Xcel Energy 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 51

Environmental Costs Environmental costs are recorded when it is probable Xcel Energy is liable for the costs and the liability can reasonably be

estimated. Costs may be deferred as a regulatory asset based on an expectation that the costs will be recovered from customers in future rates. Otherwise,

the costs are expensed. If an environmental expense is related to facilities currently in use, such as emission-control equipment, the cost is capitalized

and depreciated over the life of the plant, assuming the costs are recoverable in future rates or future cash flow.

Estimated remediation costs, excluding inflationary increases and possible reductions for insurance coverage and rate recovery, are recorded. The estimates

are based on experience, an assessment of the current situation and the technology currently available for use in the remediation. The recorded costs are

regularly adjusted as estimates are revised and as remediation proceeds. If several designated responsible parties exist, only Xcel Energy’s expected share

of the cost is estimated and recorded. Any future costs of restoring sites where operation may extend indefinitely are treated as a capitalized cost of plant

retirement. The depreciation expense levels recoverable in rates include a provision for these estimated removal costs. However, as discussed further

in Note 18 to the Consolidated Financial Statements, removal costs recovered in rates were reclassified to Regulatory Liabilities beginning in 2002.

Income Taxes Xcel Energy and its domestic subsidiaries file consolidated federal income tax returns. NRG and its domestic subsidiaries were included

in Xcel Energy’s consolidated federal income tax returns prior to NRG’s March 2001 public equity offering. Xcel Energy and its domestic subsidiaries

file combined and separate state income tax returns. NRG and one or more of its domestic subsidiaries were included in some, but not all, of these

combined returns in 2002 and will be included in these returns in 2003. NRG will not be consolidated or combined in any of Xcel Energy’s income tax

returns after 2003.

Federal income taxes paid by Xcel Energy, as parent of the Xcel Energy consolidated group, are allocated to the Xcel Energy subsidiaries based on separate

company computations of tax. A similar allocation is made for state income taxes paid by Xcel Energy in connection with combined state filings.

In accordance with PUHCA requirements, the holding company also allocates its own net income tax benefits to its direct subsidiaries based on

the positive tax liability of each company.

Xcel Energy defers income taxes for all temporary differences between pretax financial and taxable income, and between the book and tax bases of assets

and liabilities. Xcel Energy uses the tax rates that are scheduled to be in effect when the temporary differences are expected to turn around, or reverse.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, the reversal of some temporary differences are

accounted for as current income tax expense. Investment tax credits are deferred and their benefits amortized over the estimated lives of the related

property. Utility rate regulation also has created certain regulatory assets and liabilities related to income taxes, which are summarized in Note 19

to the Consolidated Financial Statements. See a discussion of the income tax policy for international operations in Note 10 to the Consolidated

Financial Statements.

Foreign Currency Translation Xcel Energy’s foreign operations, which are limited to Xcel Energy International and NRG before divestiture, generally

use the local currency as their functional currency in translating international operating results and balances to U.S. currency. Foreign-currency-denominated

assets and liabilities are translated at the exchange rates in effect at the end of a reporting period. Revenue, expense and cash flows are translated at weighted-

average exchange rates for the period. Xcel Energy accumulates the resulting currency translation adjustments and reports them as a component of Other

Comprehensive Income in Common Stockholders’ Equity.

Use of Estimates In recording transactions and balances resulting from business operations, Xcel Energy uses estimates based on the best information

available. Estimates are used for such items as plant depreciable lives, tax provisions, uncollectible amounts, environmental costs, unbilled revenues,

jurisdictional fuel and energy cost allocations and actuarially determined benefit costs. The recorded estimates are revised when better information

becomes available or when actual amounts can be determined. Those revisions can affect operating results. The depreciable lives of certain plant

assets are reviewed or revised annually, if appropriate.

Cash and Cash Equivalents Xcel Energy considers investments in certain debt instruments with a remaining maturity of three months or less at the

time of purchase to be cash equivalents. Those debt instruments are primarily commercial paper and money market funds.

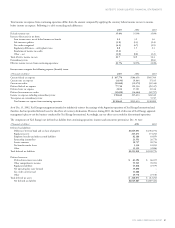

Restricted cash in 2003 consists primarily of funds received from NRG to be used to collateralize in full existing agreements of Xcel Energy to indemnify

NRG, which continued after the divestiture of NRG. Restricted cash in 2002 consists primarily of cash collateral for letters of credit and funds held in

trust accounts to satisfy the requirements of certain debt agreements. Restricted cash is classified as a current asset as all restricted cash is designated for

interest and principal payments due within one year.

Inventory All inventory is recorded at average cost, with the exception of natural gas in underground storage at PSCo and Cheyenne, which is

recorded using last-in-first-out pricing.

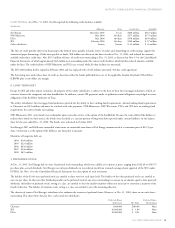

Regulatory Accounting Our regulated utility subsidiaries account for certain income and expense items using SFAS No. 71 – “Accounting for the

Effects of Certain Types of Regulation.” Under SFAS No. 71:

–certain costs, which would otherwise be charged to expense, are deferred as regulatory assets based on the expected ability to recover them in future rates; and

–certain credits, which would otherwise be reflected as income, are deferred as regulatory liabilities based on the expectation they will be returned to

customers in future rates.