eBay 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

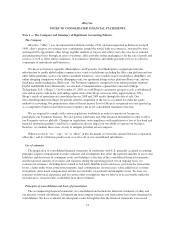

Our other revenues are derived principally from contractual arrangements with third parties that provide

services to eBay and PayPal users, interest earned from banks on certain PayPal customer account balances and

interest and fees earned on the Bill Me Later portfolio of receivables from loans. Revenues from contractual

arrangements with third parties are recognized as the contracted services are delivered to end users. Revenues

from interest income are recognized when earned. Interest and fees earned on the Bill Me Later portfolio of

receivables from loans are computed and recognized based on the amount of loans outstanding and related

contractual interest and fee rates, and are net of any required necessary reserves.

To drive traffic to our websites, we provide incentives to our users in the form of coupons and buyer and

seller rewards. These incentives are treated as reductions in revenue.

Software development costs

Costs related to the planning and post implementation phases of our software development efforts are

recorded as an operating expense. Direct costs incurred during the development phase are capitalized and

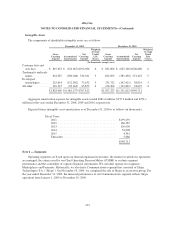

amortized over an estimated useful life of one to three years. During the years ended December 31, 2008, 2009

and 2010, we capitalized $147.7 million, $160.4 million and $193.1 million of software development costs,

respectively.

Advertising expense

We expense the costs of producing advertisements at the time production occurs and expense the cost of

communicating advertisements in the period during which the advertising space or airtime is used as sales and

marketing expense. Internet advertising expenses are recognized based on the terms of the individual agreements,

which is generally over the greater of the ratio of the number of impressions delivered over the total number of

contracted impressions, on a pay-per-click basis, or on a straight-line basis over the term of the contract.

Advertising expense totaled $923.4 million, $799.9 million and $808.4 million for the years ended December 31,

2008, 2009 and 2010, respectively.

Stock-based compensation

We primarily issue two types of stock-based awards: restricted stock units (including performance-based

restricted stock units) and stock options. We determine compensation expense associated with restricted stock

units based on the fair value of our common stock on the date of grant. We determine compensation expense

associated with stock options based on the estimated grant date fair value method using the Black-Scholes

valuation model. We generally recognize compensation expense using a straight-line amortization method over

the respective vesting period for awards that are ultimately expected to vest. Accordingly, stock-based

compensation for 2008, 2009 and 2010 has been reduced for estimated forfeitures. When estimating forfeitures,

we consider voluntary termination behaviors as well as trends of actual option forfeitures. We recognize a benefit

from stock-based compensation in equity if an incremental tax benefit is realized by following the ordering

provisions of the tax law. In addition, we account for the indirect effects of stock-based compensation on the

research tax credit and the foreign tax credit through the income statement.

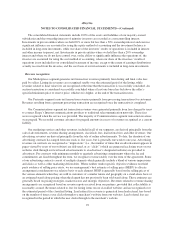

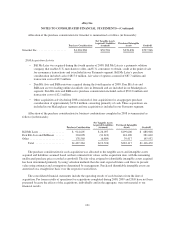

Provision for transaction losses

We are exposed to losses due to payment card and other payment misuse, as well as non-performance of and

credit losses from sellers. Provisions for these items represent our estimate of actual losses based on our

historical experience and actuarial techniques, as well as economic conditions. Provision for transaction losses

includes PayPal’s transaction loss expense as well as losses resulting from our customer protection programs.

93