Xcel Energy 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

XCEL ENERGY 2003 ANNUAL REPORT 37

commercial commitments at Dec. 31, 2003. See additional discussion in the Consolidated Statements of Capitalization and Notes 4, 5, 6, 8, 15 and

17 to the Consolidated Financial Statements.

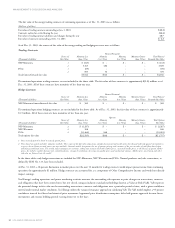

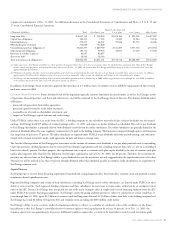

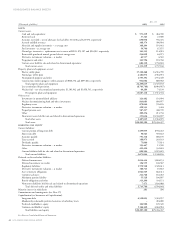

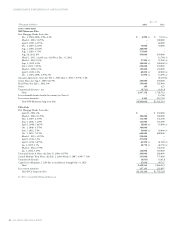

Payments due by period

(Thousands of dollars) Total Less than 1 year 1 to 3 years 4 to 5 years After 5 years

Long-term debt $ 6,635,158 $ 158,024 $1,058,169 $ 991,058 $4,427,907

Capital lease obligations 106,315 7,365 13,860 12,964 72,126

Operating leases(a) 272,211 48,567 95,826 81,772 46,046

NRG bankruptcy settlement 752,000 752,000–––

Unconditional purchase obligations(b) 10,861,257 1,669,769 2,521,209 1,937,336 4,732,943

Other long-term obligations 180,112 39,976 49,654 37,439 53,043

Payments to vendors in process 96,887 96,887–––

Short-term debt 58,563 58,563–––

Total contractual cash obligations(c) $18,962,503 $2,831,151 $3,738,718 $3,060,569 $9,332,065

(a) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease expiration date. Most of Xcel Energy’s

railcar, vehicle and equipment, and aircraft leases have these terms. At Dec. 31, 2003, the amount that Xcel Energy would have to pay if it chose to terminate these leases was

approximately $142.9 million.

(b) Obligations to purchase fuel for electric generating plants, and electricity and natural gas for resale. Energy costs are largely recoverable from customers in rates. In addition,

approximately $2 billion of the obligation is based on prices tied to a commodity index; as such the obligation will change as the commodity index changes.

(c) Xcel Energy also has outstanding authority under contracts and blanket purchase orders to purchase up to $600 million of goods and services through the year 2020, in addition

to the amounts disclosed in this table and in the forecasted capital expenditures.

In addition, Xcel Energy’s board of directors approved the repurchase of 2.5 million shares of common stock to fulfill the requirements of the restricted

stock unit exercise in 2004.

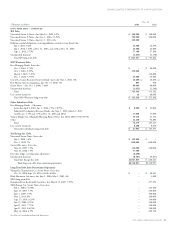

Common Stock Dividends Future dividend levels will be dependent upon the statutory limitations discussed further, as well as Xcel Energy’s results

of operations, financial position, cash flows and other factors, and will be evaluated by the Xcel Energy board of directors. The ultimate dividend policy

will balance:

–projected cash generation from utility operations;

–projected capital investment in the utility businesses;

–reasonable rate of return on shareholder investment; and

–impact on Xcel Energy’s capital structure and credit ratings.

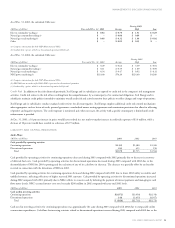

Under PUHCA, unless there is an order from the SEC, a holding company or any subsidiary may only declare and pay dividends out of retained

earnings. Xcel Energy had $369 million of retained earnings at Dec. 31, 2003, and expects to declare dividends as scheduled. The cash to pay dividends

to Xcel Energy shareholders is primarily derived from dividends received from the utility subsidiaries. The utility subsidiaries are generally limited in the

amount of dividends allowed by state regulatory commissions to be paid to the holding company. The limitation is imposed through equity ratio limitations

that range from 30 percent to 57 percent. All utility subsidiaries are required under PUHCA to pay dividends only from retained earnings, and some must

comply with covenant restrictions under credit agreements for debt and interest coverage ratios.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock is outstanding.

Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding company basis only, i.e., not on a consolidated

basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to common stock plus surplus divided by the sum of common stock plus

surplus plus long-term debt. Based on this definition, Xcel Energy’s capitalization ratio at Dec. 31, 2003, was 83 percent. Therefore, the restrictions do

not place any effective limit on Xcel Energy’s ability to pay dividends because the restrictions are only triggered when the capitalization ratio is less than

25 percent or will be reduced to less than 25 percent through dividends (other than dividends payable in common stock), distributions or acquisitions of

Xcel Energy common stock.

Capital Sources

Xcel Energy expects to meet future financing requirements by periodically issuing long-term debt, short-term debt, common stock and preferred securities

to maintain desired capitalization ratios.

Registered holding companies and certain of their subsidiaries, including Xcel Energy and its utility subsidiaries, are limited under PUHCA in their

ability to issue securities. Such registered holding companies and their subsidiaries may not issue securities unless authorized by an exemptive rule or

order of the SEC. Because Xcel Energy does not qualify for any of the main exemptive rules, it sought and received financing authority from the SEC

under PUHCA for various financing arrangements. Xcel Energy’s current financing authority permits it, subject to satisfaction of certain conditions, to

issue through June 30, 2005, up to $2.5 billion of common stock and long-term debt and $1.5 billion of short-term debt at the holding-company level.

Xcel Energy has issued $2 billion of long-term debt and common stock, including the $400 million credit facility.

Xcel Energy’s ability to issue securities under the financing authority is subject to a number of conditions. One of the conditions of the financ-

ing authority is that Xcel Energy’s consolidated ratio of common equity to total capitalization be at least 30 percent. As of Dec. 31, 2003, the

common equity ratio was approximately 43 percent. Additional conditions require that a security to be issued that is rated, be rated investment grade