Xcel Energy 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 49

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business and System of Accounts Xcel Energy’s utility subsidiaries are engaged principally in the generation, purchase, transmission, distribution

and sale of electricity and in the purchase, transportation, distribution and sale of natural gas. Xcel Energy and its subsidiaries are subject to the regulatory

provisions of the PUHCA. The utility subsidiaries are subject to regulation by the FERC and state utility commissions. All of the utility companies’

accounting records conform to the FERC uniform system of accounts or to systems required by various state regulatory commissions, which are the same

in all material respects.

Principles of Consolidation Xcel Energy directly owns five utility subsidiaries that serve electric and natural gas customers in 11 states. These

utility subsidiaries are Northern States Power Co., a Minnesota corporation (NSP-Minnesota), Northern States Power Co., a Wisconsin corporation

(NSP-Wisconsin), Public Service Company of Colorado (PSCo), Southwestern Public Service Co. (SPS) and Cheyenne Light, Fuel and Power Co.

(Cheyenne). Their service territories include portions of Colorado, Kansas, Michigan, Minnesota, New Mexico, North Dakota, Oklahoma, South

Dakota, Texas, Wisconsin and Wyoming. Xcel Energy’s regulated subsidiaries also included WestGas Interstate Inc. (WGI), an interstate natural gas

pipeline company. Also, until 2003, Xcel Energy’s regulated businesses included Viking Gas Transmission Co. (Viking), which was sold in January 2003,

and Black Mountain Gas Co. (BMG), which was sold in October 2003. See Note 3 to the Consolidated Financial Statements for more information on

the discontinued operations of Viking and BMG. In January 2004, Xcel Energy reached an agreement to sell Cheyenne, pending regulatory approval.

Xcel Energy’s nonregulated businesses in continuing operations include Utility Engineering Corp. (engineering, construction and design), Seren Innovations,

Inc. (broadband telecommunications services), Planergy International, Inc. (energy management solutions) and Eloigne Co. (investments in rental

housing projects that qualify for low-income housing tax credits). In December 2003, Xcel Energy’s board of directors approved management’s plan

to exit the businesses conducted by the nonregulated subsidiaries Xcel Energy International Inc. (an international independent power producer) and

e prime inc. (a natural gas marketing and trading company). Both of these businesses are presented as a component of discontinued operations, as

discussed in Note 3 to the Consolidated Financial Statements.

Xcel Energy also divested its ownership interest in NRG Energy, Inc. (NRG), an independent power producer, in 2003. Xcel Energy owned 82 percent

of NRG at the beginning of 2001. In March 2001, 8 percent of NRG was sold to the public, leaving Xcel Energy with an interest of about 74 percent

at Dec. 31, 2001. On June 3, 2002, Xcel Energy acquired the 26 percent of NRG held by the public, resulting in 100-percent ownership interest at

Dec. 31, 2002. On May 14, 2003, NRG and certain of its affiliates filed voluntary petitions in the U.S. Bankruptcy Court for the Southern District

of New York for reorganization under Chapter 11 of the U.S. Bankruptcy Code to restructure their debt. On Dec. 5, 2003, NRG completed its

reorganization and emerged from bankruptcy. As a result, Xcel Energy divested its ownership interest in NRG. At Dec. 31, 2003, Xcel Energy

reports NRG’s financial activity as a component of discontinued operations. See Note 3 to the Consolidated Financial Statements.

Xcel Energy owns the following additional direct subsidiaries, some of which are intermediate holding companies with additional subsidiaries: Xcel Energy

Wholesale Energy Group Inc., Xcel Energy Markets Holdings Inc., Xcel Energy Ventures Inc., Xcel Energy Retail Holdings Inc., Xcel Energy Communications

Group Inc., Xcel Energy WYCO Inc. and Xcel Energy O&M Services Inc. Xcel Energy and its subsidiaries collectively are referred to as Xcel Energy.

Xcel Energy uses the equity method of accounting for its investments in partnerships, joint ventures and certain projects. Under this method, a proportionate

share of pretax income is recorded as equity earnings from investments in affiliates. The portion of earnings from international investments is recorded

after subtracting foreign income taxes, if applicable. In the consolidation process, all significant intercompany transactions and balances are eliminated.

Xcel Energy has investments in several plants and transmission facilities jointly owned with other utilities. These projects are accounted for on a proportionate

consolidation basis, consistent with industry practice. See Note 9 to the Consolidated Financial Statements.

Revenue Recognition Revenues related to the sale of energy are generally recorded when service is rendered or energy is delivered to customers.

However, the determination of the energy sales to individual customers is based on the reading of their meter, which occurs on a systematic basis

throughout the month. At the end of each month, amounts of energy delivered to customers since the date of the last meter reading are estimated and

the corresponding unbilled revenue is determined.

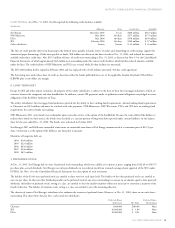

Xcel Energy’s utility subsidiaries have various rate-adjustment mechanisms in place that currently provide for the recovery of certain purchased natural gas

and electric energy costs. These cost adjustment tariffs may increase or decrease the level of costs recovered through base rates and are revised periodically,

as prescribed by the appropriate regulatory agencies, for any difference between the total amount collected under the clauses and the recoverable costs

incurred. In addition, Xcel Energy presents its revenue net of any excise or other fiduciary-type taxes or fees. A summary of significant rate-adjustment

mechanisms follows:

–PSCo’s electric rates in Colorado permitted recovery of 100 percent of prudently incurred 2003 electric fuel and purchased energy expense. In 2002

and 2001, PSCo’s electric rates in Colorado were adjusted under an incentive cost-adjustment mechanism, which resulted in the sharing of cost

increases and decreases with customers and sharing of trading margins, as discussed later.

–NSP-Minnesota’s rates include a cost-of-fuel-and-energy and a cost-of-gas recovery mechanism allowing dollar-for-dollar recovery of the respective

costs, which are trued-up on a two-month and annual basis, respectively.

–NSP-Wisconsin’s rates include a cost-of-gas adjustment clause for purchased natural gas, but not for purchased electric energy or electric fuel. In

Wisconsin, requests can be made for recovery of those electric costs prospectively through the rate review process, which normally occurs every two

years, and an interim fuel-cost hearing process.