Xcel Energy 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 XCEL ENERGY 2003 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

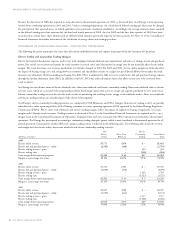

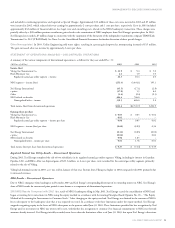

Because the divestiture of NRG has required its reclassification to discontinued operations in 2003, as discussed later, Xcel Energy is now reporting

income from continuing operations in 2003 and 2002. Under accounting requirements, the calculation of diluted earnings per share must be changed

for prior periods that reported losses, in which equivalents were previously considered antidilutive. Accordingly, the average common shares assumed

in the diluted earnings per share amounts for the third and fourth quarters of 2002, the year 2002 and the first three quarters of 2003 have been

recalculated to assume more share dilution and are different from amounts previously reported for those periods. See Note 11 to the Consolidated

Financial Statements for further discussion of the calculation of average shares and earnings per share.

STATEMENT OF OPERATIONS ANALYSIS – CONTINUING OPERATIONS

The following discussion summarizes the items that affected the individual revenue and expense items reported in the Statement of Operations.

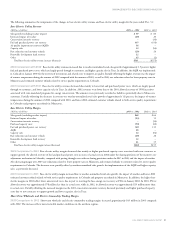

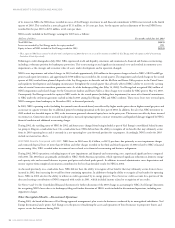

Electric Utility and Commodity Trading Margins

Electric fuel and purchased power expenses tend to vary with changing retail and wholesale sales requirements and unit cost changes in fuel and purchased

power. Due to fuel cost recovery mechanisms for retail customers in several states, most fluctuations in energy costs do not materially affect electric utility

margin. The retail fuel clause cost recovery mechanism in Colorado changed in 2003. For 2002 and 2001, electric utility margins in Colorado reflect

the impact of sharing energy costs and savings between customers and shareholders relative to a target cost per delivered kilowatt-hour under the retail

incentive cost adjustment (ICA) ratemaking mechanism. For 2003, PSCo is authorized to fully recover its retail electric fuel and purchased energy expense

through the interim adjustment clause (IAC). In addition to the IAC, PSCo has other adjustment clauses that allow certain costs to be recovered from

retail customers.

Xcel Energy has two distinct forms of electric wholesale sales: short-term wholesale and electric commodity trading. Short-term wholesale refers to electric

sales for resale, which are associated with energy produced from Xcel Energy’s generation assets or energy and capacity purchased to serve native load.

Electric commodity trading refers to the sales for resale activity of purchasing and reselling electric energy to the wholesale market. Short-term wholesale

and electric trading activities are considered part of the electric utility segment.

Xcel Energy’s electric commodity trading operations are conducted by NSP-Minnesota and PSCo. Margins from electric trading activity are partially

redistributed to other operating utilities of Xcel Energy, pursuant to a joint operating agreement (JOA) approved by the Federal Energy Regulatory

Commission (FERC). PSCo’s short-term wholesale and electric trading margins reflect the impact of regulatory sharing, if applicable, of certain

margins with Colorado retail customers. Trading revenues, as discussed in Note 1 to the Consolidated Financial Statements, are reported net (i.e., on a

margin basis) in the Consolidated Statements of Operations. Trading revenue and costs associated with NRG’s operations are included in discontinued

operations. Xcel Energy has participated in natural gas commodity trading through e prime, which is now considered a discontinued operation for all

periods presented. Consequently, neither NRG nor e prime trading activity is reflected in the following table. The following table details the revenue

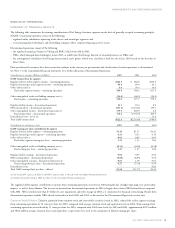

and margin for base electric utility, short-term wholesale and electric commodity trading activities:

Base Electric

Electric Short-Term Commodity Consolidated

(Millions of dollars) Utility Wholesale Trading Totals

2003

Electric utility revenue $5,773 $179 $ – $5,952

Electric fuel and purchased power – utility (2,592) (118) – (2,710)

Electric trading revenue – gross ––333 333

Electric trading costs ––(316) (316)

Gross margin before operating expenses $3,181 $ 61 $17 $3,259

Margin as a percentage of revenue 55.1% 34.1% 5.1% 51.9%

2002

Electric utility revenue $5,232 $203 $ – $5,435

Electric fuel and purchased power – utility (2,029) (170) – (2,199)

Electric trading revenue – gross – – 1,529 1,529

Electric trading costs – – (1,527) (1,527)

Gross margin before operating expenses $3,203 $ 33 $ 2 $3,238

Margin as a percentage of revenue 61.2% 16.3% 0.1% 46.5%

2001

Electric utility revenue $5,607 $788 $ – $6,395

Electric fuel and purchased power – utility (2,559) (613) – (3,172)

Electric trading revenue – gross – – 1,337 1,337

Electric trading costs – – (1,268) (1,268)

Gross margin before operating expenses $3,048 $175 $69 $3,292

Margin as a percentage of revenue 54.4% 22.2% 5.2% 42.6%