Xcel Energy 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18 XCEL ENERGY 2003 ANNUAL REPORT

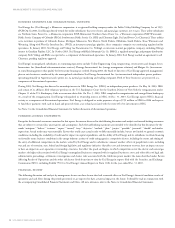

MANAGEMENT’S DISCUSSION AND ANALYSIS

BUSINESS SEGMENTS AND ORGANIZATIONAL OVERVIEW

Xcel Energy Inc. (Xcel Energy), a Minnesota corporation, is a registered holding company under the Public Utility Holding Company Act of 1935

(PUHCA). In 2003, Xcel Energy directly owned five utility subsidiaries that serve electric and natural gas customers in 11 states. These utility subsidiaries

are Northern States Power Co., a Minnesota corporation (NSP-Minnesota); Northern States Power Co., a Wisconsin corporation (NSP-Wisconsin);

Public Service Company of Colorado (PSCo); Southwestern Public Service Co. (SPS) and Cheyenne Light, Fuel and Power Co. (Cheyenne). These utilities

serve customers in portions of Colorado, Kansas, Michigan, Minnesota, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, Wisconsin and

Wyoming. Along with WestGas InterState Inc. (WGI), an interstate natural gas pipeline, these companies comprise our continuing regulated utility

operations. In January 2003, Xcel Energy sold Viking Gas Transmission Co. (Viking), an interstate natural gas pipeline company, including Viking’s

interest in Guardian Pipeline, LLC. In October 2003, Xcel Energy sold Black Mountain Gas Co. (BMG), a regulated natural gas and propane distribution

company. Both Viking and BMG are reported as a component of discontinued operations. In January 2004, Xcel Energy reached an agreement to sell

Cheyenne, pending regulatory approval.

Xcel Energy’s nonregulated subsidiaries in continuing operations include Utility Engineering Corp. (engineering, construction and design), Seren

Innovations, Inc. (broadband telecommunications services), Planergy International, Inc. (energy management solutions) and Eloigne Co. (investments

in rental housing projects that qualify for low-income housing tax credits). During 2003, the board of directors of Xcel Energy approved management’s

plan to exit businesses conducted by the nonregulated subsidiaries Xcel Energy International Inc. (an international independent power producer,

operating primarily in Argentina) and e prime inc. (a natural gas marketing and trading company). Both of these businesses are presented as a

component of discontinued operations.

During 2003, Xcel Energy also divested its ownership interest in NRG Energy, Inc. (NRG), an independent power producer. On May 14, 2003, NRG

and certain of its affiliates filed voluntary petitions in the U.S. Bankruptcy Court for the Southern District of New York for reorganization under

Chapter 11 of the U.S. Bankruptcy Code to restructure their debt. On Dec. 5, 2003, NRG completed its reorganization and emerged from bankruptcy.

As a result of the reorganization, Xcel Energy relinquished its ownership interest in NRG. At Dec. 31, 2003, Xcel Energy reports NRG’s financial

activity as a component of discontinued operations. Xcel Energy is obligated to make payments of up to $752 million to NRG in 2004 and expects

to fund these payments with cash on hand and proceeds from a tax refund associated with the write-off of its investment in NRG.

See Note 3 to the Consolidated Financial Statements for further discussion of discontinued operations.

FORWARD-LOOKING STATEMENTS

Except for the historical statements contained in this report, the matters discussed in the following discussion and analysis are forward-looking statements

that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements are intended to be identified in this document by the

words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar

expressions. Actual results may vary materially. Factors that could cause actual results to differ materially include, but are not limited to: general economic

conditions, including the availability of credit and its impact on capital expenditures and the ability of Xcel Energy and its subsidiaries to obtain financing

on favorable terms; business conditions in the energy industry; actions of credit rating agencies; competitive factors, including the extent and timing of

the entry of additional competition in the markets served by Xcel Energy and its subsidiaries; unusual weather; effects of geopolitical events, including

war and acts of terrorism; state, federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an impact on rates

or have an impact on asset operation or ownership; structures that affect the speed and degree to which competition enters the electric and natural gas

markets; the higher risk associated with Xcel Energy’s nonregulated businesses compared with its regulated businesses; costs and other effects of legal and

administrative proceedings, settlements, investigations and claims; risks associated with the California power market; the items described under Factors

Affecting Results of Operations; and the other risk factors listed from time to time by Xcel Energy in reports filed with the Securities and Exchange

Commission (SEC), including Exhibit 99.01 to Xcel Energy’s Annual Report on Form 10-K for the year ended Dec. 31, 2003.

FINANCIAL REVIEW

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel Energy’s financial condition, results of

operations and cash flows during the periods presented, or are expected to have a material impact in the future. It should be read in conjunction with

the accompanying Consolidated Financial Statements and Notes. All note references refer to the Notes to Consolidated Financial Statements.