eBay 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

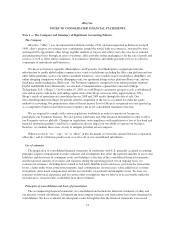

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The consolidated financial statements include 100% of the assets and liabilities of our majority-owned

subsidiaries and the ownership interests of minority investors are recorded as a noncontrolling interest.

Investments in private entities where we hold 20% or more but less than a 50% ownership interest and exercise

significant influence are accounted for using the equity method of accounting and the investment balance is

included in long-term investments, while our share of the investees’ results of operations is included in interest

and other income (expense), net. Investments in private entities where we hold less than a 20% ownership

interest and where we do not have control over, or the ability to significantly influence the operations of, the

investee are accounted for using the cost method of accounting, where our share of the investees’ results of

operations is not included in our consolidated statement of income, except to the extent of earnings distributions

actually received from the investee, and the cost basis of our investments is included in long-term investments.

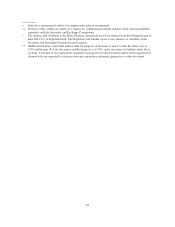

Revenue recognition

Our Marketplaces segment generates net transaction revenues primarily from listing and final value fees

paid by sellers. Listing fee revenues are recognized ratably over the estimated period of the listing, while

revenues related to final value fees are recognized at the time that the transaction is successfully concluded. An

auction transaction is considered successfully concluded when at least one buyer has bid above the seller’s

specified minimum price or reserve price, whichever is higher, at the end of the transaction term.

Our Payments segment earns net transaction revenues primarily from processing transactions for customers.

Revenues resulting from a payment processing transaction are recognized once the transaction is completed.

Our Communications segment net transaction revenues were generated primarily from fees charged to users

to connect Skype’s Internet communications products to traditional telecommunication networks. These fees

were recognized when the service was provided. The majority of Communications segment transaction revenues

were prepaid. We recorded customer advances for prepaid amounts in excess of revenues recognized as a current

liability.

Our marketing services and other revenues, included in all of our segments, are derived principally from the

sale of advertisements, revenue sharing arrangements, classifieds fees, lead referral fees and other revenues. Our

advertising revenues are derived principally from the sale of online advertisements. To date, the duration of our

advertising contracts has ranged from one week to five years, but is generally one week to one year. Advertising

revenues on contracts are recognized as “impressions” (i.e., the number of times that an advertisement appears in

pages viewed by users of our websites) are delivered, or as “clicks” (which are generated each time users on our

websites click through our text-based advertisements to an advertiser’s designated website) are provided to

advertisers. For contracts with minimum monthly or quarterly advertising commitments where the fee and

commitments are fixed throughout the term, we recognize revenue ratably over the term of the agreement. Some

of our advertising contracts consist of multiple elements which generally include a blend of various impressions

and clicks as well as other marketing deliverables. Where neither vendor specific objective evidence nor third

party evidence of selling price exists, we use management’s best estimate of selling price (BESP) to allocate

arrangement consideration on a relative basis to each element. BESP is generally based on the selling prices of

the various elements when they are sold to customers of a similar nature and geography on a stand-alone basis or

an estimated stand-alone pricing when the element has not previously been sold stand-alone. These estimates are

generally based on pricing strategies, market factors and strategic objectives. Revenues related to revenue sharing

arrangements are recognized based on revenue reports received from our partners, provided that collectability is

reasonably assured. Revenues related to fees for listing items on our classified websites and are recognized over

the estimated period of the classified listing. Lead referral fee revenue is generated from lead referral fees based

on the number of times a user clicks through to a merchant’s website from our websites. Lead referral fees are

recognized in the period in which the user clicks through to the merchant’s website.

92