Xcel Energy 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 69

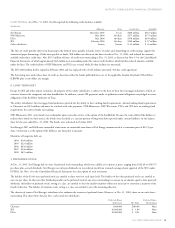

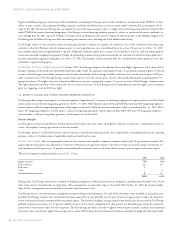

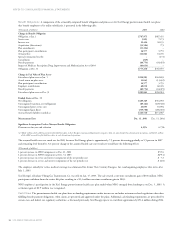

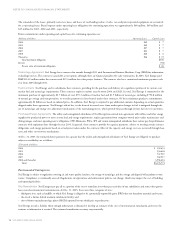

Benefit Costs The components of net periodic postretirement benefit cost are:

(Thousands of dollars) 2003 2002 2001

Service cost $ 5,893 $ 7,173 $ 6,160

Interest cost 52,426 50,135 46,579

Expected return on plan assets (22,185) (21,030) (18,920)

Curtailment (gain) loss (2,128) ––

Settlement (gain) loss (916) ––

Amortization of transition obligation 15,426 16,771 16,771

Amortization of prior service cost (credit) (1,533) (1,130) (1,235)

Amortization of net loss (gain) 15,409 5,380 1,457

Net periodic postretirement benefit cost (credit) under SFAS No. 106(a) 62,392 57,299 50,812

Additional cost recognized due to effects of regulation 3,883 4,043 3,738

Net cost recognized for financial reporting $66,275 $61,342 $54,550

Significant assumptions used to measure costs (income)

Discount rate 6.75% 7.25% 7.75%

Expected average long-term rate of return on assets (pretax) 8.0%–9.0% 9.0% 8.0%–9.5%

(a) Includes amounts related to discontinued operations of ($3.0) million of credit in 2003, $2.7 million of cost in 2002, and $2.0 million of cost in 2001.

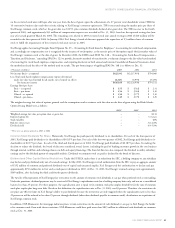

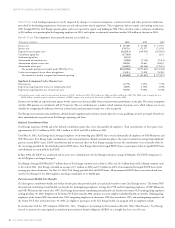

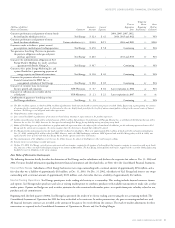

Impact of 2003 Medicare Legislation On Dec. 8, 2003, President Bush signed into law the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the Act). The Act expanded Medicare to include, for the first time, coverage for prescription drugs. This new coverage

is generally effective Jan. 1, 2006. Many of Xcel Energy’s retiree medical programs provide prescription drug coverage for retirees over age 65 with

coverage at least equivalent to the benefit to be provided under Medicare. While retirees remain in Xcel Energy’s postretirement health care plan

without participating in the new Medicare prescription drug coverage, Medicare will share the cost of Xcel Energy’s plan. This legislation has therefore

reduced Xcel Energy’s share of the obligation for future retiree medical benefits.

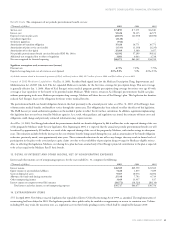

The postretirement health care benefit obligation shown in the chart previously is the actuarial present value, as of Dec. 31, 2003, of Xcel Energy’s share

of future retiree medical benefits attributable to service through the current year. This obligation has been reduced to reflect the effects of this legislation.

The FASB has not yet issued authoritative guidance on the method it prefers to reflect the Act in these calculations. In addition, regulations implementing

this legislation have not yet been issued by Medicare agencies. As a result, when guidance and regulations are issued, the estimates of future costs and

obligations could change and previously estimated information may require revision.

As of Dec. 31, 2003, Xcel Energy had reduced the postretirement health care benefit obligation by $64.6 million due to the expected sharing of the cost

of the program by Medicare under the new legislation. Also, beginning in 2004, it is expected that the annual net periodic postretirement benefit cost will

be reduced by approximately $10 million as a result of the expected sharing of the cost of the program by Medicare, with similar savings in subsequent

years. This reduction includes both the decrease in the cost of future benefits being earned during this year, and an amortization of the benefit obligation

reduction, previously noted, over approximately nine years. These estimated reductions do not reflect any changes that may result in future levels of

participation in the plan or the associated per capita claims cost due to the availability of prescription drug coverage for Medicare-eligible retirees.

Also, in reflecting this legislation, Medicare cost sharing for a plan has been assumed only if Xcel Energy’s projected contribution to the plan is expected

to be at least equal to the Medicare Part D basic benefit.

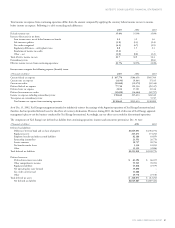

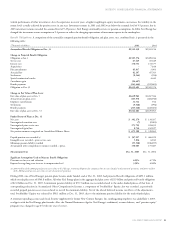

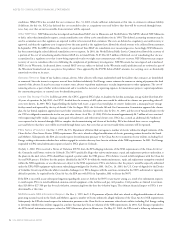

13. DETAIL OF INTEREST AND OTHER INCOME, NET OF NONOPERATING EXPENSES

Interest and other income, net of nonoperating expenses, for the years ended Dec. 31, comprises the following:

(Thousands of dollars) 2003 2002 2001

Interest income $16,589 $29,559 $21,589

Equity income in unconsolidated affiliates 5,628 1,835 7,029

Gain on disposal of assets 9,365 10,076 14,696

Allowance for funds used during construction 25,338 7,793 6,739

Other nonoperating income 3,169 13,937 817

Interest expense on corporate-owned life insurance (24,372) (18,523) (20,116)

Total interest and other income, net of nonoperating expenses $35,717 $44,677 $30,754

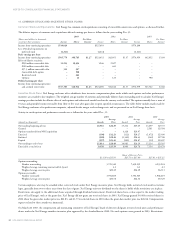

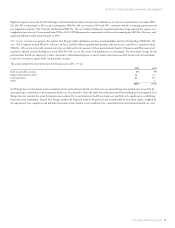

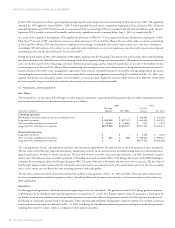

14. EXTRAORDINARY ITEMS

SPS In April 2003, New Mexico enacted legislation that repealed its Electric Utility Restructuring Act of 1999, as amended. The implementation of

restructuring had been delayed in 2001. The legislation provides that a public utility be entitled to an opportunity to recover its transition costs. Utilities,

including SPS, may retain the transition costs as a regulatory asset on their books pending recovery, which shall be completed by January 2010.