eBay 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

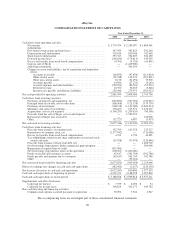

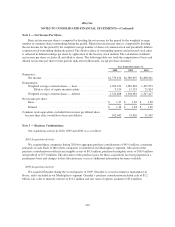

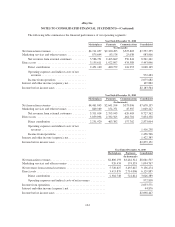

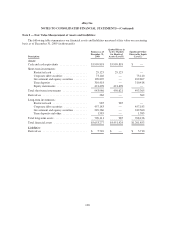

Note 2 — Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted average

number of common shares outstanding during the period. Diluted net income per share is computed by dividing

the net income for the period by the weighted average number of shares of common stock and potentially dilutive

common stock outstanding during the period. The dilutive effect of outstanding options and restricted stock units

is reflected in diluted earnings per share by application of the treasury stock method. The calculation of diluted

net income per share excludes all anti-dilutive shares. The following table sets forth the computation of basic and

diluted net income per share for the periods indicated (in thousands, except per share amounts):

Year Ended December 31,

2008 2009 2010

Numerator:

Net income ............................................ $1,779,474 $2,389,097 $1,800,961

Denominator:

Weighted average common shares — basic ................... 1,303,454 1,289,848 1,305,593

Dilutive effect of equity incentive plans .................. 9,154 15,133 21,824

Weighted average common shares — diluted .................. 1,312,608 1,304,981 1,327,417

Net income per share:

Basic ................................................. $ 1.37 $ 1.85 $ 1.38

Diluted ................................................ $ 1.36 $ 1.83 $ 1.36

Common stock equivalents excluded from income per diluted share

because their effect would have been anti-dilutive ................ 102,642 53,026 31,509

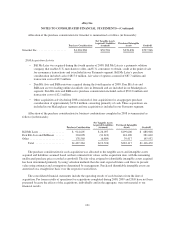

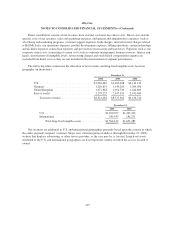

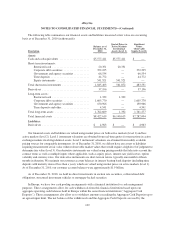

Note 3 — Business Combinations:

Our acquisition activity in 2010, 2009 and 2008, was as follows:

2010 Acquisition Activity

We acquired three companies during 2010 for aggregate purchase consideration of $95.9 million, consisting

primarily of cash. Each of these three companies is included in our Marketplaces segment. Allocation of the

purchase consideration resulted in net tangible assets of $0.3 million, purchased intangible assets of $18.0 million

and goodwill of $77.6 million. The allocation of the purchase price for these acquisitions has been prepared on a

preliminary basis and changes to that allocation may occur as additional information becomes available.

2009 Acquisition Activity

We acquired Gmarket during the second quarter of 2009. Gmarket is a retail ecommerce marketplace in

Korea, and is included in our Marketplaces segment. Gmarket’s purchase consideration included cash of $1.2

billion, fair value of minority interest of $12.2 million and fair value of options assumed of $5.4 million.

100