Xcel Energy 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 73

Currency Exchange Risk During 2003 and 2002, NRG and Xcel Energy International, both of which are included in discontinued operations, held

certain investments in foreign countries, exposing them to foreign currency exchange risk. The foreign currency exchange risk included the risk relative

to the recovery of net investment in a project, as well as the risk relative to the earnings and cash flows generated from such operations. These subsidiaries

managed their exposure to changes in foreign currency by entering into derivative instruments as determined by management. Xcel Energy’s risk

management policy provided for this risk management activity.

Trading Risk Xcel Energy’s subsidiaries conduct various trading operations and power marketing activities, including the purchase and sale of electric

capacity and energy and, prior to December 2003, through e prime for natural gas. The trading operations are conducted in the United States with

primary focus on specific market regions where trading knowledge and experience have been obtained. Xcel Energy’s risk management policy allows

management to conduct the trading activity within approved guidelines and limitations as approved by our risk management committee comprising

management personnel not involved in the trading operations.

Derivatives as Hedges

Xcel Energy and its subsidiaries record all derivative instruments on the balance sheet at fair value unless exempted as a normal purchase or sale. Changes

in non-exempt derivative instrument’s fair value are recognized currently in earnings unless the derivative has been designated in a qualifying hedging

relationship. The application of hedge accounting allows a derivative instrument’s gains and losses to offset related results of the hedged item in the

statement of operations, to the extent effective. SFAS No. 133, as amended, requires that the hedging relationship be highly effective and that a

company formally designate a hedging relationship to apply hedge accounting.

A fair value hedge requires that the effective portion of the change in the fair value of a derivative instrument be offset against the change in the fair

value of the underlying asset, liability or firm commitment being hedged. That is, fair value hedge accounting allows the offsetting gain or loss on the

hedged item to be reported in an earlier period to offset the gain or loss on the derivative instrument. A cash flow hedge requires that the effective portion

of the change in the fair value of a derivative instrument be recognized in Other Comprehensive Income, and reclassified into earnings in the same period

or periods during which the hedged transaction affects earnings. The ineffective portion of a derivative instrument’s change in fair value is currently

recognized in earnings.

Xcel Energy and its subsidiaries formally document hedge relationships, including, among other things, the identification of the hedging instrument

and the hedged transaction, as well as the risk management objectives and strategies for undertaking the hedged transaction. Derivatives are recorded

in the balance sheet at fair value. Xcel Energy and its subsidiaries also formally assess, both at inception and at least quarterly thereafter, whether the

derivative instruments being used are highly effective in offsetting changes in either the fair value or cash flows of the hedged items.

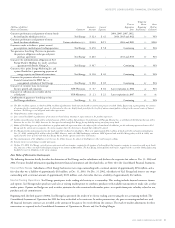

Financial Impacts of Derivatives

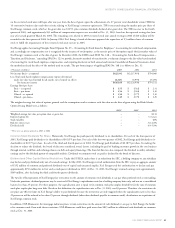

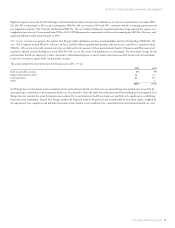

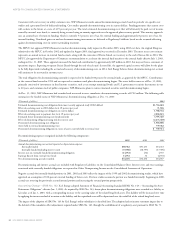

The impact of the components of hedges on Xcel Energy’s Other Comprehensive Income, included in the Consolidated Statements of Stockholders’

Equity, are detailed in the following table:

(Millions of dollars)

Net unrealized transition loss at adoption, Jan. 1, 2001 $(28.8)

After-tax net unrealized gains related to derivatives accounted for as hedges 43.6

After-tax net realized losses on derivative transactions reclassified into earnings 19.4

Accumulated other comprehensive income related to hedges at Dec. 31, 2001 $ 34.2

After-tax net unrealized losses related to derivatives accounted for as hedges (68.3)

After-tax net realized losses on derivative transactions reclassified into earnings 28.8

Acquisition of NRG minority interest 27.4

Accumulated other comprehensive income related to hedges at Dec. 31, 2002 $ 22.1

After-tax net unrealized gains related to derivatives accounted for as hedges 24.1

After-tax net realized gains on derivative transactions reclassified into earnings (38.1)

Accumulated other comprehensive income related to hedges at Dec. 31, 2003 $ 8.1

Xcel Energy records the fair value of its derivative instruments in its Consolidated Balance Sheet as a separate line item identified as Derivative Instruments

Valuation for assets and liabilities, as well as current and noncurrent.

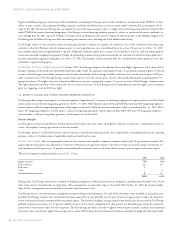

Cash Flow Hedges Xcel Energy and its subsidiaries enter into derivative instruments to manage variability of future cash flows from changes in

commodity prices. These derivative instruments are designated as cash flow hedges for accounting purposes, and the changes in the fair value of these

instruments are recorded as a component of Other Comprehensive Income. At Dec. 31, 2003, Xcel Energy had various commodity-related contracts

deemed as cash flow hedges extending through 2009. Amounts deferred are recorded in earnings as the hedged purchase or sales transaction is settled.

This could include the physical purchase or sale of electric energy, the use of natural gas to generate electric energy or gas purchased for resale. As of

Dec. 31, 2003, Xcel Energy had net losses of $0.7 million accumulated in Other Comprehensive Income that are expected to be recognized in

earnings or deferred as a regulatory liability during the next 12 months as the hedged transactions settle. However, due to the volatility of commodities

markets, the value in Other Comprehensive Income will likely change prior to its recognition in earnings or deferral as a regulatory liability.