eBay 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

equivalent value thereof in cash or property at our election). Each deferred stock unit award granted to a new

non-employee director upon election to the Board vests 25% one year from the date of grant, and at a rate of

2.08% per month thereafter. If the services of the director are terminated at any time, all rights to the unvested

deferred stock units will also terminate. In addition, directors may elect to receive, in lieu of annual retainer and

committee chair fees and at the time these fees would otherwise be payable (i.e., on a quarterly basis in arrears

for services provided), fully vested deferred stock units with an initial value equal to the amount based on the fair

market value of common stock at the date of grant. Deferred stock units are payable following the termination of

a director’s tenure as a director. As of December 31, 2010, there were approximately 203,819 deferred stock

units outstanding included in our restricted stock unit activity below.

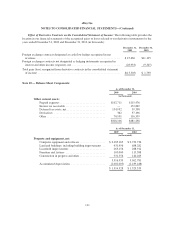

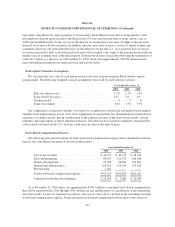

Stock Option Valuation Assumptions

We calculated the fair value of each option award on the date of grant using the Black-Scholes option

pricing model. The following weighted-average assumptions were used for each respective period:

Year Ended December 31,

2008 2009 2010

Risk-free interest rates ................................. 2.3% 1.7% 1.4%

Expected life (in years) ................................. 3.8 3.8 3.4

Dividend yield ....................................... — % — % — %

Expected volatility .................................... 34% 47% 37%

Our computation of expected volatility was based on a combination of historical and market-based implied

volatility from traded options on our stock. Our computation of expected life was determined based on historical

experience of similar awards, giving consideration to the contractual terms of the stock-based awards, vesting

schedules and expectations of future employee behavior. The interest rate for periods within the contractual life

of the award was based on the U.S. Treasury yield curve in effect at the time of grant.

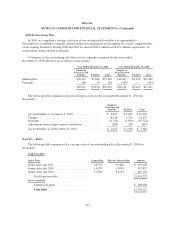

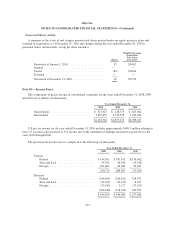

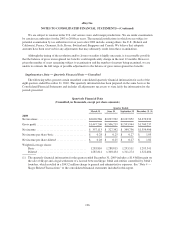

Stock-Based Compensation Expense

The following table presents details of total stock-based compensation expense that is included in each line

item on our consolidated statement of income (in thousands):

Year Ended December 31,

2008 2009 2010

Cost of net revenues ........................... $ 43,417 $ 49,275 $ 48,764

Sales and marketing ........................... 94,314 121,724 106,208

Product development .......................... 95,396 98,609 101,001

General and administrative ..................... 118,915 125,199 125,519

Restructuring ................................ 1,281 — —

Total stock-based compensation expense .......... $353,323 $394,807 $381,492

Capitalized in Product Development .............. $ 10,550 $ 9,060 $ 10,484

As of December 31, 2010, there was approximately $530.1 million of unearned stock-based compensation

that will be expensed from 2011 through 2014. If there are any modifications or cancellations of the underlying

unvested awards, we may be required to accelerate, increase or cancel all or a portion of the remaining unearned

stock-based compensation expense. Future unearned stock-based compensation will increase to the extent we

121