Xcel Energy 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 75

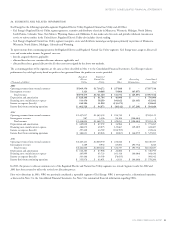

17. COMMITMENTS AND CONTINGENCIES

Commitments

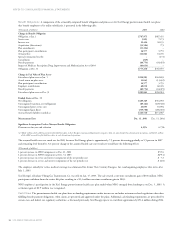

Legislative Resource Commitments In 1994 and 2003, NSP-Minnesota received Minnesota legislative approval for additional on-site temporary

spent-fuel storage facilities at its Prairie Island nuclear power plant, provided NSP-Minnesota satisfies certain requirements. The use of 29 dry cask

containers has been approved. As of Dec. 31, 2003, NSP-Minnesota had loaded 17 of the containers.

In 1994, as a condition of approving 17 dry cask storage containers, the Minnesota Legislature established several energy-resource and other commitments

for NSP-Minnesota to obtain the Prairie Island temporary nuclear-fuel storage facility approval. These commitments can be met by building, purchasing

or, in the case of biomass, converting generation resources. Other commitments established by the Legislature included a discount for low-income electric

customers, required conservation-improvement expenditures and various study and reporting requirements to a legislative electric energy task force.

NSP-Minnesota has implemented programs to meet the legislative commitments. NSP-Minnesota’s capital commitments include the known effects of

the Prairie Island legislation.

On May 29, 2003, the Minnesota Legislature enacted additional legislation, which will enable NSP-Minnesota to store at least 12 more casks of spent

fuel outside the Prairie Island nuclear generating plant. This will allow NSP-Minnesota to continue to operate the facility and store spent fuel there

until its licenses with the Nuclear Regulatory Commission (NRC) expire in 2013 and 2014. The legislation transfers the primary authority concerning

future spent-fuel storage issues from the state Legislature to the MPUC. It also allows for additional storage without the requirement of an affirmative

vote from the state Legislature, if the NRC extends the licenses of the Prairie Island and Monticello plants and the MPUC grants a certificate of need for

such additional storage. The legislation requires NSP-Minnesota to add at least 300 megawatts of additional wind power by 2010 with an option to own

100 megawatts of this power.

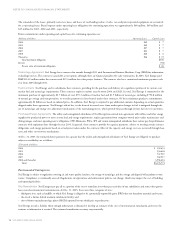

The legislation also requires payments during the remaining operating life of the Prairie Island plant. These payments include: $2.25 million per year to

the Prairie Island Tribal Community beginning in 2004; 5 percent of NSP-Minnesota’s conservation-program expenditures (estimated at $2 million per

year) to the University of Minnesota for renewable energy research; and an increase in funding commitments to the previously established Renewable

Development Fund from $8.5 million in 2002 to $16 million per year beginning in 2003. The legislation also designated $10 million in one-time grants

to the University of Minnesota for additional renewable energy research, which is to be funded from commitments already made to the Renewable

Development Fund. All of the cost increases to NSP-Minnesota from these required payments and funding commitments are expected to be recoverable

in Minnesota retail customer rates, mainly through existing cost recovery mechanisms. Funding commitments to the Renewable Development Fund

would terminate after the Prairie Island plant discontinues operation unless the MPUC determines that NSP-Minnesota failed to make a good faith

effort to move the waste, in which case NSP-Minnesota would have to make payments in the amount of $7.5 million per year.

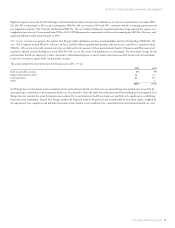

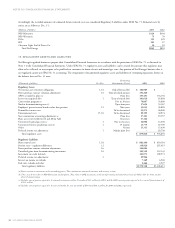

Reliability Commitments In 2002, the MPUC directed the Office of the Attorney General and the Minnesota Department of Commerce (state

agencies) to investigate the accuracy of NSP-Minnesota’s electric reliability records, which are summarized and reported to the MPUC on a monthly

and annual basis, subject to penalty for not meeting threshold requirements, under the terms of the merger settlement agreements.

In 2003, NSP-Minnesota and the state agencies announced that they had reached a settlement agreement, which was approved with modifications by

the MPUC in January 2004. Initially, the settlement requires NSP-Minnesota to refund $1 million to customers in Minnesota, which has been accrued.

In addition, it requires NSP-Minnesota to incur at least $15 million of costs for actions to improve system reliability above amounts being currently

recovered in rates by Jan. 1, 2005. The MPUC modified the settlement to include an additional under-performance payment for any future finding of

inaccurate reliability data. The final order has not yet been issued by the MPUC, and all parties to the settlement have the option to void the settlement

in the event of a significant modification to the settlement.

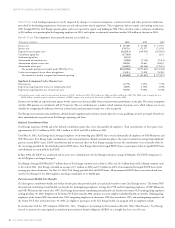

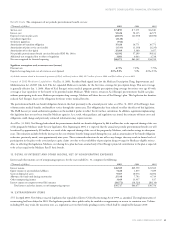

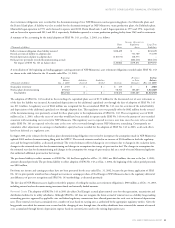

Capital Commitments As discussed in Liquidity and Capital Resources under Management’s Discussion and Analysis, the estimated cost, as of

Dec. 31, 2003, of the capital expenditure programs and other capital requirements of Xcel Energy and its subsidiaries is approximately $1.4 billion

in 2004, $1.5 billion in 2005 and $2.1 billion in 2006.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction expenditures may vary

from the estimates due to changes in electric and natural gas projected load growth, the desired reserve margin and the availability of purchased power, as

well as alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of restructuring requirements,

compliance with future requirements to install emission-control equipment, and merger, acquisition and divestiture opportunities to support corporate

strategies may impact actual capital requirements.

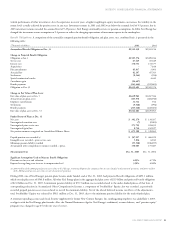

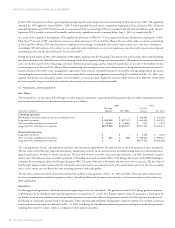

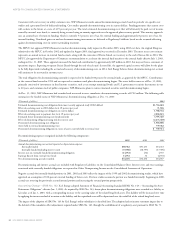

Leases Xcel Energy and its subsidiaries lease a variety of equipment and facilities used in the normal course of business. Some of these leases qualify

as capital leases and are accounted for accordingly. The capital leases expire in 2024 and 2025. The net book value of property under capital leases was

approximately $48 million and $50 million at Dec. 31, 2003 and 2002, respectively. Assets acquired under capital leases are recorded as property at

the lower of fair market value or the present value of future lease payments, and are amortized over their actual contract term in accordance with

practices allowed by regulators. The related obligation is classified as long-term debt. Executory costs are excluded from the minimum lease payments.