Xcel Energy 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 55

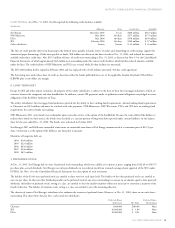

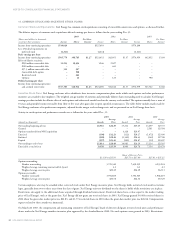

NRG’s continuing operations incurred $3.5 billion of asset impairments and estimated disposal losses related to projects and equity investments, respectively,

with lower expected cash flows or fair values. These charges recorded by NRG in the third and fourth quarters of 2002 included write-downs of $2.3 billion

and $983 million for projects in development and operating projects, respectively, and $196 million for impairment charges and disposal losses related

to equity investments.

Approximately $2.5 billion of these NRG impairment charges in 2002 related to NRG assets considered held for use under SFAS No. 144 as of Dec. 31, 2002.

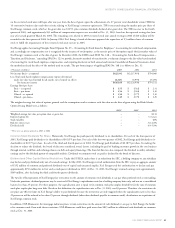

For fair values determined by similar asset prices, the fair value represented NRG’s estimate of recoverability at that time, if the project assets were to be

sold. For fair values determined by estimated market price, the fair value represented a market bid or appraisal received by NRG that NRG believed was

best reflective of fair value at that time. For fair values determined by projected cash flows, the fair value represents a discounted cash flow amount over

the remaining life of each project that reflected project-specific assumptions for long-term power pool prices, escalated future project operating costs and

expected plant operation given assumed market conditions at that time.

NRG continued to incur asset impairments and related charges in 2003. Prior to its bankruptcy filing in May 2003, NRG recorded more than $500 million

in impairment and related charges resulting from planned disposals of an international project and several projects in the United States, and to regulatory

developments and changing circumstances throughout the second quarter that adversely affected NRG’s ability to recover the carrying value of certain

merchant generation units in the Northeastern United States.

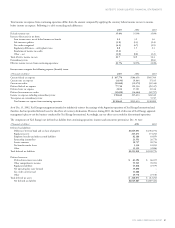

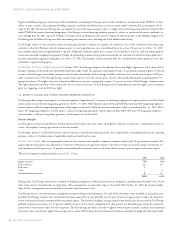

Nonregulated Subsidiaries – All Other Segment

Xcel Energy International and e prime In December 2003, the board of directors of Xcel Energy approved management’s plan to exit the businesses

conducted by its nonregulated subsidiaries Xcel Energy International and e prime. Xcel Energy is in the process of marketing the remaining assets and

operations of these businesses to prospective buyers and expects to exit the businesses during 2004.

Results of discontinued nonregulated operations in 2003, other than NRG, include an after-tax loss expected on the disposal of all Xcel Energy

International assets of $59 million, based on the estimated fair value of such assets. The fair value represents a market bid or appraisal received that

is believed to best reflect the assets’ fair value at Dec. 31, 2003. Xcel Energy’s remaining investment in Xcel Energy International at Dec. 31, 2003,

was approximately $39 million. Losses from discontinued nonregulated operations in 2003 also include a charge of $16 million for costs of settling

a Commodity Futures Trading Commission trading investigation of e prime.

Results of discontinued nonregulated operations in 2002 were reduced by impairment losses recorded by Xcel Energy International for certain Argentina

assets. In 2002, Xcel Energy International decided it would no longer fund one of its power projects in Argentina. This decision resulted in the shutdown

of the Argentina plant facility, pending financing of a necessary maintenance outage. Updated cash flow projections for the plant were insufficient to provide

recovery of Xcel Energy International’s investment. The project was written down to estimated fair value, based on an appraisal received that is believed to best

reflect the assets’ fair value at Dec. 31, 2002. The write-down for this Argentina facility was approximately $13 million.

Results of discontinued nonregulated operations in 2002 also were reduced by a loss on disposal of Xcel Energy International’s remaining investment in

Yorkshire Power Group Limited.

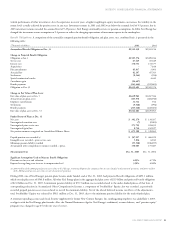

Tax Benefits Related to Investment in NRG With NRG’s emergence from bankruptcy in December 2003, Xcel Energy has divested its ownership

interest in NRG and plans to take a tax deduction in 2003. These benefits are reported as discontinued operations. During 2002, Xcel Energy recognized

tax benefits of $706 million. This benefit was based on the estimated tax basis of Xcel Energy’s cash and stock investments already made in NRG, and

their deductibility for federal income tax purposes.

Based on the results of a 2003 study, Xcel Energy recorded $105 million of additional tax benefits in 2003, reflecting an updated estimate of the tax basis of

Xcel Energy’s investments in NRG and state tax deductibility. Upon NRG’s emergence from bankruptcy in December 2003, an additional $288 million of

tax benefit was recorded to reflect the deductibility of the settlement payment of $752 million, uncollectible receivables from NRG, other state tax benefits and

further adjustments to the estimated tax basis in NRG. Another $11 million of state tax benefits were accrued earlier in 2003 based on projected impacts.