Xcel Energy 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 79

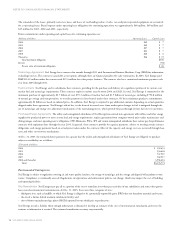

request to Xcel Energy seeking additional information regarding NSR compliance at its plants in Minnesota. Xcel Energy completed its response

to the follow-up information request during the fall of 2002.

NSP-Minnesota Notice of Violation On Dec. 10, 2001, the Minnesota Pollution Control Agency issued a notice of violation to NSP-Minnesota

alleging air quality violations related to the replacement of a coal conveyor and violations of an opacity limitation at the A.S. King generating plant.

NSP-Minnesota has responded to the notice of violation and is working to resolve the allegations.

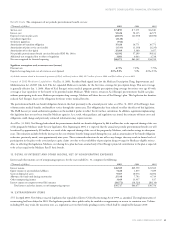

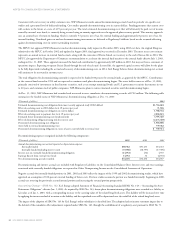

Nuclear Insurance NSP-Minnesota’s public liability for claims resulting from any nuclear incident is limited to $10.9 billion under the 1988

Price-Anderson amendment to the Atomic Energy Act of 1954. NSP-Minnesota has secured $300 million of coverage for its public liability exposure

with a pool of insurance companies. The remaining $10.6 billion of exposure is funded by the Secondary Financial Protection Program, available

from assessments by the federal government in case of a nuclear accident. NSP-Minnesota is subject to assessments of up to $100.6 million for

each of its three licensed reactors, to be applied for public liability arising from a nuclear incident at any licensed nuclear facility in the United

States. The maximum funding requirement is $10 million per reactor during any one year.

NSP-Minnesota purchases insurance for property damage and site decontamination cleanup costs from Nuclear Electric Insurance Ltd. (NEIL). The

coverage limits are $2.0 billion for each of NSP-Minnesota’s two nuclear plant sites. NEIL also provides business interruption insurance coverage,

including the cost of replacement power obtained during certain prolonged accidental outages of nuclear generating units. Premiums are expensed over

the policy term. All companies insured with NEIL are subject to retroactive premium adjustments if losses exceed accumulated reserve funds. Capital

has been accumulated in the reserve funds of NEIL to the extent that NSP-Minnesota would have no exposure for retroactive premium assessments in

case of a single incident under the business interruption and the property damage insurance coverage. However, in each calendar year, NSP-Minnesota

could be subject to maximum assessments of approximately $7.5 million for business interruption insurance and $25.6 million for property damage

insurance if losses exceed accumulated reserve funds.

Legal Contingencies

In the normal course of business, Xcel Energy is subject to claims and litigation arising from prior and current operations. Xcel Energy is actively

defending these matters and has recorded an estimate of the probable cost of settlement or other disposition.

The ultimate outcome of these matters cannot presently be determined. Accordingly, the ultimate resolution of these matters could have a material

adverse effect on Xcel Energy’s financial position and results of operations.

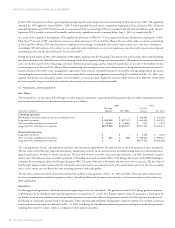

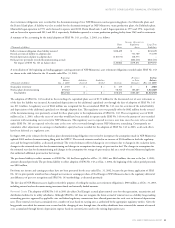

Department of Labor Audit In 2001, Xcel Energy received notice from the Department of Labor (DOL) Employee Benefit Security Administration

that it intended to audit the Xcel Energy pension plan. After multiple on-site meetings and interviews with Xcel Energy personnel, the DOL indicated

on Sept. 18, 2003, that it is prepared to take the position that Xcel Energy, as plan sponsor and through its delegate, the Pension Trust Administration

Committee, breached its fiduciary duties under the Employee Retirement Income Security Act of 1974 (ERISA) with respect to certain investments

made in limited partnerships and hedge funds in 1997 and 1998.

All discussions related to potential ERISA fiduciary violations have been preliminary and unofficial. The DOL has offered to conclude the audit at this

time if Xcel Energy is willing to contribute to the plan the full amount of losses from each of these questioned investments, or approximately $13 million.

Xcel Energy has responded with a letter to the DOL asserting that no fiduciary violations have occurred, and extended an offer to meet to discuss the

matter further. In December 2003, the DOL requested, and Xcel Energy agreed, to toll the statute of limitations under ERISA with respect to this

claim. The DOL now has until Dec. 5, 2004, to assert a claim. If the DOL offer is put into effect, the requested contribution would affect cash flows

only and not the net income of Xcel Energy.

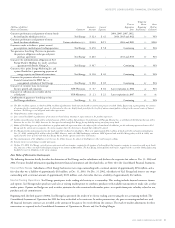

Xcel Energy Inc. Securities Litigation On July 31, 2002, a lawsuit purporting to be a class action on behalf of purchasers of Xcel Energy’s common

stock between Jan. 31, 2001, and July 26, 2002, was filed in the U.S. District Court for the District of Minnesota. The complaint named Xcel Energy;

Wayne H. Brunetti, chairman and chief executive officer; Edward J. McIntyre, former vice president and chief financial officer; and former chairman

James J. Howard as defendants. Among other things, the complaint alleged violations of Section 10(b) of the Securities Exchange Act and Rule 10(b-5)

related to allegedly false and misleading disclosures concerning various issues including but not limited to “round trip” energy trades; the nature, extent

and seriousness of liquidity and credit difficulties at NRG; and the existence of cross-default provisions (with NRG credit agreements) in certain of Xcel

Energy’s credit agreements. After filing the lawsuit, several additional lawsuits were filed with similar allegations, one of which added claims on behalf of

a purported class of purchasers of two series of Senior Notes issued by NRG in January 2001. The cases have all been consolidated, and a consolidated

amended complaint has been filed. The amended complaint charges false and misleading disclosures concerning “round trip” energy trades and the existence

of provisions in Xcel Energy’s credit agreements for cross-defaults in the event of a default by NRG in one or more of NRG’s credit agreements; it adds

as additional defendants Gary R. Johnson, general counsel; Richard C. Kelly, then president of Xcel Energy Enterprises; two former executive officers

and one current executive officer of NRG, David H. Peterson, Leonard A. Bluhm, and William T. Pieper; and a former independent director of NRG,

Luella G. Goldberg; and it adds claims of false and misleading disclosures, also regarding “round trip” trades and the cross-default provisions, as well as

the extent to which the “fortunes” of NRG were tied to Xcel Energy, especially in the event of a buyback of NRG’s publicly owned shares under

Section 11 of the Securities Act, with respect to issuance of the Senior Notes by NRG. The amended complaint seeks compensatory and rescissionary

damages, interest and an award of fees and expenses. On Sept. 30, 2003, in response to the defendants’ motion to dismiss, the court issued an order