eBay 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

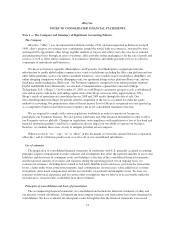

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

U.S. and internationally. Our loans and interest receivable are derived from consumer financing activities for

customers located in the U.S. As of December 31, 2009 and 2010, no customers accounted for more than 10% of

net accounts receivable or net loans receivable. During the years ended December 31, 2008, 2009 and 2010, no

customers accounted for more than 10% of net revenues.

Impairment of long-lived assets

We evaluate long-lived assets (including intangible assets) for impairment whenever events or changes in

circumstances indicate that the carrying amount of a long-lived asset may not be recoverable. An asset is

considered impaired if its carrying amount exceeds the undiscounted future net cash flow the asset is expected to

generate. If an asset is considered to be impaired, the impairment to be recognized is measured by the amount by

which the carrying amount of the asset exceeds its fair market value. We assess the recoverability of our long-

lived and intangible assets by determining whether the unamortized balances can be recovered through

undiscounted future net cash flows of the related assets. The amount of impairment, if any, is measured using fair

market values which are estimated based on projected discounted future net cash flows.

Recent accounting pronouncements

In 2009, we adopted new accounting guidance for business combinations as issued by the Financial

Accounting Standards Board (FASB). The new accounting guidance establishes principles and requirements for

how an acquirer in a business combination recognizes and measures in its financial statements the identifiable

assets acquired, liabilities assumed, and any noncontrolling interests in the acquiree, as well as the goodwill

acquired. Significant changes from previous guidance resulting from this new guidance include the expansion of

the definitions of a “business” and a “business combination.” For all business combinations (whether partial, full

or step acquisitions), the acquirer will record 100% of all assets and liabilities of the acquired business, including

goodwill, generally at their fair values; contingent consideration will be recognized at its fair value on the

acquisition date and; for certain arrangements, changes in fair value will be recognized in earnings until

settlement; and acquisition-related transaction and restructuring costs will be expensed rather than treated as part

of the cost of the acquisition. The new accounting guidance also establishes disclosure requirements to enable

users to evaluate the nature and financial effects of the business combination. The adoption of this accounting

guidance did not have a material impact on our consolidated financial statements. See “Note 3 — Business

Combinations” for additional details.

In 2009, we adopted new accounting guidance for noncontrolling interests in subsidiaries as issued by the

FASB. The new accounting guidance establishes accounting and reporting standards for the noncontrolling

interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a

subsidiary, which is sometimes referred to as a minority interest, is a third-party ownership interest in the

consolidated entity that should be reported as a component of equity in the consolidated financial statements.

Among other requirements, the new guidance requires the consolidated statement of income to be reported at

amounts that include the amounts attributable to both the parent and the noncontrolling interest. The new

guidance also requires disclosure on the face of the consolidated statement of income of the amounts of

consolidated net income attributable to the parent and to the noncontrolling interest. As a result of the new

accounting guidance, we remeasured the noncontrolling interest in Skype at its estimated fair value and recorded

a gain upon sale of controlling interest on November 19, 2009. See “Note 4 — Skype Related Transactions” for

additional details.

In 2009, the FASB issued new accounting guidance that amends the evaluation criteria used to identify the

primary beneficiary of a variable interest entity (VIE) and requires ongoing reassessment of whether an

enterprise is the primary beneficiary of the VIE. The new guidance significantly changes the consolidation rules

98