Xcel Energy 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Consistent with cost recovery in utility customer rates, NSP-Minnesota records annual decommissioning accruals based on periodic site-specific cost

studies and a presumed level of dedicated funding. Cost studies quantify decommissioning costs in current dollars. Funding presumes that current costs

will escalate in the future at a rate of 4.19 percent per year. The total estimated decommissioning costs that will ultimately be paid, net of income

earned by external trust funds, is currently being accrued using an annuity approach over the approved plant-recovery period. This annuity approach

uses an assumed rate of return on funding, which is currently 5.5 percent, net of tax, for external funding and approximately 8 percent, net of tax, for

internal funding. Unrealized gains on nuclear decommissioning investments are deferred as Regulatory Liabilities based on the assumed offsetting

against decommissioning costs in current ratemaking treatment.

The MPUC last approved NSP-Minnesota’s nuclear decommissioning study request in December 2003, using 2002 cost data. An original filing was

submitted to the MPUC in October 2002 and updated in August 2003; final approval was received in December 2003. The most recent cost estimate

represents an annual increase in external fund accruals, along with the extension of Prairie Island cost recovery to the end of license life in 2014. The

MPUC also approved the Department of Commerce recommendation to accelerate the internal fund transfer to the external funds effective July 1, 2003,

ending on Dec. 31, 2005. These approvals increased the fund cash contribution by approximately $29 million in 2003, but may not have a statement of

operations impact. Expecting to operate Prairie Island through the end of each unit’s licensed life, the approved capital recovery will allow for the plant

to be fully depreciated, including the accrual and recovery of decommissioning costs, in 2014. Xcel Energy believes future decommissioning cost accruals

will continue to be recovered in customer rates.

The total obligation for decommissioning currently is expected to be funded 100 percent by external funds, as approved by the MPUC. Contributions

to the external fund started in 1990 and are expected to continue until plant decommissioning begins. The assets held in trusts as of Dec. 31, 2003,

primarily consisted of investments in fixed income securities, such as tax-exempt municipal bonds and U.S. government securities that mature in one

to 20 years, and common stock of public companies. NSP-Minnesota plans to reinvest matured securities until decommissioning begins.

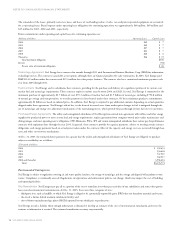

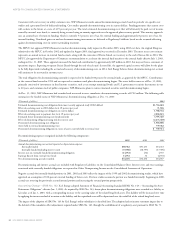

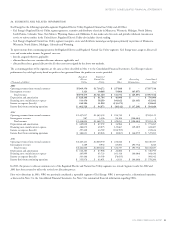

At Dec. 31, 2003, NSP-Minnesota had recorded and recovered in rates cumulative decommissioning accruals of $722 million. The following table

summarizes the funded status of NSP-Minnesota’s decommissioning obligation at Dec. 31, 2003:

(Thousands of dollars) 2003

Estimated decommissioning cost obligation from most recently approved study (2002 dollars) $1,716,618

Effect of escalating costs to 2003 dollars (at 4.19 percent per year) 71,926

Estimated decommissioning cost obligation in current dollars 1,788,544

Effect of escalating costs to payment date (at 4.19 percent per year) 2,004,821

Estimated future decommissioning costs (undiscounted) 3,793,365

Effect of discounting obligation (using risk-free interest rate) (2,274,469)

Discounted decommissioning cost obligation 1,518,896

Assets held in external decommissioning trust 779,382

Discounted decommissioning obligation in excess of assets currently held in external trust $739,514

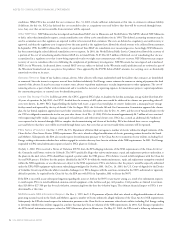

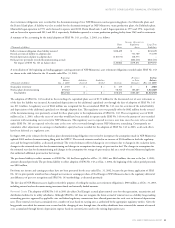

Decommissioning expenses recognized include the following components:

(Thousands of dollars) 2003 2002 2001

Annual decommissioning cost accrual reported as depreciation expense:

Externally funded $80,582 $51,433 $51,433

Internally funded (including interest costs) (35,906) (18,797) (17,396)

Interest cost on externally funded decommissioning obligation (14,952) (32) 4,535

Earnings (losses) from external trust funds 14,952 32 (4,535)

Net decommissioning accruals recorded $44,676 $32,636 $34,037

Decommissioning and interest accruals are included with Regulatory Liabilities on the Consolidated Balance Sheet. Interest costs and trust earnings

associated with externally funded obligations are reported in Other Nonoperating Income on the Consolidated Statement of Operations.

Negative accruals for internally funded portions in 2001, 2002 and 2003 reflect the impacts of the 1999 and 2002 decommissioning studies, which have

approved an assumption of 100-percent external funding of future costs. Previous studies assumed a portion was funded internally; beginning in 2000,

accruals are reversing the previously accrued internal portion and increasing the external portion prospectively.

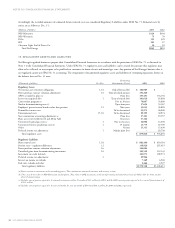

Accounting Change – SFAS No. 143 Xcel Energy adopted Statement of Financial Accounting Standard (SFAS) No. 143 – “Accounting for Asset

Retirement Obligations” effective Jan. 1, 2003. As required by SFAS No. 143, future plant decommissioning obligations were recorded as a liability at

fair value as of Jan. 1, 2003, with a corresponding increase to the carrying values of the related long-lived assets. This liability will be increased over time

by applying the interest method of accretion to the liability, and the capitalized costs will be depreciated over the useful life of the related long-lived assets.

The impact of the adoption of SFAS No. 143 for Xcel Energy’s utility subsidiaries is described later. The adoption had no income statement impact due to

the deferral of the cumulative effect adjustments required under SFAS No. 143, through the establishment of a regulatory asset pursuant to SFAS No. 71.