Xcel Energy 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 59

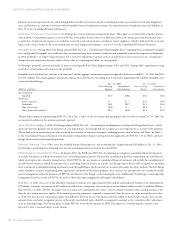

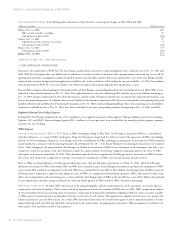

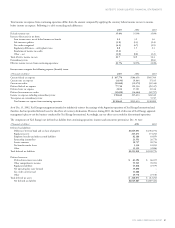

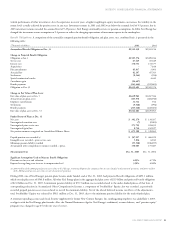

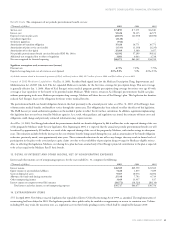

Credit Facilities As of Dec. 31, 2003, Xcel Energy had the following credit facilities available:

Credit Line

Maturity Term Credit Line Available

Xcel Energy November 2005 5 years $400 million $381 million

NSP-Minnesota May 2004 364 days $275 million $175 million

PSCo May 2004 364 days $350 million $349 million

SPS February 2004 364 days $100 million $ 97 million

Other subsidiaries Various Various $ 65 million $ 65 million

The lines of credit provide short-term financing in the form of notes payable to banks, letters of credit, and, depending on credit ratings, support for

commercial paper borrowings. Of the notes payable to banks, $58 million was drawn on the lines of credit at Dec. 31, 2003, and reduced the amounts

available under these credit lines. Also, $95.5 million of letters of credit were outstanding at Dec. 31, 2003, as discussed in Note 15 to the Consolidated

Financial Statements, of which approximately $65 million were outstanding under the various credit facilities, which further reduced amounts available

under the lines. The credit facilities of NSP-Minnesota and PSCo are secured, while all other facilities are unsecured.

The SPS $100 million facility expired in February 2004 and was replaced with a $125 million unsecured, 364-day credit agreement.

The borrowing rates under these lines of credit are based on either the bank’s published base rate or the applicable London Interbank Offered Rate

(LIBOR) plus a euro dollar rate margin.

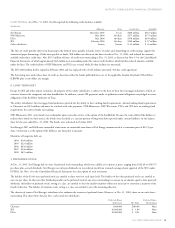

6. LONG-TERM DEBT

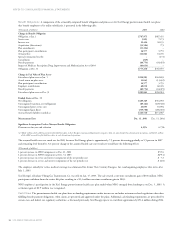

Except for SPS and other minor exclusions, all property of the utility subsidiaries is subject to the liens of their first mortgage indentures, which are

contracts between the companies and their bondholders. In addition, certain SPS payments under its pollution-control obligations are pledged to secure

obligations of the Red River Authority of Texas.

The utility subsidiaries’ first mortgage bond indentures provide for the ability to have sinking-fund requirements. Annual sinking-fund requirements

at Cheyenne are $0.2 million and must be satisfied with cash payments. NSP-Minnesota, NSP-Wisconsin, PSCo and SPS have no sinking-fund

requirements for current bonds outstanding.

NSP-Minnesota’s 2011 series bonds were redeemable upon seven-days notice at the option of the bondholder. Because the terms allowed the holders to

redeem these bonds on short notice, the bonds were classified as a current portion of long-term debt reported under current liabilities on the balance

sheet for the year ended Dec. 31, 2002. The bonds were redeemed in October 2003.

Xcel Energy’s 2007 and 2008 series convertible senior notes are convertible into shares of Xcel Energy common stock at a conversion price of $12.33 per

share. Conversion is at the option of the holder at any time prior to maturity.

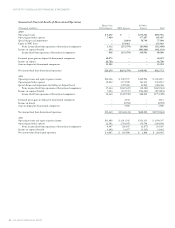

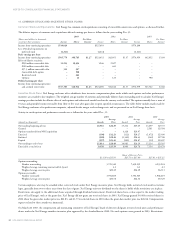

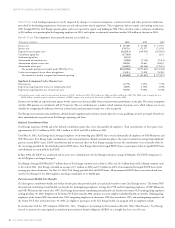

Maturities of long-term debt are:

2004 $160 million

2005 $224 million

2006 $838 million

2007 $340 million

2008 $655 million

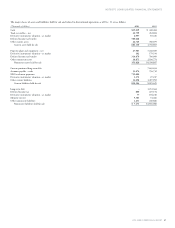

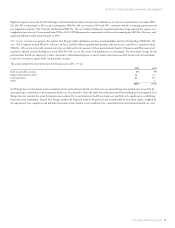

7. PREFERRED STOCK

At Dec. 31, 2003, Xcel Energy had six series of preferred stock outstanding, which were callable at its option at prices ranging from $102.00 to $103.75

per share plus accrued dividends. Xcel Energy can only pay dividends on its preferred stock from retained earnings absent approval of the SEC under

PUHCA. See Note 11 to the Consolidated Financial Statements for a description of such restrictions.

The holders of the $3.60 series preferred stock are entitled to three votes for each share held. The holders of the other preferred stocks are entitled to

one vote per share. In the event that dividends payable on the preferred stock of any series outstanding is in arrears in an amount equal to four quarterly

dividends, the holders of preferred stocks, voting as a class, are entitled to elect the smallest number of directors necessary to constitute a majority of the

board of directors. The holders of common stock, voting as a class, are entitled to elect the remaining directors.

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred shares. However, at Dec. 31, 2003, there are no such shares

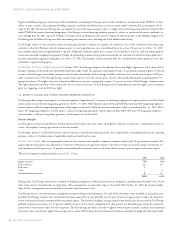

outstanding. This chart shows data for first- and second-tier subsidiaries:

Preferred Shares Preferred Shares

Authorized Par Value Outstanding

Cheyenne 1,000,000 $100.00 None

SPS 10,000,000 $ 1.00 None

PSCo 10,000,000 $ 0.01 None