Xcel Energy 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

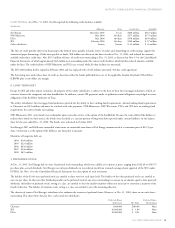

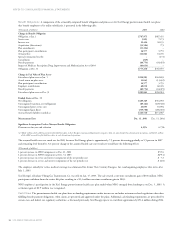

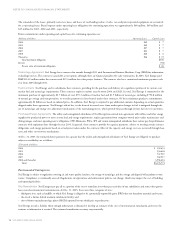

Benefit Obligations A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy postretirement health care plans

that benefit employees of its utility subsidiaries is presented in the following table:

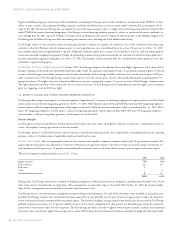

(Thousands of dollars) 2003 2002

Change in Benefit Obligation

Obligation at Jan. 1 $767,975 $687,455

Service cost 5,893 7,173

Interest cost 52,426 50,135

Acquisitions (divestitures) (31,584) 773

Plan amendments (33,304) –

Plan participants’ contributions 16,577 5,755

Actuarial loss 122,864 61,276

Special termination benefits –(173)

Curtailments (249) –

Benefit payments (60,754) (44,419)

Impact of Medicare Prescription Drug, Improvement and Modernization Act of 2003 (64,614) –

Obligation at Dec. 31 $775,230 $767,975

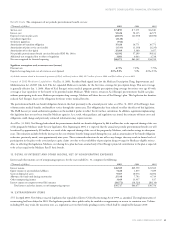

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 $250,983 $242,803

Actual return on plan assets 11,045 (13,632)

Plan participants’ contributions 16,577 5,755

Employer contributions 68,010 60,476

Benefit payments (60,754) (44,419)

Fair value of plan assets at Dec. 31 $285,861 $250,983

Funded Status at Dec. 31

Net obligation $489,369 $516,992

Unrecognized transition asset (obligation) (69,164) (169,328)

Unrecognized prior service cost 20,093 10,904

Unrecognized gain (loss) (319,788) (206,601)

Accrued benefit liability recorded(a) $120,510 $151,967

Measurement Date Dec. 31, 2003 Dec. 31, 2002

Significant Assumptions Used to Measure Benefit Obligations

Discount rate for year-end valuation 6.25% 6.75%

(a) ($0.6) million of the 2003 accrued benefit liability relates to Xcel Energy’s remaining obligation for companies that are now classified as discontinued operations, and $28.3 million

of the 2002 accrued benefit liability relates to such discontinued operations.

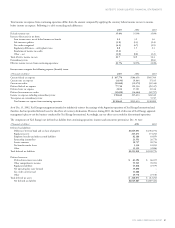

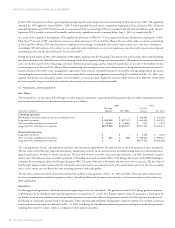

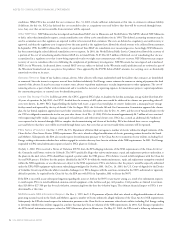

The assumed health care cost trend rate for 2003 for most Xcel Energy plans is approximately 7.5 percent, decreasing gradually to 5.5 percent in 2007

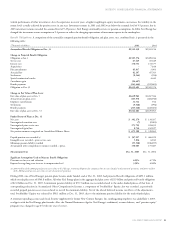

and remaining level thereafter. A 1-percent change in the assumed health care cost trend rate would have the following effects:

(Thousands of dollars)

1-percent increase in APBO components at Dec. 31, 2003 $ 95.8

1-percent decrease in APBO components at Dec. 31, 2003 $(79.4)

1-percent increase in service and interest components of the net periodic cost $ 7.3

1-percent decrease in service and interest components of the net periodic cost $ (6.0)

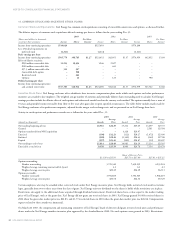

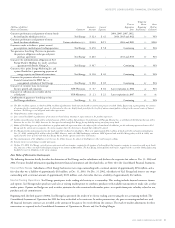

The employer subsidy for retiree medical coverage was eliminated for former New Century Energies, Inc. nonbargaining employees who retire after

July 1, 2003.

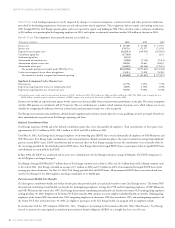

Xcel Energy’s subsidiary Viking Gas Transmission Co. was sold on Jan. 17, 2003. The sale created a one-time curtailment gain of $0.8 million. NRG

participants withdrew from the retiree life plan, resulting in a $1.3 million one-time curtailment gain in 2003.

NRG employees’ participation in the Xcel Energy postretirement health care plan ended when NRG emerged from bankruptcy on Dec. 5, 2003. A

settlement gain of $0.9 million was recognized.

Cash Flows The postretirement health care plans have no funding requirements under income tax and other retirement-related regulations other than

fulfilling benefit payment obligations, when claims are presented and approved under the plans. Additional cash funding requirements are prescribed by

certain state and federal rate regulatory authorities, as discussed previously. Xcel Energy expects to contribute approximately $51.4 million during 2004.