Xcel Energy 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 XCEL ENERGY 2003 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

deconsolidation of NRG for 2003 reporting and the exclusion of any of its cash flows in that year. NRG had significant construction expenditures

during 2002 prior to its financial difficulties.

Cash used in investing activities for continuing operations decreased slightly during 2002 compared with 2001 primarily due to lower utility construction

expenditures in 2002. Cash used in investing activities for discontinued operations decreased during 2002 compared with 2001 primarily due to lower levels

of nonregulated capital expenditures as a result of NRG terminating its acquisition program due to its financial difficulties. Such nonregulated expenditures

decreased $2.8 billion in 2002 due mainly to NRG asset acquisitions in 2001 that did not recur in 2002.

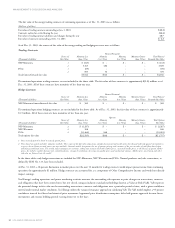

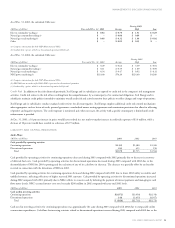

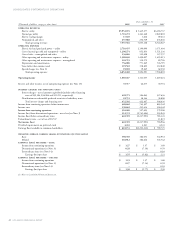

(Millions of dollars) 2003 2002 2001

Cash (used in) provided by financing activities

Continuing operations $(367) $115 $ (435)

Discontinued operations –1,465 4,148

Total $(367) $1,580 $3,713

Cash flows for financing activities related to continuing operations decreased during 2003 compared with 2002 due to refinancing activities in 2003 to

better align Xcel Energy’s capital structure and manage the cost of capital given the improving credit quality of Xcel Energy and its subsidiaries. During

2003, Xcel Energy and its subsidiaries extinguished $1.3 billion of long-term debt and issued approximately $1.7 billion of long-term debt, as shown in

the Consolidated Statement of Capitalization. Cash flows for financing activities related to discontinued operations decreased during 2003 compared

with 2002 due to the deconsolidation of NRG for 2003 reporting and the exclusion of any of its cash flows in that year. NRG obtained financing in

2002 for its construction expenditures prior to experiencing its financial difficulties.

Cash flow for financing activities related to continuing operations increased during 2002 compared with 2001 primarily due to refinancing activities in

2002, including the redemption of $867 million of short-term debt and the issuance of $1.4 billion of new debt. Cash flow provided by financing

activities for discontinued operations decreased during 2002 compared with 2001 primarily due to lower NRG capital requirements and constraints

on NRG’s ability to access the capital market due to its financial difficulties, as discussed previously. NRG’s cash provided from financing activities

declined by $2.7 billion in 2002 compared with 2001.

See discussion of trends, commitments and uncertainties with the potential for future impact on cash flow and liquidity under Capital Sources.

Capital Requirements

Utility Capital Expenditures, Nonregulated Investments and Long-Term Debt Obligations The estimated cost of the capital expenditure

programs of Xcel Energy and its subsidiaries, excluding discontinued operations, and other capital requirements for the years 2004, 2005 and 2006

are shown in the table below.

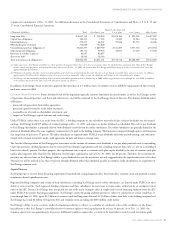

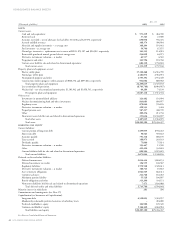

(Millions of dollars) 2004 2005 2006

Electric utility $ 975 $ 975 $1,064

Natural gas utility 115 133 111

Common utility 101 112 106

Total utility 1,191 1,220 1,281

Other nonregulated 30 31 15

Total capital expenditures 1,221 1,251 1,296

Sinking funds and debt maturities 153 224 837

Total capital requirements $1,374 $1,475 $2,133

The capital expenditure forecast includes new steam generators at the Prairie Island nuclear plant, new combustion turbines in two NSP-Minnesota

plants and costs related to a proposed coal-fired generating plant in Colorado. The capital expenditure forecast also includes the early stages of the costs

related to the MERP modifications to reduce the emissions of NSP-Minnesota’s generating plants located in the Minneapolis-St. Paul metropolitan area.

The MERP project is expected to cost approximately $1 billion, with major construction starting in 2005 and finishing in 2009. Xcel Energy expects to

recover the costs of the emission-reduction project through customer rate increases beginning in 2006.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction expenditures may vary

from the estimates due to changes in electric and natural gas projected load growth, the desired reserve margin and the availability of purchased power, as

well as alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of restructuring requirements,

compliance with future requirements to install emission-control equipment, and merger, acquisition and divestiture opportunities to support corporate

strategies may impact actual capital requirements. For more information, see Note 17 to the Consolidated Financial Statements.

Xcel Energy’s investment in exempt wholesale generators and foreign utility companies is currently limited to 100 percent of consolidated retained earnings

as a result of the PUHCA restrictions. At this time, Xcel Energy has no capacity to make additional investments in exempt wholesale generators and foreign

utility companies without authorization from the SEC.

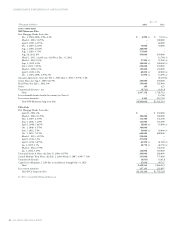

Contractual Obligations and Other Commitments Xcel Energy has contractual obligations and other commercial commitments that will need

to be funded in the future, in addition to its capital expenditure programs. The following is a summarized table of contractual obligations and other