Xcel Energy 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 61

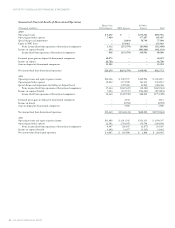

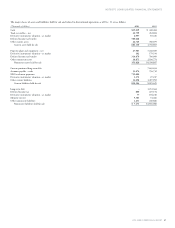

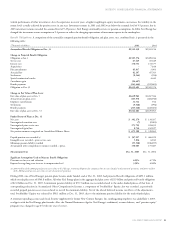

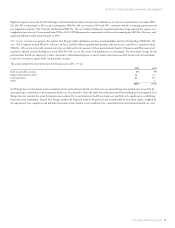

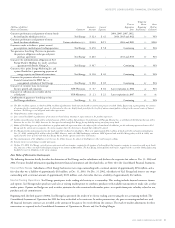

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income tax rate to income

before income tax expense. Following is a table reconciling such differences:

2003 2002 2001

Federal statutory rate 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit 2.2 3.2 3.6

Life insurance policies (3.9) (3.3) (2.4)

Tax credits recognized (4.2) (4.7) (2.9)

Regulatory differences – utility plant items 0.8 1.5 2.3

Resolution of income tax audits (5.2) ––

Other – net (1.0) (0.8) (1.2)

Total effective income tax rate 23.7 30.9 34.4

Extraordinary item ––(0.6)

