eBay 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

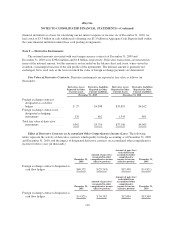

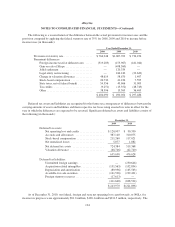

All stock options granted under these plans generally vest 25% one year from the date of grant (or 12.5% six

months from the date of grant for grants to existing employees) with the remainder vesting at a rate of 2.08% per

month thereafter, and generally expire 7 to 10 years from the date of grant. The cost of stock options is

determined using the Black-Scholes option pricing model on the date of grant.

Restricted stock units and nonvested shares are granted to eligible employees under our equity incentive

plans. In general, restricted stock units and nonvested shares vest in equal annual installments over a period of

one to five years, are subject to the employees’ continuing service to the Company and do not have an expiration

date. The cost of restricted stock units and nonvested shares is determined using the fair value of our common

stock on the date of grant.

In 2008, 2009 and 2010, certain executives were eligible to receive performance based restricted stock units.

The number of restricted stock units ultimately received depends on our business performance against specified

performance targets set by the Compensation Committee. If the performance criteria are satisfied, the

performance based restricted stock units will be granted, with one-half of the grant vesting in March following

the end of the performance period and the remaining one-half vesting one year later.

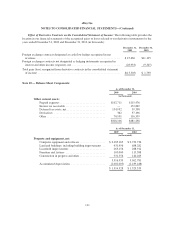

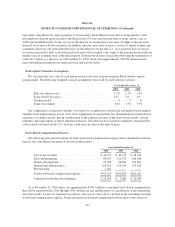

Employee Stock Purchase Plan

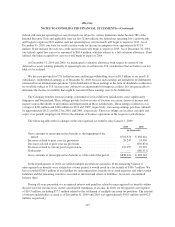

We have an employee stock purchase plan for all eligible employees. Under the plan, shares of our common

stock may be purchased over an offering period with a maximum duration of two years at 85% of the lower of

the fair market value on the first day of the applicable offering period or on the last day of the six-month

purchase period. Employees may purchase shares having a value not exceeding 10% of their eligible

compensation during an offering period. During the years ended 2008, 2009, and 2010, employees purchased

approximately 3.5 million, 4.4 million and 4.7 million shares under this plan at average prices of $17.78, $12.82

and $13.55 per share, respectively. At December 31, 2010, approximately 2.5 million shares of common stock

were reserved for future issuance. Our employee stock purchase plan contains an “evergreen” provision that

automatically increases, on each January 1, the number of shares reserved for issuance under the employee stock

purchase plan by the number of shares purchased under this plan in the preceding calendar year.

Employee Savings Plan

We have a savings plan, which qualifies under Section 401(k) of the Internal Revenue Code. Participating

employees may contribute up to 25% of their annual salary, but not more than statutory limits. In 2008, 2009 and

2010, we contributed one dollar for each dollar a participant contributed, with a maximum contribution of 4% of

each employee’s salary, subject to a maximum employer contribution of $9,200, $9,800 and $9,800, respectively,

per employee. Our non-U.S. employees are covered by various other savings plans. Our total expenses for these

savings plans were $34.2 million in 2008, $42.8 million in 2009 and $47.4 million in 2010.

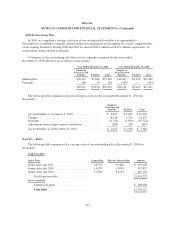

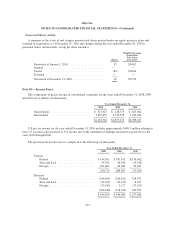

Deferred Stock Units

Since December 31, 2002, we have granted deferred stock units to non-employee directors (other than Pierre

Omidyar) elected to our Board of Directors with each new director receiving a one-time grant of deferred stock

units equal to the result of dividing $150,000 by the fair market value of our common stock on the date of grant.

Beginning with our 2008 annual meeting of stockholders, we have granted deferred stock units to each

non-employee director (other than Mr. Omidyar) at the time of our annual meeting of stockholders equal to the

result of dividing $110,000 by the fair market value of our common stock on the date of grant. Each deferred

stock unit constitutes an unfunded and unsecured promise by us to deliver one share of our common stock (or the

120