Xcel Energy 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 XCEL ENERGY 2003 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

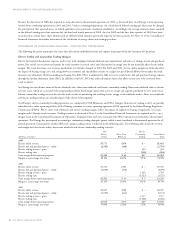

During 2003, Xcel Energy issued approximately $1.7 billion of long-term debt to refinance higher coupon debt. These actions are expected to reduce 2004

interest costs by approximately $15 million compared with 2003 levels.

Interest and financing costs increased $56 million, or 15.3 percent, in 2002 compared with 2001. During 2002, certain long-term debt was refinanced

at higher interest rates. Additionally, certain redemption costs were incurred, as noted previously.

Income Tax Expense Income tax expense decreased by approximately $77 million in 2003, compared with a decrease of $69 million in 2002.

The effective tax rate for 2003 was 23.7 percent, compared with 30.9 percent in 2002. The decrease in the effective rate in 2003 was due largely to

approximately $36 million of tax adjustments recorded mainly in the fourth quarter of 2003 to reflect the successful resolution of various outstanding

tax issues related to prior years. The tax issues resolved during 2003 included the tax deductibility of certain merger costs associated with the merger

to form Xcel Energy and NCE and the deductibility, for state purposes, of certain tax benefit transfer lease benefits. Tax expense also decreased in

2003 due to lower income levels in 2003. The decrease in 2002 was due primarily to increased tax credits and lower pretax income in 2002. See Note 10

to the Consolidated Financial Statements.

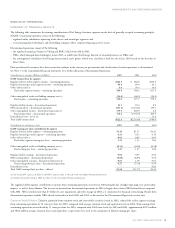

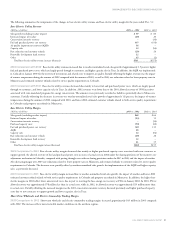

Other Nonregulated Subsidiaries and Holding Company Results

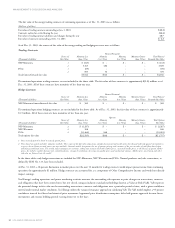

The following tables summarize the net income and earnings-per-share contributions of the continuing operations of Xcel Energy’s nonregulated businesses

and holding company results:

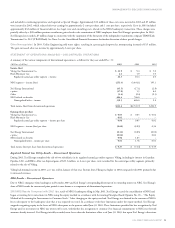

Contribution to Xcel Energy’s earnings (Millions of dollars) 2003 2002 2001

Eloigne Company $ 7.7 $ 8.0 $ 8.7

Seren Innovations (18.4) (27.0) (26.8)

Planergy (7.7) (1.7) (12.0)

Financing costs – holding company (44.1) (47.4) (34.0)

Special charges – holding company (11.2) (2.9) –

Other nonregulated and holding company results 19.7 2.5 5.8

Total nonregulated/holding company earnings (loss) – continuing operations $(54.0) $(68.5) $(58.3)

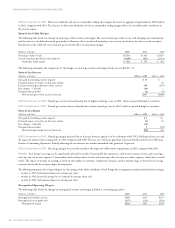

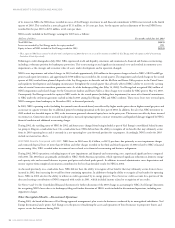

Contribution to Xcel Energy’s earnings per share 2003 2002 2001

Eloigne Company $ 0.02 $ 0.02 $ 0.03

Seren Innovations (0.04) (0.07) (0.08)

Planergy (0.02) –(0.04)

Financing costs and preferred dividends – holding company (0.09) (0.13) (0.11)

Special charges – holding company (0.03) (0.01) –

Other nonregulated and holding company results 0.04 0.01 0.02

Total nonregulated/holding company earnings (loss) per share – continuing operations $(0.12) $(0.18) $(0.18)

Eloigne Company Eloigne invests in affordable housing that qualifies for Internal Revenue Service tax credits. Eloigne’s earnings contribution

declined slightly in 2003 and 2002 as tax credits on mature affordable housing projects began to decline.

Seren Innovations Seren operates a combination cable television, telephone and high-speed Internet access system in St. Cloud, Minn., and Contra

Costa County, Calif. Operation of its broadband communications network has resulted in losses. Seren has completed its build-out phase and has been

experiencing improvement in its operating results. Neutral cash flow is expected in 2004 and positive cash flow is projected for 2005. A positive earnings

contribution is anticipated in 2007, assuming customer addition goals are met.

Planergy Planergy provides energy management services. Planergy’s losses were lower in 2002 largely due to pretax gains of approximately $8 million

from the sale of a portfolio of energy management contracts, which reduced losses by approximately 2 cents per share.

Financing Costs and Preferred Dividends Nonregulated results include interest expense and the earnings-per-share impact of preferred dividends,

which are incurred at the Xcel Energy and intermediate holding company levels, and are not directly assigned to individual subsidiaries.

In November 2002, the Xcel Energy holding company issued temporary financing, which included detachable options for the purchase of Xcel Energy

notes, which are convertible to Xcel Energy common stock. This temporary financing was replaced with long-term holding company financing in late

November 2002. Costs incurred to redeem the temporary financing included a redemption premium of $7.4 million, $5.2 million of debt discount

associated with the detachable option, and other issuance costs, which increased financing costs and reduced 2002 earnings by 2 cents per share.

Financing costs and preferred dividends per share for 2003 included above reflect the impact of dilutive securities, as discussed further in Note 11 to the

Consolidated Financial Statements. The impact of the dilutive securities, if converted, is a reduction of interest expense of approximately $11 million, or

3 cents per share.

Holding Company Special Charges During 2002, NRG experienced credit-rating downgrades, defaults under certain credit agreements, increased

collateral requirements and reduced liquidity. These events ultimately led to the restructuring of NRG in late 2002 and its bankruptcy filing in May

2003. See Note 4 to the Consolidated Financial Statements. Certain costs related to NRG’s restructuring were incurred at the holding company level