Xcel Energy 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30 XCEL ENERGY 2003 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

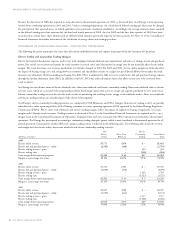

PSCo Performance-Based Regulatory Plan (PBRP) The CPUC established an electric PBRP under which PSCo operates. The major components

of this regulatory plan include:

–an annual electric earnings test with the sharing between customers and shareholders of earnings in excess of the following limits:

–all earnings above an 11-percent return on equity for 2001 and a 10.50-percent return on equity for 2002;

–no earnings sharing for 2003 as PSCo established new rates in its general rate case; and

–an annual electric earnings test with the sharing of earnings in excess of the return on equity for electric operations of 10.75 percent for 2004

through 2006;

–an electric quality of service plan (QSP) that provides for bill credits to customers if PSCo does not achieve certain performance targets relating to

electric reliability and customer service through 2006; and

–a natural gas QSP that provides for bill credits to customers if PSCo does not achieve certain performance targets relating to natural gas leak repair

time and customer service through 2007.

PSCo regularly monitors and records as necessary an estimated customer refund obligation under the PBRP. In April of each year following the measurement

period, PSCo files its proposed rate adjustment under the PBRP. The CPUC conducts proceedings to review and approve these rate adjustments annually.

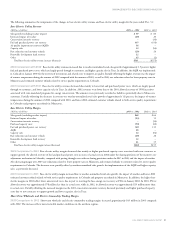

–In 2001, PSCo did not earn a return on equity in excess of 11 percent and met the electric and gas QSP benchmarks. The CPUC has accepted the

QSP components of the PBRP filing and approved the earnings test.

–In 2002, PSCo did not earn a return on equity in excess of 10.5 percent, so no refund liability has been recorded. Both electric and gas QSP

benchmarks were met. Therefore, no liability has been recorded for the earnings test. A CPUC decision is pending. The CPUC is considering

whether PSCo’s cost of debt has been adversely affected by the financial difficulties of NRG, and if so, whether any adjustments to PSCo’s cost

of capital should be made. A hearing has been set for August 2004.

–The 2003 QSP results will be filed in April 2004. An estimate of customer refund obligations under the electric QSP plan was recorded in 2003

relating to the electric service unavailability and customer complaint measures. No refund under the gas QSP is anticipated.

In 2003, PSCo filed an application to put into effect a purchased-capacity cost-adjustment mechanism that would allow it to recover 100 percent of its

incremental purchased-capacity costs over the level of these costs in rates. As a part of this application, PSCo proposed to modify the PBRP for 2004

through 2006 to provide that 100 percent of any earnings in excess of a 10.75-percent return on equity for electric operations be returned to customers.

The application is pending approval of the CPUC.

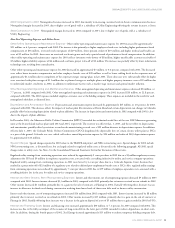

Tax Matters

The Internal Revenue Service (IRS) issued a notice of proposed adjustment proposing to disallow interest expense deductions taken in tax years

1993 through 1997 related to corporate-owned life insurance (COLI) policy loans of PSR Investments, Inc. (PSRI), a wholly owned subsidiary of

PSCo. Late in 2001, Xcel Energy received a technical advice memorandum from the IRS national office, which communicated a position adverse to PSRI.

Consequently, the IRS examination division has disallowed the interest expense deductions for the tax years 1993 through 1997. Xcel Energy plans

to challenge the IRS determination, which could require several years to reach final resolution. Because it is Xcel Energy’s position that the IRS

determination is not supported by tax law, Xcel Energy has not recorded any provision for income tax or interest expense related to this matter and

continues to take deductions for interest expense related to policy loans on its income tax returns for subsequent years. However, defense of PSCo’s

position may require significant cash outlays on a temporary basis if refund litigation is pursued in United States District Court.

The total disallowance of interest expense deductions for the period 1993 through 1997 is approximately $175 million. Additional interest expense

deductions for the period 1998 through 2003 are estimated to total approximately $404 million. Should the IRS ultimately prevail on this issue, tax

and interest payable through Dec. 31, 2003, would reduce earnings by an estimated $254 million, after tax. If COLI interest expense deductions were

no longer available, annual earnings for 2004 would be reduced by an estimated $36 million, after tax, prospectively, which represents 9 cents per share

using 2003 share levels.

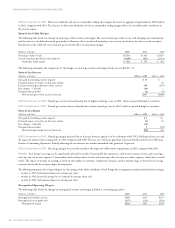

Environmental Matters

Environmental costs include payments for nuclear plant decommissioning, storage and ultimate disposal of spent nuclear fuel, disposal of hazardous materials

and wastes, remediation of contaminated sites and monitoring of discharges to the environment. A trend of greater environmental awareness and increasingly

stringent regulation has caused, and may continue to cause, slightly higher operating expenses and capital expenditures for environmental compliance.

In addition to nuclear decommissioning and spent nuclear fuel disposal expenses, costs charged to operating expenses for environmental monitoring

and disposal of hazardous materials and wastes were approximately:

–$133 million in 2003;

–$138 million in 2002; and

–$130 million in 2001.

Xcel Energy expects to expense an average of approximately $155 million per year from 2004 through 2008 for similar costs. However, the precise

timing and amount of environmental costs, including those for site remediation and disposal of hazardous materials, are currently unknown. Additionally,

the extent to which environmental costs will be included in and recovered through rates is not certain.