Xcel Energy 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

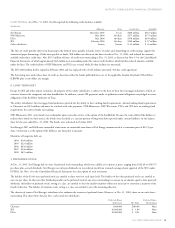

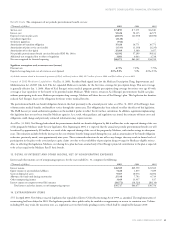

8. MANDATORILY REDEEMABLE PREFERRED SECURITIES OF SUBSIDIARY TRUSTS

Southwestern Public Service Capital I, a wholly owned, special-purpose subsidiary trust of SPS, had $100 million of 7.85-percent trust preferred

securities issued and outstanding that were originally scheduled to mature in 2036. Distributions paid by the subsidiary trust on the preferred securities

were financed through interest payments on debentures issued by SPS and held by the subsidiary trust, which were eliminated in consolidation.

Distributions and redemption payments were guaranteed by SPS. The securities were redeemable at the option of SPS after October 2001, at 100 percent

of the principal amount plus accrued interest. On Oct. 15, 2003, SPS redeemed the $100 million of trust preferred securities. A certificate of cancellation

was filed to dissolve SPS Capital I on Jan. 5, 2004.

NSP Financing I, a wholly owned, special-purpose subsidiary trust of NSP-Minnesota, had $200 million of 7.875-percent trust preferred securities

issued and outstanding that were originally scheduled to mature in 2037. Distributions paid by the subsidiary trust on the preferred securities were

financed through interest payments on debentures issued by NSP-Minnesota and held by the subsidiary trust, which were eliminated in consolidation.

Distributions and redemption payments were guaranteed by NSP-Minnesota. The preferred securities were redeemable at NSP Financing I’s option

at $25 per share, beginning in 2002. On July 31, 2003, NSP-Minnesota redeemed the $200 million of trust preferred securities. A certificate of cancellation

was filed to dissolve NSP Financing I on Sept. 15, 2003.

PSCo Capital Trust I, a wholly owned, special-purpose subsidiary trust of PSCo, had $194 million of 7.60-percent trust preferred securities issued and

outstanding that were originally scheduled to mature in 2038. Distributions paid by the subsidiary trust on the preferred securities were financed through

interest payments on debentures issued by PSCo and held by the subsidiary trust, which were eliminated in consolidation. Distributions and redemption

payments were guaranteed by PSCo. The securities were redeemable at the option of PSCo after May 2003, at 100 percent of the principal amount

outstanding plus accrued interest. On June 30, 2003, PSCo redeemed the $194 million of trust preferred securities. A certificate of cancellation was

filed to dissolve PSCo Capital Trust I on Dec. 29, 2003.

The mandatorily redeemable preferred securities of subsidiary trusts were consolidated in Xcel Energy’s Consolidated Balance Sheets. Distributions paid

to preferred security holders were reflected as a financing cost in the Consolidated Statements of Operations, along with interest charges.

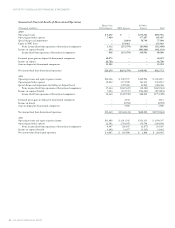

9. JOINT PLANT OWNERSHIP

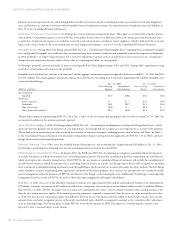

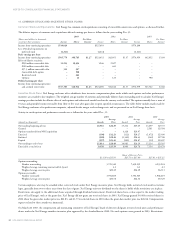

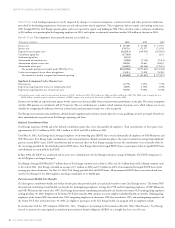

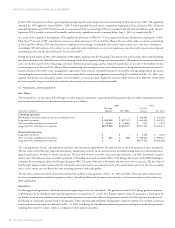

Following are the investments by Xcel Energy’s subsidiaries in jointly owned plants and the related ownership percentages as of Dec. 31, 2003:

Plant in Accumulated Construction

(Thousands of dollars) Service Depreciation Work in Progress Ownership %

NSP-Minnesota

Sherco Unit 3 $617,343 $311,252 $500 59.0

Transmission facilities, including substations 2,761 843 – 59.0

Total NSP-Minnesota $620,104 $312,095 $ 500

PSCo

Hayden Unit 1 $ 85,828 $ 40,764 $ – 75.5

Hayden Unit 2 79,818 43,834 76 37.4

Hayden Common Facilities 27,614 4,010 1,017 53.1

Craig Units 1 & 2 58,224 30,876 80 9.7

Craig Common Facilities Units 1, 2 & 3 19,109 9,246 9,935 6.5–9.7

Transmission Facilities, including substations 112,594 40,779 18,380 42.0–73.0

Total PSCo $383,187 $169,509 $29,488

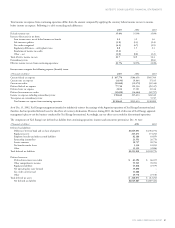

NSP-Minnesota is part owner of Sherco 3, an 860-megawatt coal-fueled electric generating unit. NSP-Minnesota is the operating agent under the joint

ownership agreement. NSP-Minnesota’s share of operating expenses and construction expenditures are included in the applicable utility components of

operating expenses. PSCo’s assets include approximately 320 megawatts of jointly owned generating capacity. PSCo’s share of operating expenses and

construction expenditures are included in the applicable utility components of operating expenses. Each of the respective owners is responsible for

the issuance of its own securities to finance its portion of the construction costs.

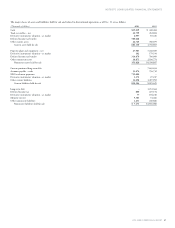

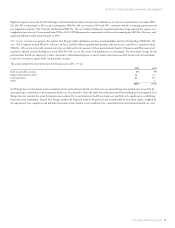

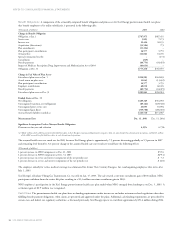

10. INCOME TAXES

Xcel Energy’s share of NRG results for current and prior periods is now shown as a component of discontinued operations, due to NRG’s emergence

from bankruptcy in December 2003 and Xcel Energy’s corresponding divestiture of its ownership interest in NRG. Accordingly, Xcel Energy’s tax

benefits related to its investment in NRG are reported in discontinued operations.

Xcel Energy’s federal net operating loss and tax credit carry forwards are estimated to be $742 million and $70 million, respectively, after considering a

two-year carry back of the loss. The carry forward periods expire in 2023. Xcel Energy also has a net operating loss carry forward in some states. The

state carry forward periods expire between 2018 and 2023.