Xcel Energy 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

XCEL ENERGY 2003 ANNUAL REPORT 33

DERIVATIVES, RISK MANAGEMENT AND MARKET RISK

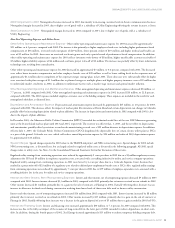

Business and Operational Risk Xcel Energy and its subsidiaries, including discontinued operations held for sale, are exposed to commodity price

risk in their generation, retail distribution and energy trading operations. In certain jurisdictions, purchased energy expenses and natural gas costs are

recovered on a dollar-for-dollar basis. However, in other jurisdictions, Xcel Energy and its subsidiaries are exposed to market price risk for the purchase

and sale of electric energy and natural gas. In such jurisdictions, electric energy and natural gas expenses are recovered based on fixed-price limits or

under established sharing mechanisms.

Xcel Energy manages commodity price risk by entering into purchase and sales commitments for electric power and natural gas, long-term contracts for

coal supplies and fuel oil, and derivative instruments. Xcel Energy’s risk management policy allows the company to manage the market price risk within

each rate-regulated operation to the extent such exposure exists. Management is limited under the policy to enter into only transactions that manage

market price risk where the rate regulation jurisdiction does not already provide for dollar-for-dollar recovery. One exception to this policy exists in

which Xcel Energy uses various physical contracts and derivative instruments to reduce the volatility in the cost of natural gas and electricity provided to

retail customers even though the regulatory jurisdiction may provide dollar-for-dollar recovery of actual costs. In these instances, the use of derivative instruments

and physical contracts is done consistently with the local jurisdictional cost-recovery mechanism.

Xcel Energy and its subsidiaries have been exposed to market price risk for the sale of electric energy and the purchase of fuel resources, including coal,

natural gas and fuel oil used to generate the electric energy within its nonregulated operations, primarily through NRG and Xcel Energy International.

With the divestiture of NRG and expected sale of Xcel Energy International, the exposure to market price risk has greatly diminished. Xcel Energy managed

this market price risk by entering into firm power sales agreements for approximately 55 percent to 75 percent of its electric capacity and energy

from each generation facility, using contracts with terms ranging from one to 25 years. In addition, Xcel Energy managed the market price risk

covering the fuel resource requirements to provide the electric energy by entering into purchase commitments and derivative instruments for coal,

natural gas and fuel oil as needed to meet fixed-priced electric energy requirements. Xcel Energy’s risk management policy allows for the management

of market price risks, and provides guidelines for the level of price risk exposure that is acceptable within the company’s operations.

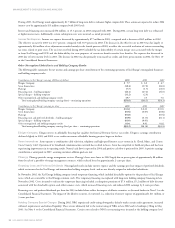

Interest Rate Risk Xcel Energy and its subsidiaries are subject to the risk of fluctuating interest rates in the normal course of business. Xcel Energy’s

policy allows interest rate risk to be managed through the use of fixed rate debt, floating rate debt and interest rate derivatives such as swaps, caps, collars

and put or call options.

Xcel Energy engages in hedges of cash flow exposure and hedges of fair value exposure. The fair value of interest rate swaps designated as cash flow

hedges are initially recorded in Other Comprehensive Income. Reclassification of unrealized gains or losses on cash flow hedges of variable rate debt

instruments from Other Comprehensive Income into earnings occurs as interest payments are accrued on the debt instrument and generally offsets the

change in the interest accrued on the underlying variable rate debt. Hedges of fair value exposure are entered into to hedge the fair value of a recognized

asset, liability or firm commitment. Changes in the derivative fair values that are designated as fair value hedges are recognized in earnings as offsets to

the changes in fair values of related hedged assets, liabilities or firm commitments. In order to test the effectiveness of such swaps, a hypothetical swap

is used to mirror all the critical terms of the underlying debt and regression analysis is utilized to assess the effectiveness of the actual swap at inception

and on an ongoing basis. The assessment is done periodically to ensure the swaps continue to be effective. The fair value of interest rate swaps is determined

through counterparty valuations, internal valuations and broker quotes. There have been no material changes in the techniques or models used in the

valuation of interest rate swaps during the periods presented.

At Dec. 31, 2003 and 2002, a 100-basis-point change in the benchmark rate on Xcel Energy’s variable debt would impact net income by approximately

$0.8 million and $12.6 million, respectively. See Note 15 to the Consolidated Financial Statements for a discussion of Xcel Energy and its subsidiaries’

interest rate swaps.

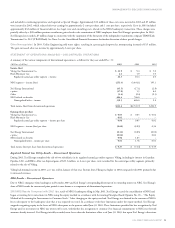

Currency Exchange Risk During 2003 and 2002, NRG and Xcel Energy International, both of which are included in discontinued operations, held

certain investments in foreign countries, creating exposure to foreign currency exchange risk. The foreign currency exchange risk included the risk

relative to the recovery of the net investment in a project, as well as the risk relative to the earnings and cash flows generated from such operations.

These subsidiaries managed their exposure to changes in foreign currency by entering into derivative instruments as determined by management.

Xcel Energy’s risk management policy provides for this risk management activity.

Trading Risk Xcel Energy’s subsidiaries conduct various trading operations and power marketing activities, including the purchase and sale of electric

capacity and energy and, prior to December 2003, through e prime for natural gas. The trading operations are conducted in the United States with

primary focus on specific market regions where trading knowledge and experience have been obtained. Xcel Energy’s risk management policy allows

management to conduct the trading activity within approved guidelines and limitations as approved by the company’s risk management committee,

which is made up of management personnel not involved in the trading operations.