Xcel Energy 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 67

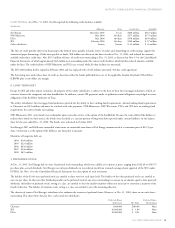

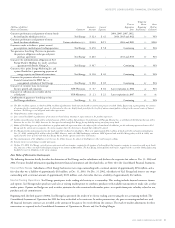

Regulatory agencies for nearly all of Xcel Energy’s retail and wholesale utility customers have allowed rate recovery of accrued benefit costs under SFAS

No. 106. PSCo transitioned to full accrual accounting for SFAS No. 106 costs between 1993 and 1997, consistent with the accounting requirements for

rate-regulated enterprises. The Colorado jurisdictional SFAS No. 106 costs deferred during the transition period are being amortized to expense on a

straight-line basis over the 15-year period from 1998 to 2012. NSP-Minnesota also transitioned to full accrual accounting for SFAS No. 106 costs, with

regulatory differences fully amortized prior to 1997.

Plan Assets Certain state agencies that regulate Xcel Energy’s utility subsidiaries also have issued guidelines related to the funding of SFAS No. 106

costs. SPS is required to fund SFAS No. 106 costs for Texas and New Mexico jurisdictional amounts collected in rates, and PSCo is required to fund

SFAS No. 106 costs in irrevocable external trusts that are dedicated to the payment of these postretirement benefits. Minnesota and Wisconsin retail

regulators required external funding of accrued SFAS No. 106 costs to the extent such funding was tax advantaged. The investment strategy for the

postretirement health care fund assets is fairly conservative, with minimal exposure to equity markets and a focus on fixed income and cash equivalents

to preserve investment capital while earning modest income.

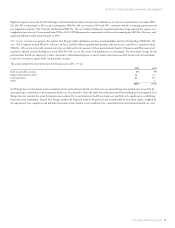

The actual composition of postretirement benefit plan assets at Dec. 31 was:

2003 2002

Fixed income/debt securities 2% 2%

Equity mutual fund securities 14 12

Cash equivalents 84 85

Other –1

100% 100%

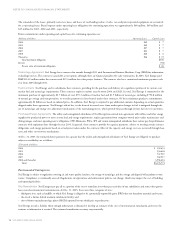

Xcel Energy bases its investment-return assumption for the postretirement health care fund assets on expected long-term performance for each of the

investment types included in its postretirement health care asset portfolio. Given the fairly short time period in which funding has been required, Xcel

Energy does not consider the actual historical returns achieved by its postretirement health care fund asset portfolio to be significant in establishing

long-term return assumptions. Instead, Xcel Energy considers the long-term return levels projected and recommended by investment experts, weighted for

the target mix of asset categories in our portfolio. Investment-return volatility is not considered to be a material factor in postretirement health care costs.