Xcel Energy 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

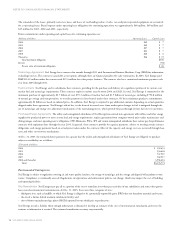

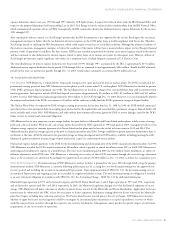

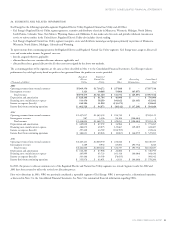

Accordingly, the recorded amounts of estimated future removal costs are considered Regulatory Liabilities under SFAS No. 71. Removal costs by

entity are as follows at Dec. 31:

(Millions of dollars) 2003 2002

NSP-Minnesota $324 $304

NSP-Wisconsin 75 70

PSCo 351 329

SPS 102 97

Cheyenne Light, Fuel & Power Co. 10 10

Total Xcel Energy $862 $810

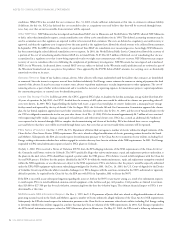

19. REGULATORY ASSETS AND LIABILITIES

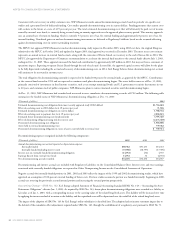

Xcel Energy’s regulated businesses prepare their Consolidated Financial Statements in accordance with the provisions of SFAS No. 71, as discussed in

Note 1 to the Consolidated Financial Statements. Under SFAS No. 71, regulatory assets and liabilities can be created for amounts that regulators may

allow to be collected, or may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel Energy’s business that is

not regulated cannot use SFAS No. 71 accounting. The components of unamortized regulatory assets and liabilities of continuing operations shown on

the balance sheet at Dec. 31 were:

Remaining

(Thousands of dollars) See Note Amortization Period 2003 2002

Regulatory Assets

Net nuclear asset retirement obligations 1, 18 End of licensed life $ 186,989 $–

Power purchase contract valuation adjustments 16 Term of related contract 154,260 –

AFDC recorded in plant(a) Plant lives 153,491 154,158

Losses on reacquired debt 1 Term of related debt 101,616 85,888

Conservation programs(a) Five to 10 years 76,087 53,860

Nuclear decommissioning costs(b) Up to four years 37,654 53,567

Employees’ postretirement benefits other than pension 12 Nine years 35,015 38,899

Renewable resource costs To be determined 25,972 26,000

Environmental costs 17, 18 To be determined 29,195 30,974

State commission accounting adjustments(a) Plant lives 17,301 19,157

Plant asset recovery (Pawnee II and Metro Ash) Four years 17,162 –

Unrecovered natural gas costs(c) 1One to two years 16,008 12,296

Unrecovered electric production costs(d) 115 months 13,779 67,709

Other Various 15,311 15,630

Deferred income tax adjustments 1 Mainly plant lives –18,738

Total regulatory assets $ 879,840 $ 576,876

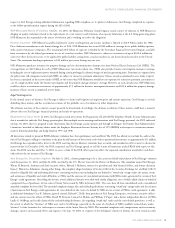

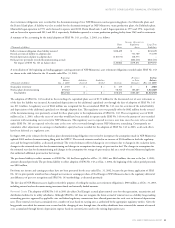

Regulatory Liabilities

Plant removal costs 1, 18 $ 862,406 $ 810,184

Pension costs – regulatory differences 12 338,926 287,615

Power purchase contract valuation adjustments 16 126,884 –

Unrealized gains from decommissioning investments 18 105,518 112,145

Investment tax credit deferrals 101,073 109,571

Deferred income tax adjustments 1 25,906 –

Interest on income tax refunds 7,369 6,569

Fuel costs, refunds and other 2,466 2,527

Total regulatory liabilities $1,570,548 $1,328,611

(a) Earns a return on investment in the ratemaking process. These amounts are amortized consistent with recovery in rates.

(b) These costs do not relate to NSP-Minnesota’s nuclear plants. They relate to DOE assessments, as discussed previously, and unamortized costs for PSCo’s Fort St. Vrain nuclear

plant decommissioning.

(c) Excludes current portion expected to be returned to customers within 12 months of $3.1 million for 2003, and the 2002 current portion expected to be recovered from customers of

$12.1 million.

(d) Excludes current portion expected to be recovered within the next 12 months of $55.8 and $54.2 million for 2003 and 2002, respectively.