eBay 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

transactions, including the alignment of our corporate structure with our organizational objectives, the

operational and tax efficiency of our corporate structure, as well as the long-term cash flows and cash needs of

our different businesses. These transactions may impact our overall tax rate and/or result in additional cash tax

payments. The impact in any period may be significant. These transactions may be complex and the impact of

such transactions on future periods may be difficult to estimate.

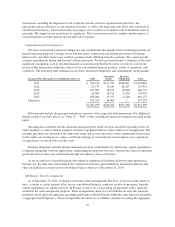

Commitments and Contingencies

We have certain fixed contractual obligations and commitments that include future estimated payments for

general operating purposes. Changes in our business needs, contractual cancellation provisions, fluctuating

interest rates, and other factors may result in actual payments differing from the estimates. We cannot provide

certainty regarding the timing and amounts of these payments. We have presented below a summary of the most

significant assumptions used in our determination of amounts presented in the tables, in order to assist in the

review of this information within the context of our consolidated financial position, results of operations, and

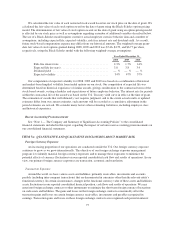

cash flows. The following table summarizes our fixed contractual obligations and commitments (in thousands):

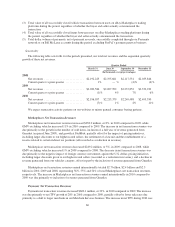

Payments Due During the Year Ending December 31, Debt

Operating

Leases

Purchase

Obligations Total

2011 ............................. $ 316,374 $117,795 $604,691 $1,038,860

2012 ............................. 21,375 56,249 68,307 145,931

2013 ............................. 429,500 26,472 10,800 466,772

2014 ............................. 26,000 18,705 4,200 48,905

2015 ............................. 626,000 13,977 4,200 644,177

Thereafter ............................. 581,250 16,004 — 597,254

$2,000,499 $249,202 $692,198 $2,941,899

Debt amounts include the principal and interest amounts of the respective debt instruments. For additional

details related to our debt, please see “Note 12 — Debt” to the consolidated financial statements included in this

report.

Operating lease amounts include minimum rental payments under our non-cancelable operating leases for

office facilities, as well as limited computer and office equipment that we utilize under lease arrangements. The

amounts presented are consistent with contractual terms and are not expected to differ significantly from actual

results under our existing leases, unless a substantial change in our headcount needs requires us to expand our

occupied space or exit an office facility early.

Purchase obligation amounts include minimum purchase commitments for advertising, capital expenditures

(computer equipment, software applications, engineering development services, construction contracts) and other

goods and services that were entered into through our ordinary course of business.

As we are unable to reasonably predict the timing of settlement of liabilities related to unrecognized tax

benefits, net, the table does not include $312.1 million of such non-current liabilities included in deferred and

other tax liabilities recorded on our consolidated balance sheet as of December 31, 2010.

Off-Balance Sheet Arrangements

As of December 31, 2010, we had no off-balance sheet arrangements that have, or are reasonably likely to

have, a current or future material effect on our consolidated financial condition, results of operations, liquidity,

capital expenditures or capital resources. In Europe, we have two cash pooling arrangements with a financial

institution for cash management purposes. These arrangements allow for cash withdrawals from this financial

institution based upon our aggregate operating cash balances held in Europe within the same financial institution

(“Aggregate Cash Deposits”). These arrangements also allow us to withdraw amounts exceeding the Aggregate

70