cash flows from financing activities:

Proceeds from issuance of common stock ......................... 152,799 102,526 235,527

Repurchases of common stock, net .............................. (2,177,942) — (711,068)

Excess tax benefits from stock-based compensation ................. 4,701 4,750 41,891

Tax withholdings related to net share settlements of restricted stock

awards and units ........................................... (19,428) (37,670) (120,646)

Proceeds from issuance of long-term debt, net ..................... — — 1,488,702

Net borrowings (repayments) under commercial paper program ....... — — 300,000

Repayment of acquired line of credit ............................. (433,981) — —

Net borrowings (repayments) under credit agreement ................ 800,000 (1,000,000) —

Funds receivable and customer accounts .......................... 45,617 (561,709) (392,786)

Funds payable and amounts due to customers ...................... (45,617) 561,709 392,786

Other ...................................................... — (15,262) —

Net cash (used in) provided by financing activities ...................... (1,673,851) (945,656) 1,234,406

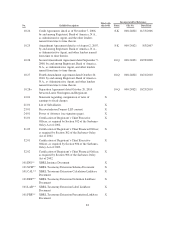

Effect of exchange rate changes on cash and cash equivalents ............. (183,061) (2,157) (120,103)

Net increase (decrease) in cash and cash equivalents .................... (1,032,263) 810,890 1,577,593

Cash and cash equivalents at beginning of period ....................... 4,221,191 3,188,928 3,999,818

Cash and cash equivalents at end of period ............................ $3,188,928 $ 3,999,818 $ 5,577,411

Supplemental cash flow disclosures:

Cash paid for interest ......................................... $ 7,759 $ 6,050 $ 54

Cash paid for income taxes .................................... 366,824 342,173 645,783

Non-cash investing and financing activities:

Common stock options assumed pursuant to acquisition ............. 92,092 5,361 2,947

The accompanying notes are an integral part of these consolidated financial statements.

90