Xcel Energy 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

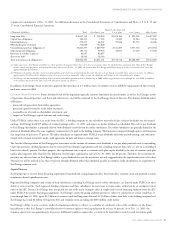

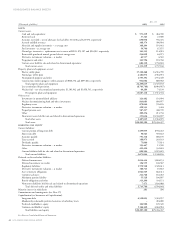

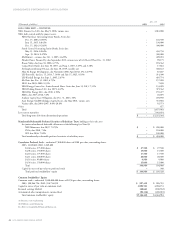

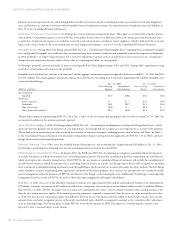

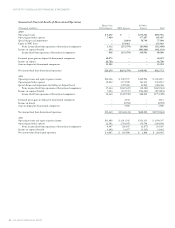

CONSOLIDATED STATEMENTS OF CAPITALIZATION

XCEL ENERGY 2003 ANNUAL REPORT 47

Dec. 31

(Thousands of dollars) 2003 2002

LONG-TERM DEBT – CONTINUED

SPS Debt

Unsecured Senior A Notes, due March 1, 2009, 6.2% $ 100,000 $ 100,000

Unsecured Senior B Notes, due Nov. 1, 2006, 5.125% 500,000 500,000

Unsecured Senior C Notes, due Oct. 1, 2033, 6% 100,000 –

Pollution control obligations, securing pollution control revenue bonds due:

July 1, 2011, 5.2% 44,500 44,500

July 1, 2016, 1.25% at Dec. 31, 2003, and 1.6% at Dec. 31, 2002 25,000 25,000

Sept. 1, 2016, 5.75% 57,300 57,300

Unamortized discount (1,653) (1,138)

Total SPS long-term debt $ 825,147 $ 725,662

NSP-Wisconsin Debt

First Mortgage Bonds Series due:

Oct. 1, 2003, 5.75% $ – $ 40,000

Oct. 1, 2018, 5.25% 150,000 –

March 1, 2023, 7.25% –110,000

Dec. 1, 2026, 7.375% 65,000 65,000

City of La Crosse Resource Recovery Bond, Series due Nov. 1, 2021, 6% 18,600 (a) 18,600 (a)

Fort McCoy System Acquisition, due Oct. 31, 2030, 7% 895 930

Senior Notes – due, Oct. 1, 2008, 7.64% 80,000 80,000

Unamortized discount (1,051) (1,388)

Total 313,444 313,142

Less current maturities 34 40,034

Total NSP-Wisconsin long-term debt $313,410 $ 273,108

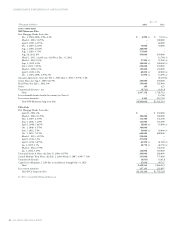

Other Subsidiaries Debt

First Mortgage Bonds – Cheyenne:

Series due April 1, 2003–Jan. 1, 2024, 7.5%–7.875% $8,000 $ 12,000

Industrial Development Revenue Bonds, due Sept. 1, 2021–March 1, 2027,

variable rate, 1.3% and 1.7% at Dec. 31, 2003 and 2002 17,000 17,000

Various Eloigne Co. Affordable Housing Project Notes, due 2004–2026, 0.3%–9.91% 39,139 41,353

Other 12,140 94,894

Total 76,279 165,247

Less current maturities 8,288 9,670

Total other subsidiaries long-term debt $67,991 $ 155,577

Xcel Energy Inc. Debt

Unsecured Senior Notes, Series due:

July 1, 2008, 3.4% $195,000 $ –

Dec. 1, 2010, 7% 600,000 600,000

Convertible notes, Series due:

Nov. 21, 2007, 7.5% 230,000 230,000

Nov. 21, 2008, 7.5% 57,500 –

Fair value hedge, carrying value adjustment (6,298) –

Unamortized discount (8,387) (9,837)

Total Xcel Energy Inc. debt $1,067,815 $ 820,163

Total long-term debt from continuing operations $6,518,853 $5,318,957

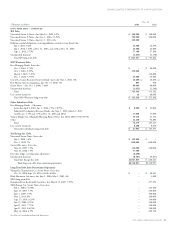

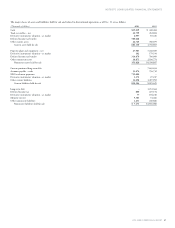

Long-Term Debt from Discontinued Operations

Viking Gas Transmission Co. Senior Notes, Series due:

Oct. 31, 2008–Sept. 30, 2014, 6.65%–8.04% $ – $ 40,421

Black Mountain Gas notes, due June 1, 2004–May 1, 2005, 6% –3,000

NRG long-term debt:

Remarketable or Redeemable Securities, due March 15, 2005, 7.97% –257,552

NRG Energy, Inc. Senior Notes, Series due:

Feb. 1, 2006, 7.625% –125,000

June 15, 2007, 7.5% –250,000

June 1, 2009, 7.5% –300,000

Nov. 1, 2013, 8% –240,000

Sept. 15, 2010, 8.25% –350,000

July 15, 2006, 6.75% –340,000

April 1, 2011, 7.75% –350,000

April 1, 2031, 8.625% –500,000

May 16, 2006, 6.5% –285,728

See Notes to Consolidated Financial Statements.