Xcel Energy 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 63

on the restricted stock units will lapse after one year from the date of grant, upon the achievement of a 27 percent total shareholder return (TSR) for

10 consecutive business days and other criteria relating to Xcel Energy’s common equity ratio. TSR is measured using the market price per share of

Xcel Energy common stock, which at the grant date was $12.93, plus common dividends declared after grant date. The TSR was met in the fourth

quarter of 2003, and approximately $31 million of compensation expense was recorded at Dec. 31, 2003, based on the expected vesting date (one

year after award grant) of March 28, 2004. The remaining costs related to 2003 restricted stock unit awards vesting in 2004 of $10 million will be

recorded in the first quarter of 2004. In January 2004, Xcel Energy’s board of directors approved the repurchase of 2.5 million shares of common

stock to fulfill the requirements of the restricted stock unit exercise in 2004.

Xcel Energy applies Accounting Principles Board Opinion No. 25 – “Accounting for Stock Issued to Employees,” in accounting for stock-based compensation

and, accordingly, no compensation cost is recognized for the issuance of stock options, as the exercise price of the options equals the fair-market value of

Xcel Energy’s common stock at the date of grant. In December 2002, the FASB issued SFAS No. 148 – “Accounting for Stock-Based Compensation –

Transition and Disclosure,” amending SFAS No. 123 to provide alternative methods of transition for a voluntary change to the fair-value-based method

of accounting for stock-based employee compensation, and requiring disclosure in both annual and interim Consolidated Financial Statements about

the method used and the effect of the method used on results. The pro forma impact of applying SFAS No. 148 is as follows at Dec. 31:

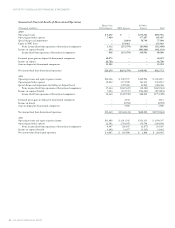

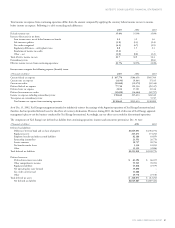

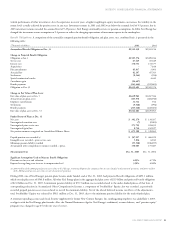

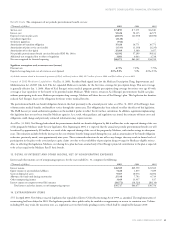

(Thousands of dollars) 2003 2002 2001

Net income (loss) – as reported $622,392 $(2,217,991) $794,966

Less: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effects (6,223) (6,959) (3,455)

Pro forma net income $616,169 $(2,224,950) $791,511

Earnings (loss) per share:

Basic – as reported $1.55 $(5.82) $ 2.31

Basic – pro forma $1.54 $(5.84) $ 2.30

Diluted – as reported $1.50 $(5.77) $ 2.30

Diluted – pro forma $1.49 $(5.79) $ 2.29

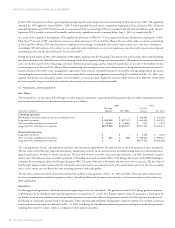

The weighted-average fair value of options granted, and the assumptions used to estimate such fair value on the date of grant using the Black-Scholes

Option Pricing Model were as follows:

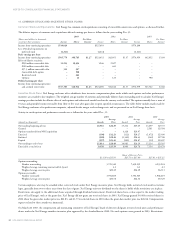

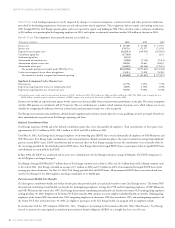

2003*2002*2001

Weighted-average fair value per option share at grant date –– $2.13

Expected option life ––3–5 years

Stock volatility –– 18%

Risk-free interest rate –– 3.8–4.8%

Dividend yield –– 4.9–5.8%

* There were no options granted in 2003 or 2002.

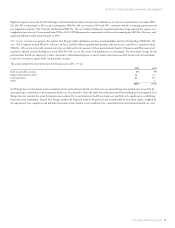

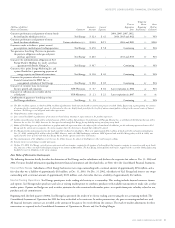

Common Stock Dividends Per Share Historically, Xcel Energy has paid quarterly dividends to its shareholders. For each of the four quarters of

2003, Xcel Energy paid dividends to its shareholders of $0.1875 per share. For each of the first two quarters of 2002, Xcel Energy paid dividends to its

shareholders of $0.375 per share. In each of the third and fourth quarters of 2002, Xcel Energy paid dividends of $0.1875 per share. In making the

decision to reduce the dividend, the board of directors considered several factors, including the goal of funding customer growth in the core business

through internal cash flow and reducing reliance on debt and equity financings. The board of directors also compared the dividend to utility subsidiary

earnings and to the dividend payout of comparable utilities. Dividends on common stock are paid as declared by the board of directors.

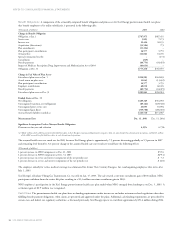

Dividend and Other Capital-Related Restrictions Under the PUHCA, unless there is an order from the SEC, a holding company or any subsidiary

may declare and pay dividends only out of retained earnings. In May 2003, Xcel Energy received authorization from the SEC to pay an aggregate amount

of $152 million of common and preferred dividends out of capital and unearned surplus. Xcel Energy used this authorization to declare and pay

approximately $150 million for its first and second quarter dividends in 2003. At Dec. 31, 2003, Xcel Energy’s retained earnings were approximately

$369 million, after declaring the third and fourth quarter dividends.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock is outstanding.

Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding company basis only, and not on a consolidated

basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to (i) common stock plus surplus divided by (ii) the sum of common

stock plus surplus plus long-term debt. Based on this definition, the capitalization ratio at Dec. 31, 2003, was 83 percent. Therefore, the restrictions do

not place any effective limit on Xcel Energy’s ability to pay dividends because the restrictions are only triggered when the capitalization ratio is less than

25 percent or will be reduced to less than 25 percent through dividends (other than dividends payable in common stock), distributions or acquisitions of

Xcel Energy common stock.

In addition, NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy, the holder

of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $815 million in additional cash dividends on common

stock at Dec. 31, 2003.