eBay 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

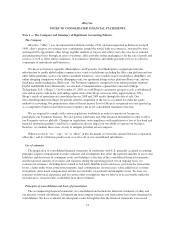

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Fair value of financial instruments

Our financial instruments, including cash, cash equivalents, accounts receivable, loans and interest

receivable, funds receivable, customer accounts, short-term debt, accounts payable, funds payable and amounts

due to customers are carried at cost, which approximates their fair value because of the short-term maturity of

these instruments.

Foreign currency

Most of our foreign subsidiaries use the local currency of their respective countries as their functional

currency. Assets and liabilities are translated at exchange rates prevailing at the balance sheet dates. Revenues,

costs and expenses are translated into U.S. dollars using daily exchange rates if the transaction is recorded in our

accounting systems on a daily basis, otherwise using average exchange rates for the period. Gains and losses

resulting from the translation of our consolidated balance sheet are recorded as a component of accumulated

other comprehensive income.

Realized gains and losses from foreign currency transactions are recognized as interest and other income

(expense), net.

Derivative instruments

We have significant international revenues as well as costs denominated in foreign currencies, subjecting us to

foreign currency risk. We purchase foreign currency exchange contracts that qualify as cash flow hedges, generally

with maturities of 15 months or less, to reduce the volatility of cash flows primarily related to forecasted revenue

and intercompany transactions denominated in certain foreign currencies. All outstanding designated derivatives

that qualify for hedge accounting are recognized on the balance sheet at fair value. The effective portion of the

designated derivative’s gain or loss is initially reported as a component of accumulated other comprehensive income

and is subsequently reclassified into the financial statement line item in which the hedged item is recorded in the

same period the forecasted transaction affects earnings. We also economically hedge our exposure to foreign

currency denominated monetary assets and liabilities with foreign currency contracts. The gains and losses on the

foreign exchange contracts economically offset transaction gains and losses on certain foreign currency

denominated monetary assets and liabilities recognized in earnings. Accordingly, these outstanding non-designated

derivatives are recognized on the balance sheet at fair value and changes in fair value from these contracts are

recorded in interest and other income (expense), net, in the consolidated statement of income. Our derivatives

program is not designed or operated for trading or speculative purposes.

Our derivative instruments expose us to credit risk to the extent that our counterparties may be unable to

meet the terms of the agreements. We seek to mitigate this risk by limiting our counterparties to major financial

institutions and by spreading the risk across several major financial institutions. In addition, the potential risk of

loss with any one counterparty resulting from this type of credit risk is monitored on an ongoing basis. See

“Note 9 — Derivative Instruments” for additional information related to our derivative instruments.

Concentration of credit risk

Our cash, cash equivalents, accounts receivable, loans and interest receivable, funds receivable and

customer accounts are potentially subject to concentration of credit risk. Cash, cash equivalents and customer

accounts are placed with financial institutions that management believes are of high credit quality. In addition,

funds receivable are generated with financial institutions or credit card companies that management believes are

of high credit quality. Our accounts receivable are derived from revenue earned from customers located in the

97