Xcel Energy 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

XCEL ENERGY 2003 ANNUAL REPORT 39

–In February 2002, Xcel Energy filed a $1 billion shelf registration with the SEC. Xcel Energy may issue debt securities, common stock and rights

to purchase common stock under this shelf registration. Xcel Energy has approximately $482.5 million remaining under this registration.

–In April 2001, NSP-Minnesota filed a $600 million, long-term debt shelf registration with the SEC. NSP-Minnesota has approximately $40 million

remaining under this registration.

–PSCo has an effective shelf registration statement with the SEC under which $800 million of secured first collateral trust bonds or unsecured senior

debt securities were registered. PSCo has approximately $225 million remaining under this registration.

Future Financing Plans

Xcel Energy generally expects to fund its operations and capital investments through internally generated funds. Xcel Energy plans to renew its credit

facilities at NSP-Minnesota, PSCo and SPS during 2004 and may refinance existing long-term debt with lower-rate debt, based on market conditions.

See discussion of funding for the NRG settlement payments in the following section.

Impact of Settlement Agreement with NRG

As discussed previously and in Note 4 to the Consolidated Financial Statements, NRG has completed its plan of reorganization through a bankruptcy

proceeding, and the terms of a settlement among NRG, Xcel Energy and members of NRG’s major creditor constituencies was approved and put

into effect.

As part of the reorganization, Xcel Energy completely divested its ownership interest in NRG, which in turn issued new common equity to its creditors.

The financial terms of the settlement agreement included a provision that Xcel Energy will pay $752 million to NRG to settle all claims of NRG against

Xcel Energy and claims of NRG creditors against Xcel Energy under the NRG plan of reorganization as follows:

–$400 million paid on Feb. 20, 2004, including $112 million to NRG’s bank lenders.

–$352 million will be paid on April 30, 2004, unless at such time Xcel Energy has not received tax refunds equal to at least $352 million associated

with the loss on its investment in NRG. To the extent such refunds are less than the required payments, the difference between the required payments

and those refunds would be due on May 30, 2004.

–In return for such payments, Xcel Energy received, or was granted, voluntary and involuntary releases from NRG and its creditors.

Xcel Energy intends to fund the payments required by the settlement agreement with cash received for tax benefits related to its investment in NRG,

cash on hand and available Xcel Energy credit facilities.

Based on current forecasts of taxable income and tax liabilities, Xcel Energy expects to realize approximately $1.1 billion of cash savings from these tax

benefits through a refund of taxes paid in prior years and reduced taxes payable in future years. Xcel Energy used $130 million of these tax benefits in

2003 and expects to use $480 million in 2004. The remainder of the tax benefit carry forward is expected to be used over subsequent years.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements that have or are reasonably likely to have a current or future effect on financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Earnings Guidance

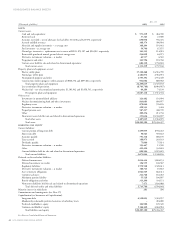

Xcel Energy’s 2004 earnings per share from continuing operations guidance and key assumptions are detailed in the following table.

2004 Diluted EPS Range

Utility operations $1.25–$1.33

Holding company financing costs (0.08)

Seren (0.03)

Eloigne 0.01

Other nonregulated subsidiaries 0.00–0.02

Xcel Energy Continuing Operations – EPS $1.15–$1.25

Key assumptions for 2004:

–NRG has no impact on Xcel Energy’s financial results in 2004;

–normal weather patterns throughout 2004;

–weather-adjusted retail electric utility sales growth of 2.2 percent;

–weather-adjusted firm retail gas utility sales growth of approximately 2.4 percent;

–successful outcome of the requested capacity rider revenue increase in Colorado;

–2004 trading and short-term wholesale margins are expected to be slightly less than 2003 margins to reflect more normal market conditions;

–2004 utility operating and maintenance expense is expected be relatively flat, compared with 2003 levels;

–2004 depreciation expense is projected to increase by about 2 percent compared with 2003;

–2004 interest expense is projected to decline by approximately $15 million, compared with 2003 levels;

–an effective tax rate of approximately 31 percent; and

–average common stock and equivalents of approximately 425 million shares in 2004, based on the “If Converted” method for convertible notes.