Effective income tax rate from continuing operations 23.7% 30.9% 33.8%

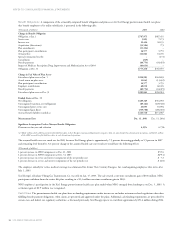

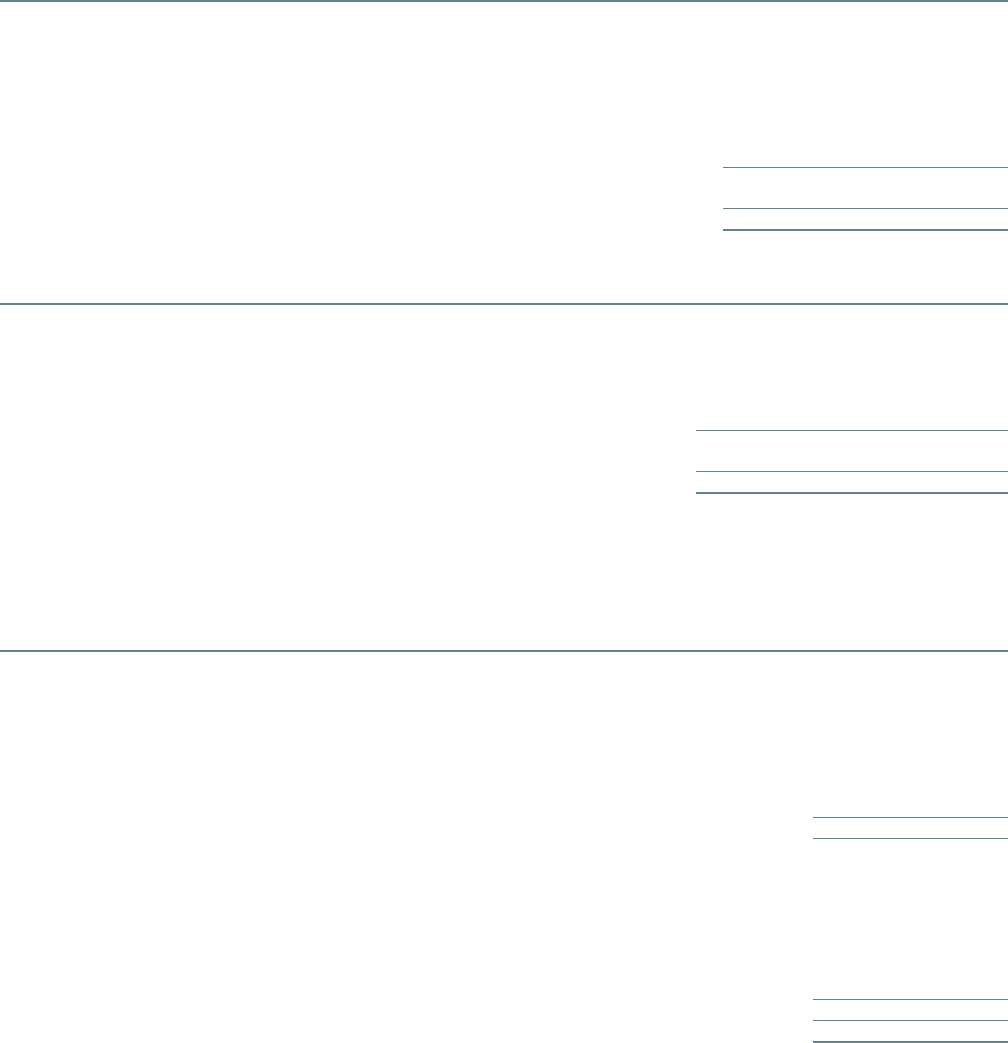

Income taxes comprise the following expense (benefit) items:

(Thousands of dollars) 2003 2002 2001

Current federal tax expense $107,770 $104,658 $305,709

Current state tax expense (1,194) 19,864 37,185

Current tax credits (15,269) (19,079) (13,544)

Deferred federal tax expense 77,730 129,556 (25,547)

Deferred state tax expense 2,104 17,301 13,336

Deferred investment tax credits (12,499) (16,686) (12,797)

Income tax expense excluding extraordinary items 158,642 235,614 304,342

Tax expense on extraordinary items –– 5,747

Total income tax expense from continuing operations $158,642 $235,614 $310,089

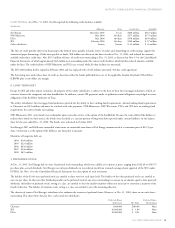

As of Dec. 31, 2002, Xcel Energy management intended to indefinitely reinvest the earnings of the Argentina operations of Xcel Energy International and,

therefore, had not provided deferred taxes for the effects of currency devaluations. However, during 2003, the board of directors of Xcel Energy approved

management’s plan to exit the business conducted by Xcel Energy International. Accordingly, any tax effects are recorded in discontinued operations.

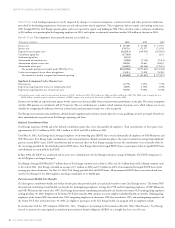

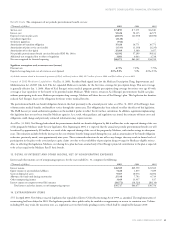

The components of Xcel Energy’s net deferred tax liability from continuing operations (current and noncurrent portions) at Dec. 31 were:

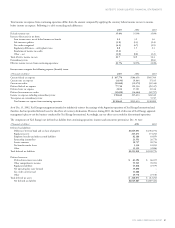

(Thousands of dollars) 2003 2002

Deferred tax liabilities:

Differences between book and tax basis of property $1,845,091 $1,784,754

Regulatory assets 243,671 171,292

Employee benefits and other accrued liabilities 82,186 63,079

Partnership income/loss 23,551 26,778

Service contracts 18,757 20,794

Tax benefit transfer leases 5,330 10,993

Other 35,352 32,086

Total deferred tax liabilities $2,253,938 $2,109,776

Deferred tax assets:

Deferred investment tax credits $61,394 $ 66,472

Other comprehensive income 55,525 70,703

Regulatory liabilities 43,816 47,579

Net operating loss carry forward 35,890 –

Tax credit carry forward 11,668 –

Other 19,778 27,538

Total deferred tax assets $228,071 $ 212,292

Net deferred tax liability $2,025,867 $1,897,484