Xcel Energy 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 83

Asset retirement obligations were recorded for the decommissioning of two NSP-Minnesota nuclear generating plants, the Monticello plant and

the Prairie Island plant. A liability was also recorded for the decommissioning of an NSP-Minnesota steam production plant, the Pathfinder plant.

Monticello began operation in 1971 and is licensed to operate until 2010. Prairie Island units 1 and 2 began operation in 1973 and 1974, respectively,

and are licensed to operate until 2013 and 2014, respectively. Pathfinder operated as a steam production peaking facility from 1969 until its retirement.

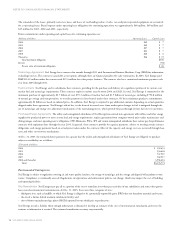

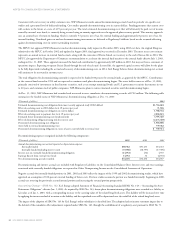

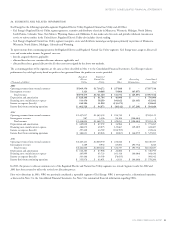

A summary of the accounting for the initial adoption of SFAS No. 143, as of Jan. 1, 2003, is as follows:

Increase (decrease) in:

Plant Regulatory Long-Term

(Thousands of dollars) Assets Assets Liabilities

Reflect retirement obligation when liability incurred $130,659 $ – $130,659

Record accretion of liability to adoption date – 731,709 731,709

Record depreciation of plant to adoption date (110,573) 110,573 –

Recharacterize previously recorded decommissioning accruals – (662,411) (662,411)

Net impact of SFAS No. 143 on balance sheet $ 20,086 $179,871 $199,957

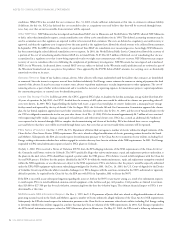

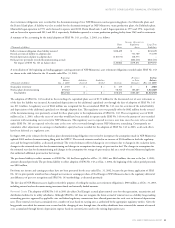

A reconciliation of the beginning and ending aggregate carrying amounts of NSP-Minnesota’s asset retirement obligations recorded under SFAS No. 143

are shown in the table below for the 12 months ended Dec. 31, 2003:

Beginning Revisions Ending

Balance Liabilities Liabilities to Prior Balance

(Thousands of dollars) Jan. 1, 2003 Incurred Settled Accretion Estimates Dec. 31, 2003

Steam plant retirement $ 2,725 $ – $ – $ 135 $ – $2,860

Nuclear plant decommissioning 859,643 – – 58,341 103,685 1,021,669

Total liability $862,368 $ – $ – $58,476 $103,685 $1,024,529

The adoption of SFAS No. 143 resulted in the recording of a capitalized plant asset of $131 million for the discounted cost of asset retirement as

of the date the liability was incurred. Accumulated depreciation on this additional capitalized cost through the date of adoption of SFAS No. 143

was $111 million. A regulatory asset of $842 million was recognized for the accumulated SFAS No. 143 costs for accretion of the initial liability

and depreciation of the additional capitalized cost through adoption date. This regulatory asset was partially offset by $662 million for the reversal

of the decommissioning costs previously accrued for these plants prior to the implementation of SFAS No. 143. The net regulatory asset of $180

million at Jan. 1, 2003, reflects the excess of costs that would have been recorded in expense under SFAS No. 143 over the amount of costs recorded

consistent with ratemaking cost recovery for NSP-Minnesota. This regulatory asset is expected to reverse over time since the costs to be accrued

under SFAS No. 143 are expected to be the same as the costs to be recovered through current NSP-Minnesota ratemaking. Consequently, no

cumulative effect adjustment to earnings or shareholders’ equity has been recorded for the adoption of SFAS No. 143 in 2003, as all such effects

have been deferred as a regulatory asset.

In August 2003, prior estimates for the nuclear plant decommissioning obligations were revised to incorporate the assumptions made in NSP-Minnesota’s

updated 2002 nuclear decommissioning filing with the MPUC. The revised estimates resulted in an increase of $104 million to both the regulatory

asset and the long-term liability, as discussed previously. The revised estimates reflected changes in cost estimates due to changes in the escalation factor,

changes in the estimated start date for decommissioning and changes in assumptions for storage of spent nuclear fuel. The changes in assumptions for

the estimated start date for decommissioning and changes in the assumptions for storage of spent nuclear fuel are a result of recent Minnesota legislation

that authorized additional spent nuclear fuel storage.

The pro forma liability to reflect amounts as if SFAS No. 143 had been applied as of Dec. 31, 2002, was $862 million, the same as the Jan. 1, 2003,

amounts discussed previously. The pro forma liability to reflect adoption of SFAS No. 143 as of Jan. 1, 2002, the beginning of the earliest period presented,

was $810 million.

Pro forma net income and earnings per share have not been presented for the year ended Dec. 31, 2002, because the pro forma application of SFAS

No. 143 to prior periods would not have changed net income or earnings per share of Xcel Energy or NSP-Minnesota due to the regulatory deferral of

any differences of past cost recognition and SFAS No. 143 methodology, as discussed previously.

The fair value of NSP-Minnesota assets legally restricted for purposes of settling the nuclear asset retirement obligations is $900 million as of Dec. 31, 2003,

including external nuclear decommissioning investment funds and internally funded amounts.

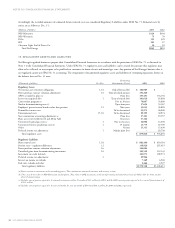

Removal Costs The adoption of SFAS No. 143 in 2003 also affects Xcel Energy’s accrued plant removal costs for other generation, transmission and

distribution facilities for its utility subsidiaries. Although SFAS No. 143 does not recognize the future accrual of removal costs as a liability, long-standing

ratemaking practices approved by applicable state and federal regulatory commissions have allowed provisions for such costs in historical depreciation

rates. These removal costs have accumulated over a number of years based on varying rates as authorized by the appropriate regulatory entities. Given the

long periods over which the amounts were accrued and the changing of rates through time, the utility subsidiaries have estimated the amount of removal

costs accumulated through historic depreciation expense based on current factors used in the existing depreciation rates.