eBay 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

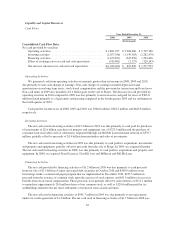

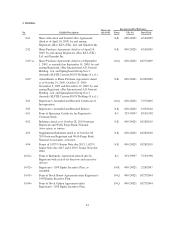

We calculated the fair value of each restricted stock award based on our stock price on the date of grant. We

calculated the fair value of each stock option award on the date of grant using the Black-Scholes option pricing

model. The determination of fair value of stock option awards on the date of grant using an option-pricing model

is affected by our stock price as well as assumptions regarding a number of additional variables described below.

The use of a Black-Scholes model requires extensive actual employee exercise behavior data and a number of

assumptions, including expected life, expected volatility, risk-free interest rate and dividend yield. As a result,

future stock-based compensation expense may differ from our historical amounts. The weighted-average grant-

date fair value of stock options granted during 2008, 2009 and 2010 was $7.46, $4.59, and $6.77 per share,

respectively, using the Black-Scholes model with the following weighted-average assumptions:

Year Ended December 31,

2008 2009 2010

Risk-free interest rate .................................. 2.3% 1.7% 1.4%

Expected life (in years) ................................. 3.8 3.8 3.4

Dividend yield ....................................... — % — % — %

Expected volatility .................................... 34% 47% 37%

Our computation of expected volatility for 2008, 2009 and 2010 was based on a combination of historical

and market-based implied volatility from traded options on our stock. Our computation of expected life was

determined based on historical experience of similar awards, giving consideration to the contractual terms of the

stock-based awards, vesting schedules and expectations of future employee behavior. The interest rate for periods

within the contractual life of the award was based on the U.S. Treasury yield curve in effect at the time of grant.

The estimation of awards that will ultimately vest requires judgment, and to the extent actual results or updated

estimates differ from our current estimates, such amounts will be recorded as a cumulative adjustment in the

period estimates are revised. We consider many factors when estimating forfeitures, including employee class

and historical experience.

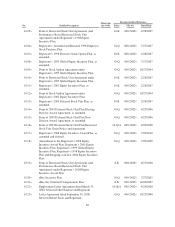

Recent Accounting Pronouncements

See “Note 1 — The Company and Summary of Significant Accounting Policies” to the consolidated

financial statements included in this report, regarding the impact of certain recent accounting pronouncements on

our consolidated financial statements.

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Foreign Currency Exposure

An increasing proportion of our operations are conducted outside the U.S. Our foreign currency exposure

continues to grow as we grow internationally. The objective of our foreign exchange exposure management

program is to identify material foreign currency exposures and to manage these exposures to minimize the

potential effects of currency fluctuations on our reported consolidated cash flow and results of operations. In our

view, our primary foreign currency exposures are transaction, economic and translation.

Transaction Exposure

Around the world, we have various assets and liabilities, primarily receivables, investments and accounts

payable (including inter-company transactions) that are denominated in currencies other than the relevant entity’s

functional currency. In certain circumstances, changes in the functional currency value of these assets and liabilities

create fluctuations in our reported consolidated financial position, cash flows and results of operations. We may

enter into foreign exchange contracts or other instruments to minimize the short-term foreign currency fluctuations

on such assets and liabilities. The gains and losses on the foreign exchange contracts economically offset the

transaction gains and losses on certain foreign currency receivables, investments and payables recognized in

earnings. Transaction gains and losses on these foreign exchange contracts are recognized each period in interest

75