Xcel Energy 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

XCEL ENERGY 2003 ANNUAL REPORT 25

and included in continuing operations and reported as Special Charges. Approximately $12 million of these costs were incurred in 2003 and $5 million

were incurred in 2002, which reduced after-tax earnings by approximately 2 cents per share and 1 cent per share, respectively. Costs in 2003 included

approximately $32 million of financial advisor fees, legal costs and consulting costs related to the NRG bankruptcy transaction. These charges were

partially offset by a $20 million pension curtailment gain related to the termination of NRG employees from Xcel Energy’s pension plan. In 2003,

Xcel Energy also recorded a $7 million charge in connection with the suspension of the formation of the independent transmission company TRANSLink

Transmission Co., LLC (TRANSLink). See Note 2 to the Consolidated Financial Statements for further discussion of these special charges.

Other Nonregulated In 2003, Utility Engineering sold water rights, resulting in a pretax gain (reported as nonoperating income) of $15 million.

The gain increased after-tax income by approximately 2 cents per share.

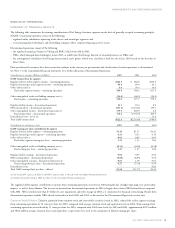

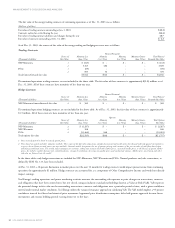

STATEMENT OF OPERATIONS ANALYSIS – DISCONTINUED OPERATIONS

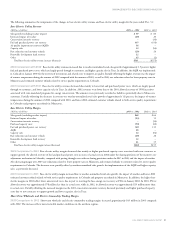

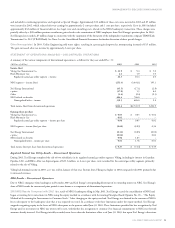

A summary of the various components of discontinued operations is as follows for the years ended Dec. 31:

(Millions of dollars) 2003 2002 2001

Income (loss)

Viking Gas Transmission Co. $21.9 $ 9.4 $ 5.0

Black Mountain Gas 2.4 1.0 1.0

Regulated natural gas utility segment – income 24.3 10.4 6.0

NRG segment – income (loss) (251.4) (3,444.1) 195.1

Xcel Energy International (45.5) (17.1) (2.9)

e prime (17.8) 1.5 8.0

Other (1.6) (2.4) (2.3)

NRG-related tax benefits 404.4 706.0 –

Nonregulated/other – income 339.5 688.0 2.8

Total income (loss) from discontinued operations $112.4 $(2,745.7) $203.9

Earnings (loss) per share

Viking Gas Transmission Co. $0.05 $ 0.03 $ 0.02

Black Mountain Gas 0.01 ––

Regulated natural gas utility segment – income per share 0.06 0.03 0.02

NRG segment – income (loss) per share (0.60) (8.95) 0.56

Xcel Energy International (0.11) (0.05) (0.01)

e prime (0.04) – 0.02

NRG-related tax benefits 0.96 1.83 –

Nonregulated/other – income per share 0.81 1.78 0.01

Total income (loss) per share from discontinued operations $0.27 $(7.14) $ 0.59

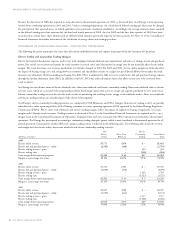

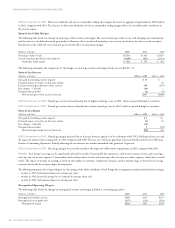

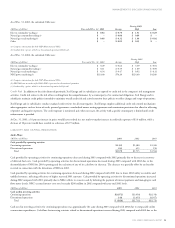

Regulated Natural Gas Utility Results – Discontinued Operations

During 2003, Xcel Energy completed the sale of two subsidiaries in its regulated natural gas utility segment: Viking, including its interest in Guardian

Pipeline, LLC, and BMG. After-tax disposal gains of $23.3 million, or 6 cents per share, were recorded for the natural gas utility segment, primarily

related to the sale of Viking.

Viking had minimal income in 2003, as it was sold in January of that year. Income from Viking was higher in 2002 compared with 2001 primarily due

to increased revenues.

NRG Results – Discontinued Operations

Due to NRG’s emergence from bankruptcy in December 2003 and Xcel Energy’s corresponding divestiture of its ownership interest in NRG, Xcel Energy’s

share of NRG results for current and prior periods is now shown as a component of discontinued operations.

2003 NRG Results Compared with 2002 As a result of NRG’s bankruptcy filing in May 2003, Xcel Energy ceased the consolidation of NRG and

began accounting for its investment in NRG using the equity method in accordance with Accounting Principles Board Opinion No. 18 – “The Equity

Method of Accounting for Investments in Common Stock.” After changing to the equity method, Xcel Energy was limited in the amount of NRG’s

losses subsequent to the bankruptcy date that it was required to record. In accordance with these limitations under the equity method, Xcel Energy

stopped recognizing equity in the losses of NRG subsequent to the quarter ended June 30, 2003. These limitations provided for loss recognition by Xcel

Energy until its investment in NRG was written off to zero, with further loss recognition to continue if its financial commitments to NRG exist beyond

amounts already invested. Xcel Energy initially recorded more losses than the limitations allow as of June 30, 2003, but upon Xcel Energy’s divestiture